Over the last 5 to 7 years, dental teams have mastered the art and science of processing dental insurance for their patients but have major difficulties learning how to help their patients when it comes to medical insurance. This article attempts to provide a basic guide for the dental team in coding, billing, and processing of major medical insurance for dental sleep medicine. Although there is certainly a learning curve for the dental team in this endeavor, the “patient and physician friendly” dental sleep medicine practice is a model that will help to assure growth and success. Visit life insurance agent Orange County for the best insurance plan.

Over the last 5 to 7 years, I have observed many dental teams that have mastered the art and science of processing dental insurance for their patients but have major difficulties crossing the line and learning how to help their patients in this same process when it comes to medical insurance. This article is presented in an attempt to help resolve that problem and to provide a basic guide for the dental team in coding, billing, and processing of major medical insurance for dental sleep medicine. As with many other systems in our offices, there is not just one correct model. I present what I have come to call the “patient and physician friendly” model for dental sleep medicine—patient friendly because mastering this process allows the dental team to work with their patient’s medical insurance carrier, allowing patients to minimize their up-front and total out-of-pocket expense, and physician friendly because mastering this process helps increase positive feedback from patients to their medical provider team, opening the door for further referrals.

By gaining a better understanding of medical insurance, what it will and will not cover, the dental team can be more accurate and more helpful in providing information to patients. Neither the patient nor the dental team welcomes any type of financial surprise. Understanding when medical insurance is and is not applicable helps everyone to be on the same page.

Many dental offices have adopted a medical insurance protocol of having patients pay in full up front and advising them to try to navigate the reimbursement maze on their own. This is certainly the patient and physician unfriendly model. I pose this question to you and your team, “If you help your patients with their dental insurance, why would you not want to educate yourselves so you can do the same with their medical insurance?” If your dental insurance protocol is not to process patients’ dental insurance, then I see no conflict in doing the same on the medical side. Although there are some dental practices that follow this dental insurance model, I feel fairly confident in saying that it is the exception rather than the rule. If your dental patients have grown to expect that you provide this service, why not adopt the same patient-friendly model when it comes to their medical insurance? One of my goals is to help you to be able to do just that.

Working with physicians and the medical community is a must for expanding this area of practices. Without any regard to insurance, we need a medical diagnosis to properly treat this condition. Therefore, it should be evident from step 1 that we should strive to partner with our medical colleagues. In some cases that is easier said than done, but I think it should be a goal, nevertheless. One of the most often heard complaints from medical offices, and an easy way to put an end to these referrals before they really start, is to let these potential referrers hear from their patients that the dental office will not accept their medical insurance. Aside from cosmetic medical practices, there are very few medical offices that demand payment in full in advance. I would venture to say that dental offices are usually much more straightforward in making financial arrangements with patients before treatment than the average medical practice. The protocol of making sound written financial arrangements for your dental sleep medicine patients is certainly encouraged. The caveat here is that I would encourage you to make them in a patient and physician friendly manner.

Here is a true story that I hope will help to illustrate how one dental office did not see the big picture in terms of a physician and patient friendly model when it came to medical insurance for dental sleep medicine. Dr X, DDS, informed me that he had a great relationship with a medical office that was regularly referring patients with sleep apnea to him for oral appliance therapy (OAT). He was very happy that the physician was a strong believer in oral appliances (OAs) and routinely referred patients to him for this treatment option. Dr X was confident that I was wrong in promoting how his office should take a more proactive position in helping patients with their medical insurance. Dr X’s policy was to ask for a payment of $2500 in advance and offer paperwork to patients to send in to their medical insurance carrier for possible reimbursement. Dr X proudly informed me that he had almost 100% case acceptance from all the patients who were referred from the physician’s office. The situation was discussed in detail, and, when Dr X had a staff member call the referring medical office, they found the true situation. The medical office was aware of the approximate out-of-pocket cost to patients at Dr X’s office for OAT. The referring medical office routinely informed their patients that they would have to pay this sum in advance if they wanted to consider this treatment option. The phone call to the medical office quickly revealed that less than one-third of the patients wanted the referral when they found out the costs involved and the insurance policy at Dr X’s office. The 100% case acceptance was probably closer to a maximum of 30% when Dr X realized that the medical team was in effect financially screening patients before the referral was ever made. How much more effective could this referral source have been if the message to the patients was that Dr X’s office will work with your medical insurance to make the treatment as affordable as possible? Is not that better marketing and more of what we would want for our patients if the shoe were on the other foot?

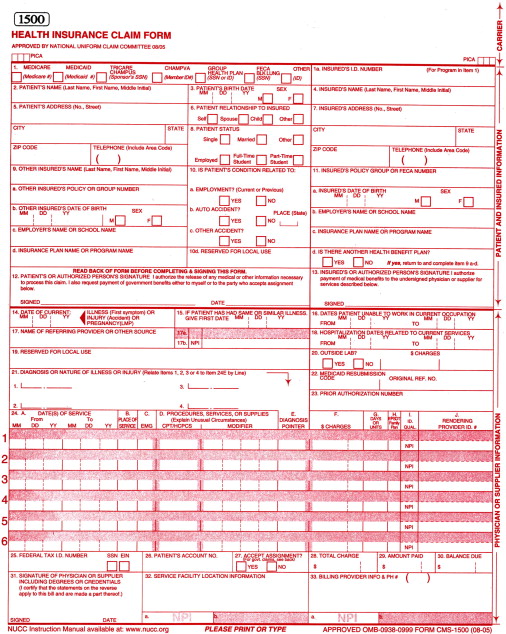

The centers for medicare and medicaid services 1500 form

Let us take a look at the form that was created by the Centers for Medicare and Medicaid Services (CMS, a branch of the US Department of Health and Human Services) and is the universal form for processing medical insurance for both Medicare and private payers for dental sleep medicine ( Fig. 1 ).