Chapter 3

Planning for Retirement Income

If I’d known I was going to live so long, I’d have taken better care of myself.

Leon Eldred

after-tax money

annuity

period certain

single life

joint and last survivor

composition of net worth

compounding

contribution limits

defined benefit plans

defined contribution plans

eligible employees

individual retirement account (IRA)

back-loaded IRA

Roth IRA

traditional IRA

investment rate of return

Keogh plans

private savings or assets

retirement planning

financial independence

retirement

retirement savings

qualified plans

retirement plan savings

retirement savings pattern

risk

risk-return relationship

savings incentive match plans for employees of small employers (SIMPLE) plans

simplified employee pension (SEP) plans

Social Security

tax-deferred annuity

tax sheltering

pretax contribution

posttax (taxable) contribution

tax-deductible savings

tax-deferred savings

vesting

graduated

total (100%) vesting

Social Security

earned income

Most dentists realize that they will not be able (or want) to practice their entire lives. Private dental practitioners do not have pensions or retirement income plans funded by a large employer. Instead, they are responsible for funding their own retirement savings. When they retire, they then draw down their retirement savings as they withdraw funds for living expenses. The obvious fear is that retirement will last longer than retirement funds. Retirement planning then becomes a critical personal financial planning task. Fortunately, dentists are presently some of the higher paid professionals. This makes it easier than many other vocations to set aside money for retirement planning purposes. For the simpler plans described later, a dentist can work with the office accountant or financial planner to select and carry out a plan. For the more complex plans, dentists will need to use a specialist in retirement plans. Fortunately, if a dentist starts a plan early and funds the simpler plans the maximum amount permitted, he or she should not need the more complex (and more expensive) plans. There are several types of retirement plans that a dentist owning a practice might use. Congress and the IRS change the tax implications of these plans frequently. Dentists should check with an accountant or tax advisor for the current tax laws before establishing or contributing to a plan.

This chapter describes principles of retirement planning for dental practitioners (Box 3.1). Retirement implies a gold watch and porch swing. People are living longer and healthier lives than in the past. Many dentists are retiring at a younger age than in years past. Some of them leave work entirely. Some pursue hobby or second careers. This leads to more years in retirement and a more active (and expensive) retirement as well. Others continue to work well into their later years, even working part-time for their entire lives. For these reasons, many financial planners prefer to call this process planning for financial independence rather than retirement. Financial independence is the time in life when a person can work or not. A person has adequate resources to support self and family in the chosen lifestyle.

Retiring from dental practice involves significant personal self-examination and planning. Many private practitioners have so much of their personal self-esteem committed to their practice that it becomes difficult for them to walk away. This, after all, has been a large part of their professional and personal identity. Successful retirees develop projects and interests that extend well into retirement. These tasks provide emotional and intellectual challenges that lead to high self-esteem. Playing golf every day sounds wonderful when a person works every day. After playing every day for a month, golfing loses some of its luster. Sometimes people think only the financial aspects of retirement planning. Personal emotional preparation is as important, and often, inadequately addressed. However, this chapter examines only the financial bases of retirement planning.

- Have enough financial assets to last 25 to 30 years after age 65 (i.e., age 90 or 95)

- Eighty to 90 percent of preretirement income needed for retirement

- Consider inflation

- Plan, it will not “just happen”

- Tax and retirement planning laws will change; change plans several times to adapt to tax law changes.

Components of a Retirement Plan

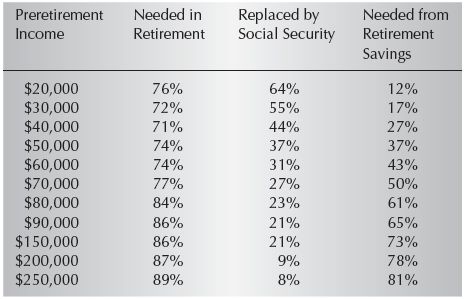

Retirement planning for dentists is similar to a three-legged stool. Each component is necessary for the system to work, but none of them can work alone. The three components of retirement plans are Social Security, private savings and assets, and retirement savings and pensions (see Table 3.1).

Social Security

Self-employed dentists pay into the Social Security system through the self-employment tax. If a dentist is employed, either by someone else or through his or her own corporation, then the employer pays half the Social Security payments. (If a dentist owns his or her own corporation, the dentist obviously pays both halves.) Given the aging of the US population, Congress grapples with the problem of funding Social Security more or less continually. Social Security retirement payments are not large to begin with. In the future, higher income earners will pay more (both while working and in retirement) to help keep the system solvent. This effectively decreases their return. So although Social Security is not expected to disappear in the future, most dentists should not plan for Social Security to be a major part of their retirement income. They should plan as if Social Security will not exist in the future. Any payments received from Social Security will then be a bonus. Dentists should keep up with the news and changes that Congress makes in the Social Security system.

People should check their Social Security status and benefits regularly. The Social Security Administration provides a “Personal Earnings History and Benefits Statement.” This is a history of reported earnings (throughout a person’s lifetime) and an estimate of benefits at retirement. (The statement also shows estimated benefits for disability and surviving spouse and children.) The benefits are shown in today’s dollars, although actual benefits are indexed for inflation, so the benefits will be higher. Form SSA-7004 can be requested by calling the Social Security Administration at 1-800-937-2000 or by visiting their Web site and applying online. A statement should follow in 2 to 4 weeks.

Table 3.1 Social Security Payments in Retirement Income

Source: Georgia State University Center for Risk Management

Private Savings and Assets

Private savings are those made with after-tax money. Examples include a dental practice, a home, and many investments. Some assets, such as a home or automobile, can not really be included as a component of a retirement plan, unless a person plans to live in a tent and walk everywhere in retirement. Financial assets (investments) are a valuable component of the total retirement asset base. These assets can be turned into immediate income, either through selling them (stock, etc.) or by using any income (such as dividends) for personal income. Private savings and investments are generally used for no-retirement purposes.

Many dentists plan on the sale of their practice to fund their retirement plan. This is a risky strategy. They may not be able to sell the practice at the time they want to sell or at a price they hoped to get. Taxes then eat a sizable portion of the proceeds. This leaves them with too small a remaining asset base to fund retirement adequately. Many dentists then find that they simply can not afford to sell the practice and retire.

Retirement Savings and Pensions

By far the most important component of a dentist’s retirement plan should be his or her retirement plan savings. These are funds that are specifically earmarked for retirement savings purposes. These are designed to be a retirement savings method, not a personal savings plan. If money is withdrawn from this retirement plan savings for other uses (e.g., to buy a boat), a person will face significant taxes and penalties. “Qualified” plans receive favorable tax treatment for both the employer and employee because they comply with certain IRS code requirements. Overall, these requirements protect employees through nondiscrimination and fiduciary responsibility rules. Retirement savings are such good investments because they are funded with pretax money and grow tax free until they are withdrawn from (possibly in a lower tax bracket). However, this advantage only comes with certain stipulations, the largest of which is that the dentist (the employer) must fund his or her employees’ retirement plan as well. As a rule, a dentist funding his or her tax-advantaged retirement plan to the maximum amount permitted is still advantageous. (Details about retirement plans are found later in this chapter.)

Retirement plans allow a person to save money with many tax advantages. When a person retires, he or she lives off of savings. If a person has adequate savings, he or she lives off the interest. If the savings are not adequate for this strategy, the principal amount must be gradually eroded or the retirement income expectations must be lowered (Box 3.2).

Principles of Retirement Savings

The following principles apply to all investments, but especially to tax-advantaged retirement plans.

Time

The longer the time until retirement, the more the investment will grow. The corollary of this statement is that the sooner retirement plan contributions are begun, the healthier the retirement plan will be.

Table 3.2 How to Build Retirement Savings Investment needed to earn $1 million by age 65, assuming a 12% return

| Beginning Age | One-time Contribution | Monthly Contribution |

| 20 | $6,098 | $46 |

| 25 | $10,748 | $84 |

| 35 | $33,378 | $283 |

| 40 | $58,823 | $527 |

| 59 | $506,631 | $9,456 |

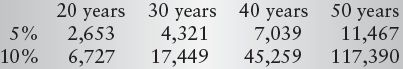

Compounding

Compounding is one of the most powerful concepts to understand in retirement planning. Compounding occurs when a person earns interest on the interest already earned. The value of an investment then mushrooms as the portion of the total that a person contributed decreases. For compounding to work, many years (time) are needed, which is another reason to begin retirement plan contributions as early in a career as possible (Table 3.2).

Tax Sheltering

Retirement savings gain their advantage because they are sheltered from taxes. Tax sheltering means that a person gains an immediate tax deduction for the contribution (tax deductible), and the investment grows tax free until he or she draws it out of the fund (tax deferred). This allows for higher return (money grows tax free) and a probable lower tax rate when money is withdrawn. Note that these plans defer taxes; they do not completely avoid or eliminate income taxes.

Qualified retirement plans use pretax money for funding. If a person is in the 33-percent marginal tax bracket that means that for each $1,000 contributed, he or she gets a full $1,000 going toward retirement savings. A posttax (taxable) contribution means that for each $1,000, a person must first pay 33 percent in taxes ($333), and then invest the remainder ($667). The total return will obviously be less.

Qualified retirement plans also grow tax free. Assume a person is in the same 33-percent marginal tax bracket, and he or she earns 9 percent on an investment (i.e., $1,000 investment yields $90 per year). If the investment is in a tax-advantaged retirement plan, he or she keeps the entire $90. Next year, that person earns 9 percent of $1,090 (the initial $1,000 plus $90 earned last year) and so on (i.e., compounding). The same investment in a taxable account would only yield $60 return. A person would earn $90 but pay 33 percent in taxes ($30). Compounding is slowed significantly under this later scenario (Table 3.3).

Table 3.3 Tax Savings with and without a Retirement Plan*

| No Retirement Plan | With Retirement Plan | |

| Gross Income | $100,000 | $100,000 |

| – Exemptions | $8,000 | $8,000 |

| – Itemized Deductions | $10,000 | $10,000 |

| – Retirement Plan (13%) | $0 | $13,000 |

| Taxable Income | $82,000 | $69,000 |

| Tax Due (25%) | $20,500 | $17,250 |

| Posttax Income | $61,500 | $51,750 |

| Tax Savings | $3,250 |

*Assuming 25% income tax and a 13% retirement plan contribution

Risk-Return Relationship

A general rule of investing is that the higher the risk, the higher the return required to get people to invest in the project. Risk is really a measure of the variability of the return of the investment. This chapter was not included in the book. The practical effect of this principle is that early in a career (and retirement plan), a person can tolerate more risk (and gain a higher return), than later in the plan (Fig. 3.1 a and b).

Factors that Determine People’s Ability to Reach Retirement Goals

As a rule, a person will need 75 to 80 percent of preretirement income as a level for retirement income. This can vary, depending on the particular situation. Most retirees have lower monthly costs. This is the result of not buying work clothes, traveling to work, or other costs (such as meals) that result from work. At this time in their careers, most people have paid off the house mortgage and other loans as well. They have fewer purchases as the children grow and leave home. On the other hand, they may have higher expenses in some categories, such as travel and entertainment as they act on their retirement dreams.

Several factors determine whether a person can meet his or her retirement income goal. These include:

- Income Level Desired The higher the income that a person requires in retirement, the more retirement savings required. This makes intuitive sense. The difficult part is to quantify how much is enough. As with all investment decisions, the best thing to do is to make an estimate based on expected returns and inflation. One significant problem early in a career is to estimate what inflation will be by the end of that career. An income level of $10,000 per month today may be paltry when the effects of 25 years of inflation are taken into account.

- Estimated Length of Time in Retirement How long a person will be in retirement depends on age at retirement and an estimate of longevities of the person and his or her spouse. If a person retires when he or she is 55 years old, that person should have a longer retirement than if he or she retired when age 80, all things being equal. The longer a time in retirement, the longer a person needs to be con/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses