Financial Planning

By Wells Fargo Practice Finance

LEARNING OBJECTIVES

• Manage your financial profile to help qualify for preferred loan amounts, rates and terms

• Understand the financial implications of a practice construction, expansion or remodel project and how to calculate whether your practice can absorb your project costs

• Compare financing options and the benefits and disadvantages of conventional practice financing, Small Business Administration loans, and specialty lender financing

• Differentiate types of lenders and the approaches they use to make credit decisions

• Identify the tax programs that can help maximize your project investment

Perhaps the most exciting aspect of designing your dental practice is watching your vision come to fruition, with the ambience, equipment and technology you’ve dreamed about. But getting there requires the disciplined work of financial planning — the careful investigation of all financial aspects of your project in order to produce a realistic design plan and budget. Sound dull? It’s not. Because as you put your financial plan together, the question of whether you can afford this kind of project is definitively answered as you learn about the financial implications of a remodel versus rebuild, the types of loans that are available, how to calculate the amount of debt your practice can manage, and much more. A careful financial planning process is the beginning of making your dream practice a reality, and starts well before your project manifests a single blueprint — with a plan to build a strong financial profile that positions you for maximum leverage with your lender.

Ask yourself — how strong is your financial profile? What does your credit history tell a lender?

Good credit is the basis for all your financial investments, whether you’re building your first dental practice or buying your first home. While lenders consider a number of factors when making a credit decision, the most critical aspects of your financial profile are your personal debt and your credit score. Your personal debt includes student loans, credit cards and lines of credit. Your credit score is determined by your personal credit report, which includes a list of your debts, payment history, public record information, and inquiries about your credit worthiness.

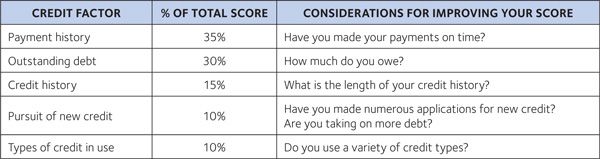

Factors Used in Calculating Credit Scores

The credit score was originated by FICO (formerly Fair Isaac Corporation) and is a numerical expression of your credit worthiness. It is based on a statistical analysis of your credit files and is primarily used in credit reports accessed by lenders and other companies to help them determine if you are a good credit risk.

Credit scores range from 350 to 850, with a score of 723 considered average for Americans. Those with scores below 650 are considered high risk borrowers. Individuals with the same credit score can have very different credit profiles based on how many credit accounts they hold, the type of accounts, whether they have a longer or shorter credit history, and to what degree they use available credit.

For example, credit decisions for practice acquisition loans are typically based on an assessment of practice cash flow and your ability to repay the loan while covering your expenses and lifestyle. Credit decisions for practice start-up loans are mostly based on your new office’s projected cash flow. The amount of your personal debt factors directly into both equations. Generally, a low level of debt yields a higher credit limit decision, meaning the lender is authorized to release more funds to you, while high personal debt results in a lower credit limit determination. (Note: Student loans are not as big a factor as most other credit advances and do not impact your score as much as other types of credit.)

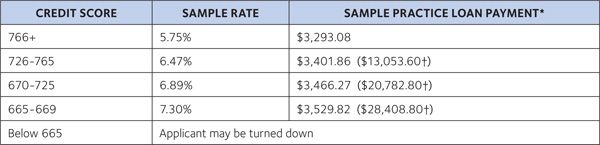

Your credit score directly impacts the interest rate offered by your lender, and can significantly impact the amount you pay over the life of your loan.

FIGURE 2.1: HOW CREDIT SCORES ARE CALCULATED

Source: www.myfico.com/crediteducation/whatsinyourscore.

FIGURE 2.2: HOW CREDIT AFFECTS INTEREST RATE

*Payments based on a 10 year, $300,000 practice loan

†Total amount of additional payments over life of loan

FIVE ACTIONS THAT CAN RUIN YOUR CREDIT SCORE

While occasionally being a day late on a bill payment may not ruin your credit score, there are five specific credit actions that can definitely lower your credit rating — in some cases, dramatically. Do everything you can to avoid these credit situations:

• Maximized credit card. A maximized credit card indicates to lenders that you are not in control of your debt.

• 30-day late payment. While a day or two late payment may be overlooked, a 30-day late payment is a red flag to lenders indicating you may be having difficulty repaying your loans.

• Debt settlement. Settling debt with a creditor is better than simply not repaying the loan, but still has a negative impact on your credit score.

• Foreclosure. Foreclosure on a personal or business mortgage will have a significant impact on your credit score.

• Bankruptcy. Bankruptcy is clearly the worst case scenario and will significantly impact your credit rating for many years.

Clearly, mismanagement of your debt can result in a poor credit score and seriously damage your overall financial profile. Based on the formula for granting loans, this will lower the amount of credit available to you and require a higher interest rate on loan payments.

Ultimately, a poor financial profile can impact your ability to build a solid foundation for dental practice success, including:

• Less money to design your practice according to your vision

• Restrained ability to develop a competitive operation

• Fewer funds for growth in salaries, marketing and overhead

• Less profit due to higher loan expenses

• Potentially a decreased opportunity for full practice success

The good news is that you have control over building and maintaining your financial profile.

TEN SIMPLE STEPS

Toward a Healthy Financial Profile

Following are ten simple steps you can take to improve your credit rating and ensure a healthy financial profile:

1. Maintain at least two or three revolving credit accounts such as credit cards and lines of credit. This shows you are credit worthy and able to manage debt.

2. Avoid applying for credit from too many lenders. Multiple credit inquiries within a short timeframe negatively impact your credit rating.

3. Demonstrate that you know how to use your credit wisely by not using all the credit available to you.

4. Make on-time monthly payments on credit cards, mortgages, installment loans and student loans. Remember, many service providers do report late payments and collections to credit bureaus.

5. Consolidate your personal loans in order to improve cash flow and generate a better financial profile.

6. If you are in dispute with a creditor, continue to make minimum monthly payments while working towards a resolution.

7. Notify creditors in writing of your address change.

8. Avoid co-signing or guarantying a loan for a friend or family member, as it has the same impact on your credit as being the primary borrower.

9. Protect your identity. Review your personal credit report at least twice a year to ensure accurate reporting of all accounts. Inform all credit bureaus in writing of any discrepancies.

10. Keep copies of all agreements, documents clearing judgments or liens, and letters from creditors clearing discrepancies in your loan history. All credit information stays on your records for up to ten years.

Start working on improving your credit profile at least 12 months before starting your project. With a strong financial profile, you have greater leverage for obtaining affordable financing at the best possible rates.

Investigate the Financial Implications of Your Project

When planning a practice upgrade, many doctors find themselves weighing the pros and cons of remodeling or expanding their existing facility versus building a new office from the ground up. There are both practical and business reasons why either option might be desirable, but what are the financial considerations when trying to make this decision?

Advantages of Remodeling an Existing Practice

It should be no surprise that remodeling a current facility will likely be less costly than building from the ground up, as you are working with an existing structure. If your current space has room to grow, you can direct a larger percentage of your funds to the décor as you are not paying to develop completely new walls, flooring, electrical services and plumbing.

In addition, with a more modest budget for a practice or space remodel, you may find it easier to obtain project financing that fully meets your needs, particularly if you are starting a new practice and have not yet established the cash flow history upon which project funding may be based. While a remodel may not allow you to incorporate all of the features of your dream practice, you should still have adequate funding for modifying the floor plan as needed to improve traffic flow, incorporating current office systems and equipment, expanding functional areas and enhancing office décor.

A key benefit of remodeling or expanding an existing practice versus constructing a new building is that most often it will not disrupt your patient base — patients will continue to find you at the same location where you have always been. At the same time, you’ll need to carefully plan for the down time your practice will experience while under remodel. This can ultimately be a costly undertaking if your project is not properly managed and runs bey/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses