Other Financial Systems

LEARNING OUTCOMES

All dental practices, regardless of size, have financial matters that need to be addressed by either internal or external accounting staff. The administrative assistant can expect to perform many tasks in addition to the accounts receivable activities highlighted in the previous chapter. These tasks might include receiving and organizing statements, paying for materials and supplies, processing payroll or tax forms, recording and analyzing expenses, and other responsibilities. In a group practice or a larger organization, the administrative assistant may collect the data for these activities and support accounting personnel in the preparation of financial documents or be responsible for entering data in a software package such as QuickBooks® (Figure 16-1). Although some offices may still perform these tasks manually, the use of computer software will provide the practice with the benefits shown in Box 16-1. The administrative assistant must have a basic understanding of the software system involved.

In the processing of financial documents, accuracy is essential. Verification of data and attention to detail are necessary to ensure that the processed information is accurate. Incorrect data can mean improper cash flow analysis, inaccurate accounts receivable, erroneous claim form preparation, or inaccurate budget and expense figures. All of these can have very serious repercussions for the entire business.

As the administrative assistant becomes more skilled in the business office, his or her responsibilities probably will include completing many monthly and annual forms vital to the dental practice. This chapter presents the major types of financial systems and the data that must be processed and managed in a modern dental practice. The chapter shows how technology is applied to the financial operations of a practice to make it more productive. In addition, it talks about the resources available through the Internet that can act as guides in procuring and filling out many of the financial forms needed by the practice.

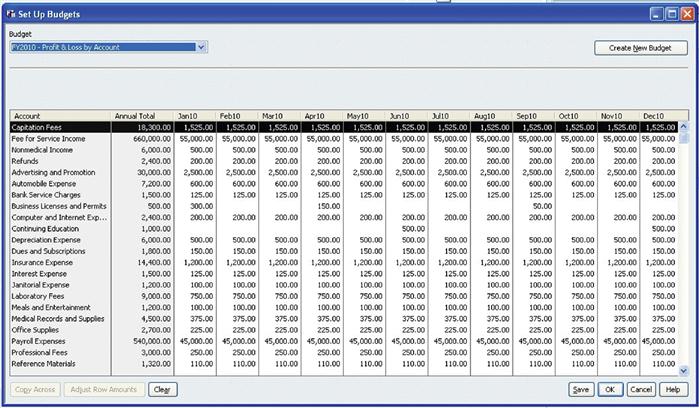

DETERMINING A BUDGET

A budget is a dental practice’s financial plan of operation for a given period, usually 1 year. The purpose of the budget is to establish the practice’s financial goals. To achieve an acceptable level of profit, expenditures, the amount of money spent to operate the practice, must be kept in balance with revenue, the amount of income received by the practice. Dentists can use spreadsheet software to develop a budget so that they can plan more thoroughly and in less time than with paper and pencil methods. Spreadsheets allow planners to see how a change in one calculation affects all the related calculations. A template of a business budget created in QuickBooks® software for a dental practice is shown in Figure 16-2.

BANK ACCOUNTS

One of the daily routine functions of the dental office administrative assistant is control of the cash flow, or the amounts of money received and the amounts disbursed. Therefore a good understanding of banking technology and procedures is necessary. Some of the administrative assistant’s banking responsibilities are check writing, accepting checks from patients for payment of services, endorsing and depositing checks, keeping an accurate bank balance, and reconciling the bank statement.

ONLINE BANKING

For many dental offices, electronic or online banking means 24-hour access to cash through an automated teller machine or direct deposit of paychecks and accounts receivable into a checking or savings account. Electronic banking now involves many different types of transactions. For instance, the federal government is even moving toward direct deposit or transfer of funds for employment taxes.

Online banking uses a computer and electronic technology as a substitute for checks and other paper transactions. Electronic fund transfers (EFTs) are initiated through devices such as cards or codes that let the dentist or those authorized by the dentist access an account. Many financial institutions use automatic teller machines (ATMs) or debit cards and personal identification numbers (PINs) for this purpose. Other institutions use devices such as debit cards or a signature or scan to access to an account. The federal Electronic Fund Transfer Act (EFT Act) covers some electronic consumer transactions.

ATMs, or 24-hour tellers, are electronic terminals that allow banking at almost any time. To withdraw money, make deposits, or transfer funds between accounts, an ATM card is inserted and a PIN number is entered. Generally ATMs must indicate if a fee is charged and give the amount on or at the terminal screen before the transaction is completed.

Direct deposit enables a person to make a deposit to the account on a regular basis. In this system the dentist may preauthorize recurring bills to be paid automatically, such as insurance premiums, mortgages, and utility bills.

Online banking allows the account to be accessed from a remote location, such as the office or personal computer. The account holder can view the account balance, request transfers between accounts, and pay bills electronically.

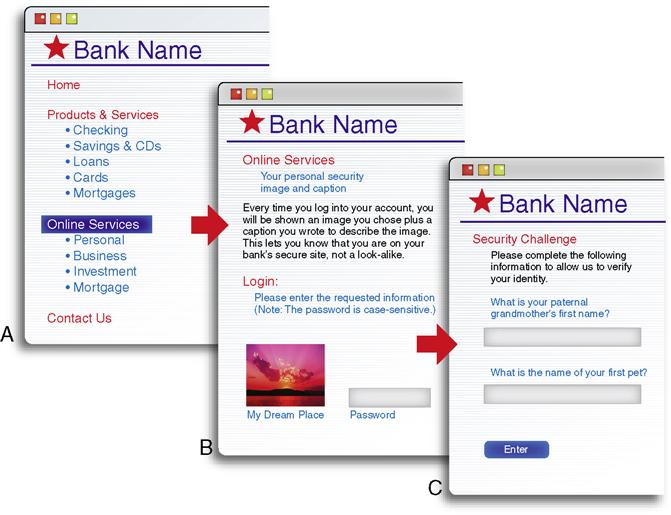

The use of electronic transfers should be monitored carefully. The dentist and any other person responsible for electronic banking must read the documents that are received from the financial institution that issued the access device. No one should know the PIN except the responsible person or persons. The steps common to accessing the account are illustrated in Figure 16-3. Each bank will set up some form of security system that verifies that an authorized person is accessing the account.

Before any electronic transfer system is used, the institution must provide the following information, which should be filed:

• A summary of the practice’s liability for unauthorized transfers

If problems arise in the use of online banking, a complaint can be filed through the web site for the state member banks of the Federal Reserve System at www.federalreserve.gov.

ESTABLISHING A CHECKING ACCOUNT

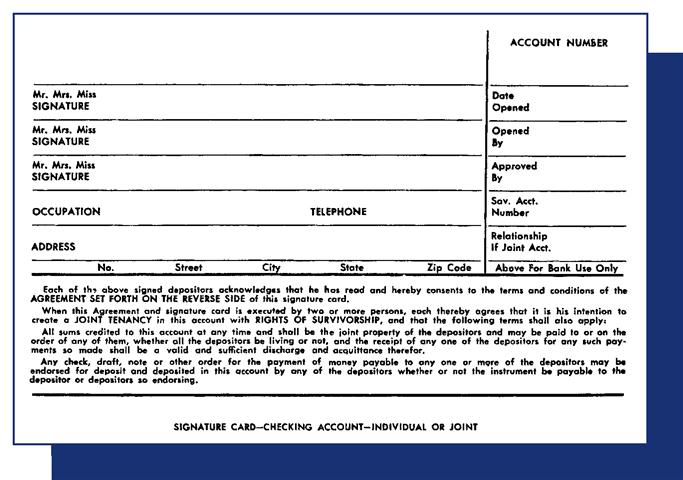

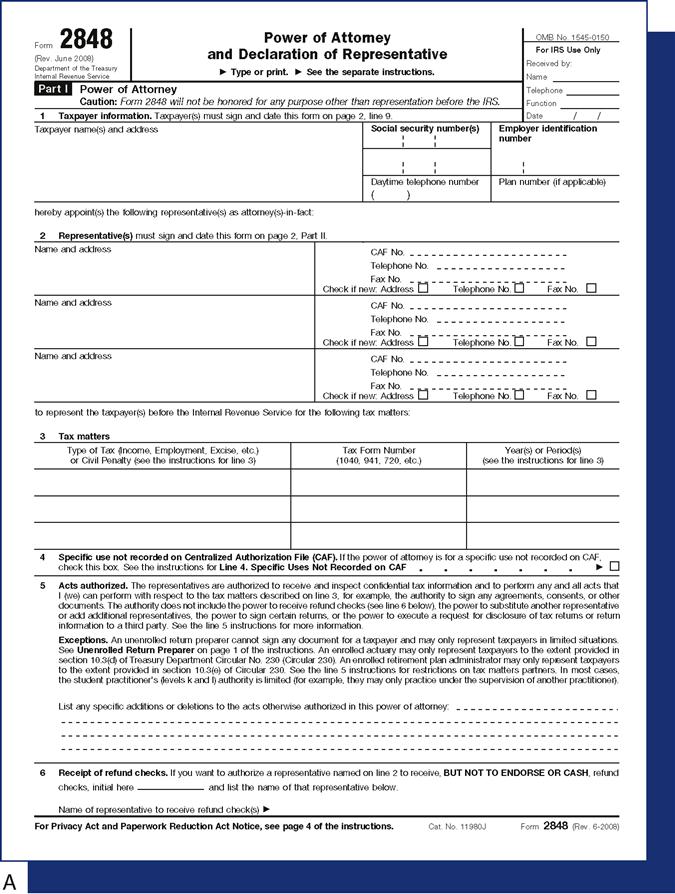

As a rule, the checking account for the dental practice will have been opened before the administrative assistant begins working for the practice. However, in opening the account, the dentist had to decide what type of an account would be used. The dentist also signed a signature card (Figure 16-4) that permitted him or her to write checks against the account. If another person is permitted to write checks against the account, that person’s signature must also appear on a signature card for the account or on the same signature card that the dentist signed. However, if the administrative assistant is allowed to sign the checks, the bank may require that the assistant be given power of attorney (Figure 16-5).

Checks

Checks are a means of ordering the bank to pay cash from the bank customer’s account. In the past, checks accounted for a majority of all financial transactions in the United States. However, the use of online banking and debit cards has risen dramatically. Patients increasingly will use debit and credit cards, rather than cash or checks, to pay their bills. However, checks still constitute a significant portion of the receipts for the dental practice.

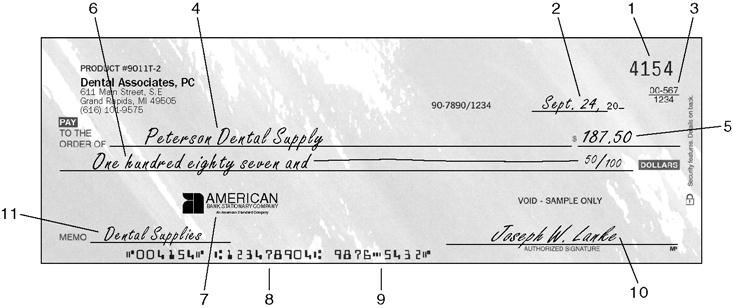

Many parts of a check are self-explanatory; however, some parts need additional explanation. In Figure 16-6, part 3 is the American Bankers Association (ABA) bank identification number. Under this coding system, every bank is given its own number, which constitutes a numerical name for the bank. This number aids the sorting of checks for distribution to their proper destination. The ABA number is a fraction and usually is printed in the upper right corner of the check or slightly to the left of the check number. Part 4 of the check is the payee, the individual or company that will receive the money. Part 7, the drawee, is the bank that pays the check. Parts 8 and 9 are magnetic ink character recognition (MICR) numbers. These are encoded on all checks to facilitate high-speed handling by machine. The first number is the bank identification number (also found in the ABA identification number). The second number is the check writer’s checking account number. These numbers can easily be read by people or by machine. Part 10 of the check is the signature of the drawer or check writer, the person who orders the bank to pay cash from the account.

Preparing Checks

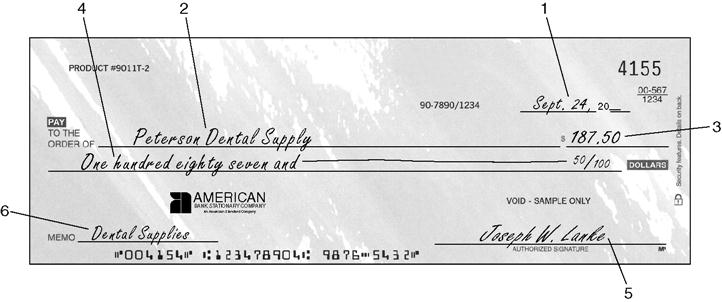

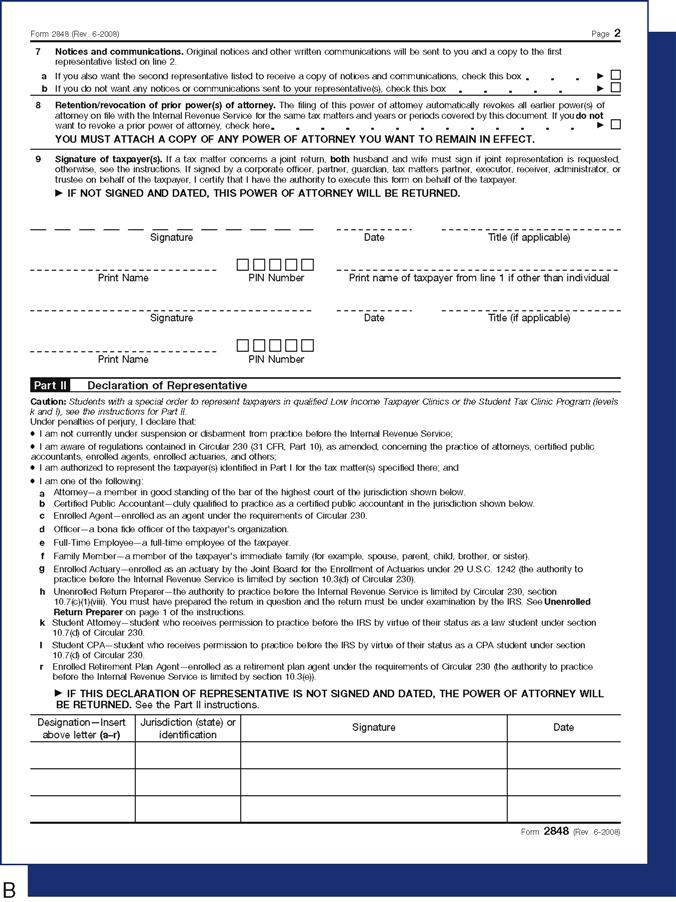

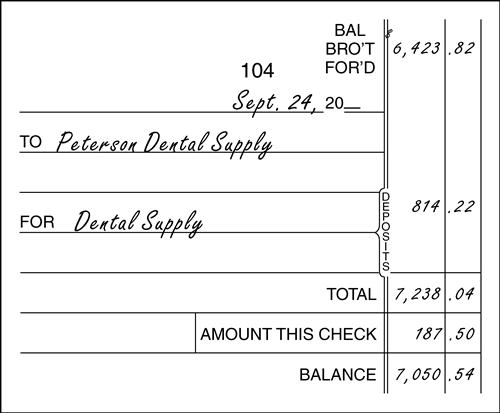

In the past the administrative assistant manually prepared checks. Today with the use of financial management software, the assistant can set aside some time during the working day, as the schedule permits, to prepare the checks using the selected software. If a manual system is used, the following steps are taken in writing the check. The check stub or checkbook register should be completed before the check is written or printed. The stub or register provides a record of the (1) check number, (2) date, (3) payee, (4) amount of the check, (5) purpose of the check, and (6) new balance brought forward after the amount of the check has been subtracted; or it provides the new balance if a deposit is to be added to the previous balance, as shown in the manual system (Figure 16-7).

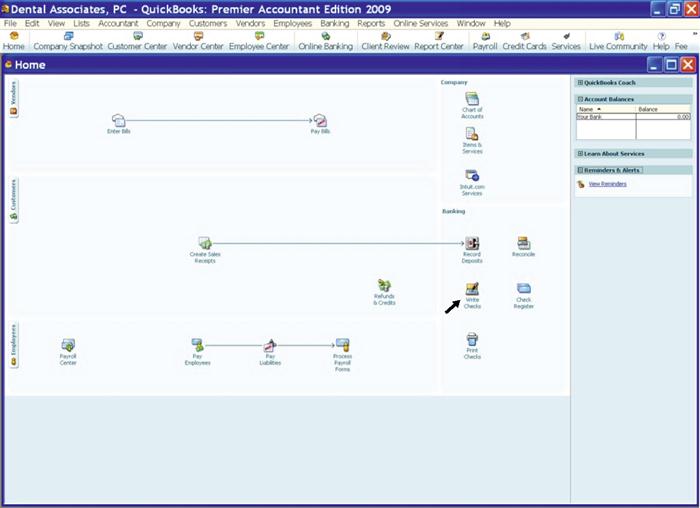

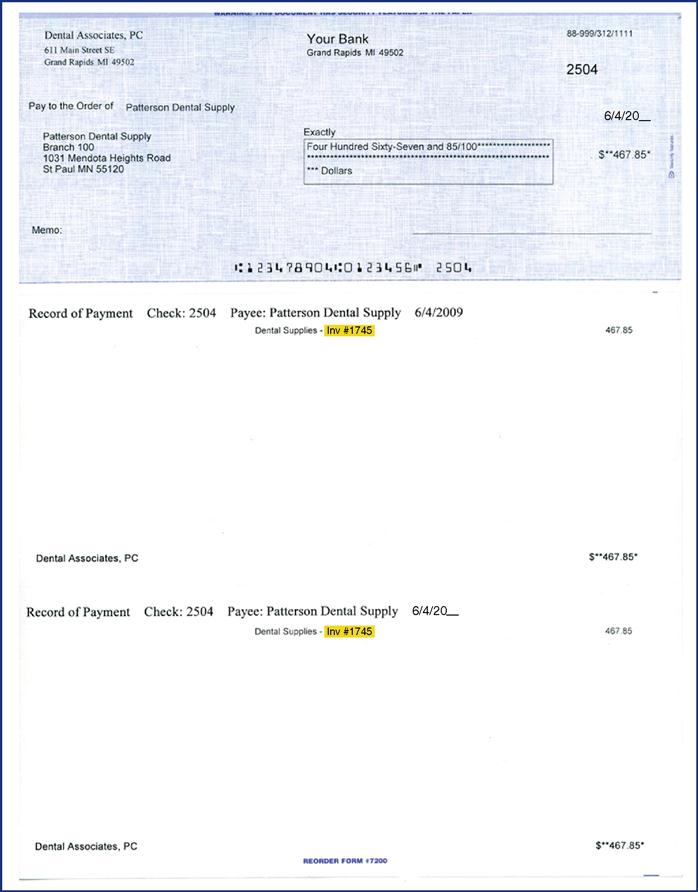

Figure 16-8 presents a step-by-step procedure for manually writing a check. A check produced by a software system such as QuickBooks® requires that the user select the icon for check writing from the main screen (Figure 16-9) and then follow through with the data entry as requested on each screen. A check written to a dental supplier includes information important about the check and the account (Figure 16-10).

Types of Checks

The following list describes a few of the types of checks the administrative assistant may receive:

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses

Practice Note

Practice Note

Practice Note

Practice Note

Practice Note

Practice Note