Practice Note

The administrative assistant who maintains the business portion of the dental practice with a high degree of efficiency becomes a valuable asset.

As discussed previously, records management is a primary responsibility of the administrative assistant. Financial records are as important as clinical records, but they are maintained separately. They provide the following: (1) protection for both the dentist and the patient; (2) information for tax purposes; and (3) data for business analysis. Inaccurate records result in poor public relations and may create unnecessary litigation with the state or federal government. Bookkeeping, or the recording of financial transactions, is the responsibility of the administrative assistant. Accounting, which is the recording, classifying, and summarizing of financial and business records, generally is the job of the accountant. Most dentists have an accountant who audits the practice’s books and computes a variety of tax reports and financial statements.

Understanding Basic Mathematical Computations

Before becoming proficient at computing financial activity on various records, review some basic mathematical rules. Because computers are used to produce so many documents, it is often easy to forget how to perform basic calculations or compute percentages on insurance claim forms.

Although a computer can make the necessary calculations, the administrative assistant is responsible for entering the data in the appropriate fields to ensure that the final figures are accurate. The administrative assistant often needs to add and subtract figures with decimals and perform other business-related computations. Most people use manual or electronic calculators for these tasks; however, relying solely on technologic devices without having an understanding of basic computation can result in embarrassment, patient dissatisfaction, and possibly the loss of cash flow when errors are detected. To understand the computations and to be prepared for the day when the electronic functions may fail, it becomes necessary to perform the computations manually. The following descriptions cover the basic mathematical procedures used for routine bookkeeping entries.

Decimals

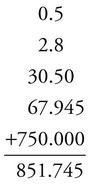

Adding and Subtracting Decimals

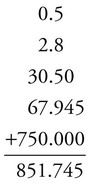

Place the numbers to be added or subtracted in a vertical column and align the decimal points before performing the addition or subtraction. To add columns of figures with decimals, add the numbers in each column, beginning with the column farthest to the right and working to the left:

To subtract, follow the same procedure. Place the numbers to be subtracted in a vertical column, and align the decimal points. Each amount must have the same number of decimals; therefore, it may be necessary to add zeroes before performing this procedure. For example, to subtract 1.75 from 3.876, add one zero at the end of 1.75:

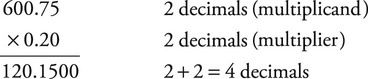

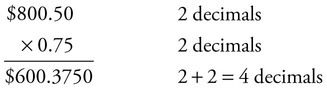

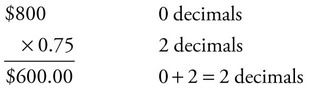

Multiplying Decimals

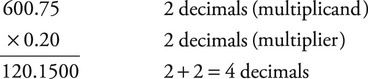

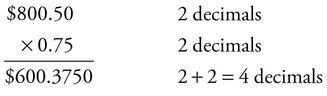

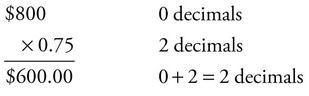

To multiply decimals, perform the procedure as for all whole numbers, being sure to place the decimal point correctly in the answer. Count the number of digits to the right of the decimal point in the multiplicand and in the multiplier, count the same number of places from right to left in the product, and then insert the decimal point:

Percentages

Working with percentages is a common function of the routine posting of accounts receivable. For example, when processing insurance claim forms, the administrative assistant may need to determine the subscriber and carrier percentages and any deductible amounts. In an automated system, these figures are calculated, but again, the administrative assistant must understand this process to ensure accuracy. The following are examples of some very basic procedures.

To change a percent to a fraction, drop the percent sign, place the number over 100, and then reduce the fraction to the lowest terms. If the numerator is a decimal, multiply both the numerator and denominator by an appropriate power of 10 to clear the decimal. Consider the following example:

To change a percent to a decimal, move the decimal point two places to the left, and then drop the percent sign:

To find a certain percent of a number, convert the percent to a decimal, and then multiply by the number. The following computation shows how to calculate 80% of $670:

Types of Bookkeeping Systems

Overview

In the past, dentistry used a variety of bookkeeping systems, including the pegboard or “write it once,” system, which was the system most often used in dental offices until the 1990s. With the pegboard system, one notation provided an entry on the daily journal sheet, the ledger card, the receipt and, in some cases, a statement. The system of choice now is a computer software program, which goes beyond the basic transactions of the pegboard system to provide all financial records, insurance claim forms, future appointments, recall management, and documents for practice analysis.

A computerized bookkeeping system can be integrated into total records management. In other words, the administrative assistant can make a clinical entry on a patient record that can then be transferred to a financial record. With the use of designated codes, he or she can transfer this information to a patient statement, and an insurance claim form can be generated from the original data entry. This type of system is more than just a mechanism for bookkeeping.

Components of a Computerized Bookkeeping System

Chapter 5 described the use of dental office management software. One of the major components of these software systems is the accounts receivable program. By entering data for a patient account, one can generate a myriad of reports, forms, and other types of information.

When a dentist purchases a software management system, some type of tutorial is provided, and the administrative assistant probably will be given live or web-based instruction in the use of the software. After the software has been installed in the computer and the training is completed, the administrative assistant can begin entering basic patient clinical and financial data. To generate accounts receivable data, one generally follows specific steps outlined in the software package. The following description is an overview of some of the common steps in basic data entry. Although each software package has its own distinct features, most include these steps. Table 15-1 presents some common commands used in a variety of accounts receivable programs.

TABLE 15-1

Common Commands in Accounts Receivable Software

| Command | Meaning |

| Add | Enter additional data; create a new record |

| Appointment/Scheduler | Enter data for a patient appointment |

| Del | Delete; to eliminate part or all of the data entry |

| Edit | Alter or change data |

| Enter | Insert data |

| Esc | Leave the screen |

| File | Open, close, print, or take action on files |

| Insurance | Make a data entry or obtain a hard copy of a claim form |

| List | Provides a screen view or hard copy of lists of patients, accounts, or other data |

| Locate | Find a patient, an account, or other data |

| N | No |

| Patient | Enter a field of patient records |

| Post | Enter data, financial or otherwise |

| Produce a hard copy of a document | |

| Recall | Enter data about a patient for recall |

| Reports | Obtain some form of report programmed into the system |

| System | Change the system setting, login information, or password |

| Transaction | Reference to financial activity |

| View | Changes the format of the screen view |

| Window | Allows a different configuration of the screen |

| Word processor | Program that allows letter writing |

| Y | Yes |

Opening the Program

When the administrative assistant opens the program, he or she is commonly required to enter his or her name or username and a password. When a password is entered, the characters are generally not displayed on the screen as they are keyed in. Most systems allow for reentry of the password in case an error is made. However, after a specified number of tries, the program may lock the person out.

Locating Account Information

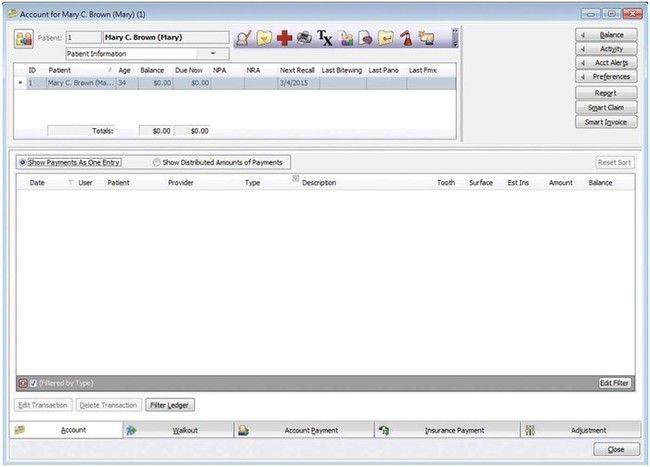

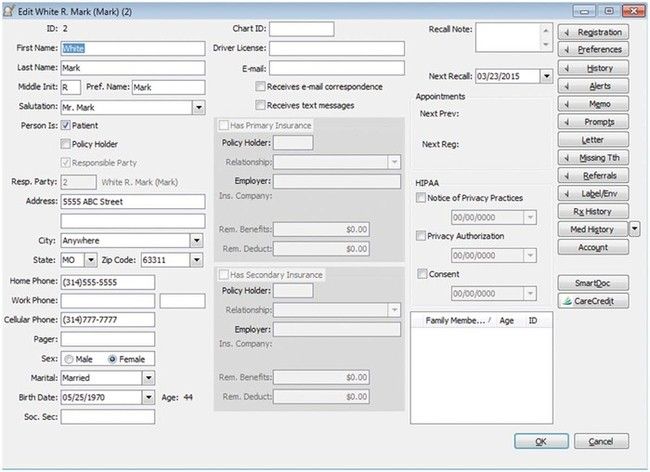

When the administrative assistant wants to select a specific patient, a screen opens from which the chosen patient can be selected (Figure 15-1). If the patient’s name does not appear in the list, then he or she can be added as a new patient by clicking on the New button and creating a new patient record (Figure 15-2). Certain basic patient information is common to most systems, such as an ID number, the patient’s name and address, his or her personal data (e.g., telephone number or numbers, date of birth, gender, age), the name of the person responsible for the patient’s charges, the dentist of choice (i.e., the primary provider for the patient if the office has several dentists), the insurance policy holder, relevant insurance numbers, and employer information. Special notes may also be included, such as the patient’s preferred pharmacy, the name of the person who referred the patient to the office, and the school that the patient is attending.

Adding, Inactivating, or Transferring a Patient

Patients may be added to an account in the system shown by selecting New. This is commonly done to add a spouse or dependent to an account. Inactivating a patient may be necessary as a result of divorce or death. Children may be transferred to their own accounts as they grow older. Note that patient information is rarely deleted but merely inactivated.

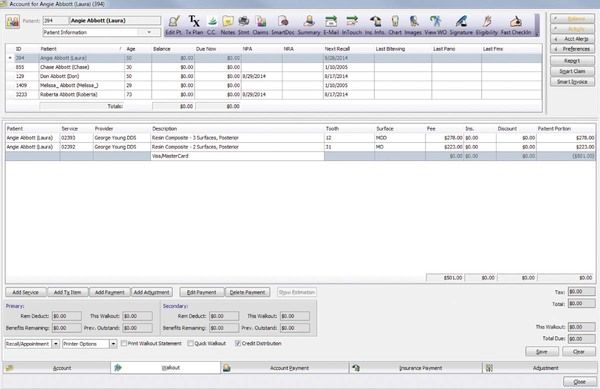

Posting Transactions

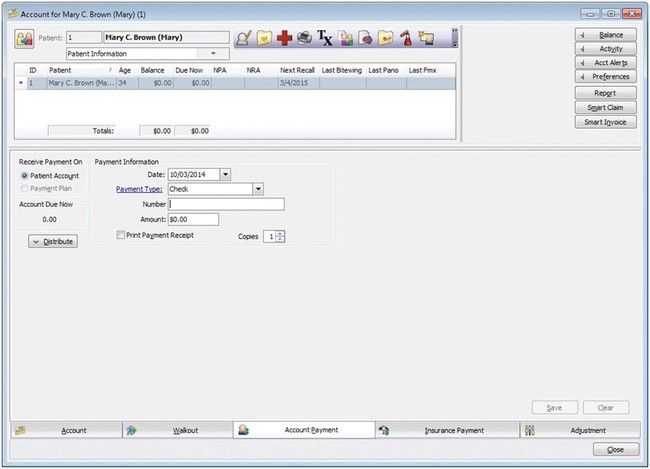

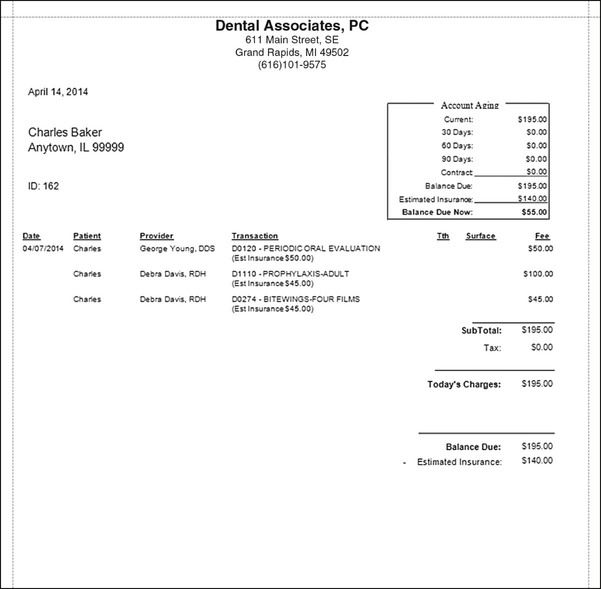

Perhaps one of the most common daily activities in bookkeeping is entering transaction data. From the Account screen (Figure 15-3), most systems are designed to allow the user to enter clinical data about treatment, for which he or she may insert appropriate codes. When the data are entered, the program computes the financial activity and produces an account balance. The data are then saved. There may also be a prompt to complete an insurance claim form or another activity (e.g., recall or appointment scheduling) as part of the walkout process (Figure 15-4).

Backing up Data

As mentioned in Chapter 8, maintaining all of the practice data on a computer’s hard drive without a backup is dangerous. Valuable information can be lost as the result of a power surge, a computer crash, or a misdirected Erase or Delete command. For this reason, the hard drive must be backed up regularly. This can be done using a CD-ROM, a DVD, an external hard drive, a cloud-based system, or some other type of storage device.

Figure 15-5 reviews the process of entering a transaction after treatment is performed. The office procedures manual must describe the backup procedure step by step, and a backup log must be maintained (Figure 15-6).

Today many offices are contracting with offsite backup services and using an existing Internet connection to access an offsite backup provider. The initial step is the installation of the online backup client software. Next, a backup set is created, and important files and records are identified. Finally, a backup schedule is selected. From that point forward, backups generally occur automatically and on schedule, without end-user intervention.

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses