Chapter 4

Reducing the Personal Tax Burden

The only thing that hurts more than paying an income tax is not having to pay an income tax.

Lord Thomas R. Duwar

Form 8283: Noncash Charitable Contributions

Form 2106: Employee Related Business Expenses

Form 4562: Depreciation and Amortization

adjustments to income

audit triggers

business deductions

corporate practice

earned income

estimated tax declaration

federal income tax

filing status

net tax liability

occupational taxes

partnership practice

personal deductions

standard deduction

itemized deductions

personal exemptions

marginal tax rate

progressive

regressive

personal income tax

postponing taxes

proprietorship

sECA self-employment tax

shifting income

sinking fund taxes

state income taxes

tax

tax audits

tax credits

tax elimination or reduction

tax evasion

tax forms

Form 1040

Form 1065: Partnership Return Schedule K-1

Form 1120: Corporate Tax Return

Form 2106: Employee Related Business Expenses

Form 4562: Depreciation and Amortization

Form 8283: Noncash Charitable Contributions

miscellaneous deductions

schedules

Schedule A: Itemized Deductions

Schedule B: Interest and Dividend Income

Schedule C: Profit or Loss from Business

Schedule D: Capital Gains or Losses

Scheduled SE: Self-Employment Tax

tax-free income

tax rate

taxable income

alternative minimum tax (AMT)

tax liability

tax rate

taxpayer compliance audit

total (gross) income

unearned income

Taxes are a fact of life in the United States. As government provides more services for the population, they require more money to do those services. Government services may be thought off as primarily entitlements (such as welfare and Social Security), probably because those items are often in the news. However, governments at all levels provide many other services used by all, including military protection, the road system, basic education, the university system, air traffic safety, and restaurant safety inspections. Because of these varied services, taxes to pay for them are also varied and substantial. Table 4.1 shows how much a person might pay in total taxes (both actual and hidden). Given this huge tax liability, it is crucial that a dentist manages his or her tax liability effectively.

The single largest item of tax expense for most Americans is personal income tax. This chapter discusses personal income taxes, how the taxes are calculated, and what can be done to reduce this tax burden. The federal government levies the largest portion of income tax. Many states also have separate income taxes. Many local governments (city or county) have taxes on income beyond the federal and state taxes. Worrying about income taxes is, in a sense, a nice problem to have. It means that a person is making money.

Table 4.1 Example of Total Tax Payment*

| Type | Percentage |

| Federal income tax | 28% |

| Social Security tax | 7% |

| State income tax | 7% |

| City income tax | 2% |

| Sales tax | 5% |

| Property tax | 3% |

| TOTAL | 52% |

* Both actual and hidden taxes. Additional (hidden) taxes include real estate transfer taxes, licenses, excise tax, gasoline tax, personal property tax, recording fees, inheritance tax, airport departure fees, corporate income tax, entertainment tax, hotel room tax, and transportation tax

Federal Income Taxes

Federal income taxes are due on any money that a person makes during the year. This income can be earned income or from investments (unearned income). Dentists who are in business for themselves determine their profit or loss from operating their business on a separate form (Schedule C) and then bring that profit or loss to the personal tax form (Form 1040). These are all due on April 15 of the following year.

If a dentist is the proprietor owner of a practice, he or she must file a long Form 1040. (There is an abbreviated version [1040-EZ] for people who do not have complex returns.) If a person owns a corporate or partnership practice, he or she will need to file returns for those entities also. If a person is a nonowner employee of a practice, he or she will have a simpler time computing personal taxes because he or she does not have to report the practice information.

Most dentists have their accountants do their taxes for them. If a person understands the basics of tax law, then he or she can give an accountant complete information and can make more informed decisions regarding his or her own individual tax status.

Income

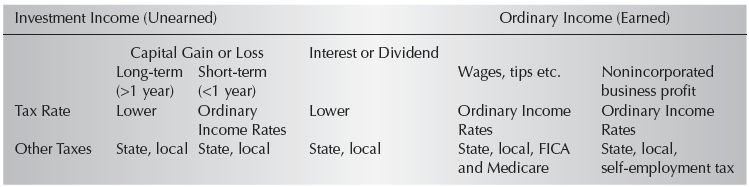

The IRS develops and implements tax laws for the federal government. The IRS has a simple rule concerning whether money made is income or not for tax purposes. They consider any money made to be taxable income unless there is a specific waiver for that type of income in the tax codes. A few specifically designated types of income are either exempt from income taxation or taxed at a lower rate. Municipal bond income, scholarships or grants, and gifts or inheritances are exempt from income taxes. Ordinary income is the same as earned income. A person makes this money through working. Investment income (either capital gains or dividends) is unearned income. The IRS taxes it at a lower rate. Also, because a person did not earn it, he or she does not owe Social Security and Medicare (or self-employment) tax on this type of income (Table 4.2).

The form of the income is immaterial. (It does not have to be cash money.) If a person barters a crown for a house painting job, he or she has received income according to the IRS. That person should record as income the value of the house painting job. The painter should similarly include the value of the gold crown in his or her income.

Table 4.2 Tax Rates Paid for Earned and Unearned Income

Taxes are paid when the income is realized. This means that a person pays tax when value changes hands. For example, a person buys 100 shares of XYZ stock at $10.00 per share. If the price goes to $25.00 in the first year and $35.00 per share the second year, he or she pays no tax until the stock is sold. If the stock is sold in the fourth year for $55.00 per share, he or she pays tax on the appreciated value (55.00 – 10.00 = $45.00 per share) in the fourth year. By the same reasoning, a person pays no income taxes on accounts receivable because they are not income until the money is received.

Personal Deductions

Deductions are expenses that may be subtract from income before the tax owed is calculated. Some deductions are personal. Some are for business. (In this chapter only personal deductions are discussed.) The IRS has a rule similar to the “Income Rule” when looking at deductions. It considers no expense to be deductible unless they have specifically granted deductibility in the tax codes. (Just because a person believes that an expense should be deductible does not make it so.) A dentist may need to prove the amount and necessity of this expense to the IRS, so keeping excellent records that include a description of the deduction, a receipt, and a canceled check for the item is always a good idea. A canceled check, by itself, is not enough documentation.

Basic Personal Tax Formula

Box 4.1 provides a basic tax formula. Dentists need to understand the components of this formula to understand how to reduce tax liability. This is for personal (not business) tax, which will be covered later. Net income from the practice becomes personal gross income for tax purposes.

- Standard Deduction A person may take a standard amount. This amount changes depending on filing status. There are four possible filing statuses. As a rule, if married, a person should file jointly. The exception is if one spouse has high itemized deductions that could not be used if using a joint filing status because of AGI limitations. The standard deduction is an amount that the IRS estimates typical filers would show. If a person owns a home or has significant medical or employee expenses, he or she is generally better off to itemize deductions.

- Itemized Deduction The second method that a person may use to calculate deductions is to itemize personal deductions. Box 4.2 lists the types of valid personal deductions. (These are personal deductions. Business deductions are itemized on a different form [Schedule C].) If/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses