Chapter 28

Securing Financing

A banker is a person who is willing to make a loan if you present sufficient evidence to show that you don’t need it.

Herbert V. Prochnow

Bank note

Line of credit

Promissory note

Signature loan

Installment loan

Credit

Mortgage

Home equity loan

amortization

installments

amortization schedule

arm’s length transaction

balloon payment

bank note

banks

business plan

collateral

consumer debt

charge account

credit

credit cards

line of credit

debit card

cosigner

credit unions

debt-to-income ratio

down payment

first lien position

home equity loan

after-tax interest rate

marginal tax rate

nontaxable interest rate

personal debt interest

real after-tax rates

tax deductible

taxable interest rate

installment loans

interest

APR

compound

fixed rate

interest rates

prime

principal

simple

term of the loan

variable rate

interest-only payments

lien

lien holder

lines of credit

loan committee

loan security

mortgage

owner financing

payment schedules

private banking

pro forma financial statement

promissory note

qualifying for a loan

second mortgage

secured loan

signature loan

Small Business Administration

unsecured loans

working capital

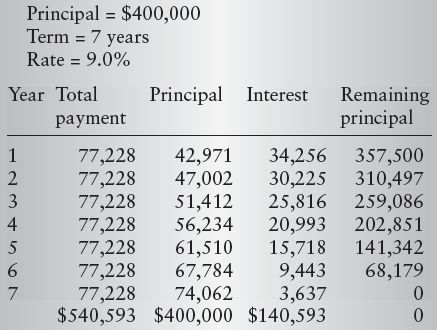

Debt can be a valuable financial tool, allowing a person to purchase goods or assets he or she could not otherwise afford (Table 28.1). It can also be a huge drain on resources, especially if not managed properly. Usually, debt is used for large purchases (such as home or practice purchase) when obtaining the item for cash would be difficult or impossible. The problem is, assuming debt means that a person must pay interest, adding to the cost of the asset, and he or she must pay off the principal, reducing the funds that are available for other purchase or investment purposes.

Table 28.1 Allowable Debt Levels

| Type of debt | Rule of Thumb |

| Consumer debt | 20% or less of gross monthly income |

| Housing costs | 28% or less of gross monthly income |

| Total debt | 36% or less of gross monthly income |

Bankers and loan officers have several rules that they go by when qualifying a client for a loan (and, therefore, debt). These rules are not simply made up by the bankers; they are often required by the agencies that underwrite the loan. For example, the Federal National Mortgage Association (Fannie Mae) requires that total monthly payment on all debt should be no more than 36 percent of the family’s gross monthly income. These debt payments include monthly housing costs, including taxes and interest, payments on installment credit, alimony, child support or maintenance payments, and any other payments on nonincome-producing property. Although some of these items (like taxes) are not really debt, they are a required periodic payment, and so lenders treat them as if they were debt.

Most professionals incur debt at some point in their career. Generally, this is during the initial phases, when practices, houses, and new automobiles are bought. Often professionals enter the marketplace with a large amount of preexisting debt needed to finance their education. This student debt may be so large that it impairs their ability to secure additional personal or professional loans. Most bank loan officers understand the large potential earning power of professionals and work to develop them as clients.

As professionals move through their professional lifetime, the need for debt usually declines, as loans are paid off and assets are accumulated. So it is during the first several years that managing debt become crucial. Mistakes made early in a career can haunt a person financially for many years.

Sources of Loans

Banks are the best-known source of loans for the professional. However, there are many other potential sources of funds. Each has specific advantages and disadvantages.

Banks

Banks are the most common source of funds for new practice loans. Bankers are in the business of lending money to people that they think will repay it. So a dentist will need to convince the banker that he or she will repay the loan (Box 28.1).

There are two types of banks, national and local. National banks have an entire division dedicated to working with professionals. A dentist will work with a special internal group called “private banking.” The private banking section manages small business and other special banking concerns. Large banks may have people within their private banking group that manage only professional (or even only dental) practice loans. These people are knowledgeable about practice financing issues. The dentist may need to establish all professional (and often personal) bank accounts within the private banking section. However, it works well because the banker will know the dentist personally. Local banks, on the other hand, are variable as to their understanding of dental office finance. Some small banks do not have private banking sections. Instead, a dentist may need to educate the banker about the specific problems faced by dental practices. (Bankers do not like to take risks they do not understand.) The larger local banks have private banking sections and individuals who service professional clients. Many of these people are also knowledgeable and helpful.

Owner Financing

Many professional practices finance some portion of the cost through the previous owner. If the bank is unwilling to lend the entire amount, then the owner may finance the remainder of the purchase price. The seller does this by allowing the buyer to pay part of the price over time to the owner, rather than the lending institution. The seller will generally charge a comparable interest rate and require a promissory note, which details all of the terms of the loan. Owner financing carries additional risk for the owner over simply getting the entire purchase price as cash up front. If the buyer runs the practice into the ground, becomes disabled, dies, or is unable, for any reason to pay off the loan, the owner may not receive the entire purchase price. Generally, the bank will require a first lien position on all tangible (hard) assets of the practice, which means that it gets to sell the assets to satisfy its. So the owner may be left holding an empty bag. This may be the only way that the owner can sell the practice for the price that he or she wants. If so, then the buyer can expect to pay the owner a reasonable interest (comparable to a bank rate) for the portion that is financed. The buyer may need to finance the down payment through a bank and arrange the rest of the purchase price as owner financing to make the buyout work.

Dental Supply Companies

Most of the major national supply companies (e.g., Patterson, Sullivan-Schein, Benco) have arrangements with banks or finance companies that allow the dentist to borrow money to establish a professional practice. There is an obvious advantage for the supplier (the dentist buys equipment and supplies through them). The advantage for dentist is that he or she may qualify for financing through these organizations when he or she may not qualify at the local bank. The down side is that the dentist often pays a higher interest rate than he or she would at the local bank. The finance company may also have significant prepayment penalties and other disadvantageous loan clauses. The dentist generally must buy his or her equipment through the particular supply company as well. Some only finance new practices, not buy-outs of existing practices. Others only offer financing for equipment purchases or upgrades. However, these companies know the dental marketplace, and if a dentist is unable to gain financing through a bank, they may offer a method of financing the establishment of his or her practice.

Family Members

The dentist may be fortunate enough to have family members who have sufficient assets to lend him or her for practice or personal needs. If this is the />

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses