Chapter 25

Practice Ownership

My son is now an “entrepreneur.” That’s what you’re called when you don’t have a job.

Ted Turner

incidents of ownership

individual practice

individual group practice

ownership compensation

relative value unit

true group

Owning a dental practice is the dream of most dental school graduates. However, that ownership comes with many costs and advantages. A dentist will spend additional time managing the business of the practice. Most dentists get into the profession because they want to treat patients, not realizing the time and emotional energy that must be devoted to running a successful business. But the upside of ownership is the pride, happiness, and financial return that come from running a successful practice.

In the past, the only type of practice ownership was the independent individual practitioner in a cottage industry business. Now there are large and small groups, franchises, and network practices. This opens many more possibilities to new graduates than were available previously.

Characteristics of Practice Ownership

Doing dental services does not require owning a dental practice. Likewise, dentists can own a dental practice and not personally do any dental services, instead hiring another dentist to do them. If dentists separate, in their minds, owning a practice from doing dentistry, they can understand better the characteristics of practice ownership.

Incidents of Ownership

Business owners have certain rights in the business that nonowners, such as employees, do not. These incidents, or rights, of ownership are the result of a dentist putting his or her capital (money) at risk in the business (Box 25.1). Because the dentist has taken on the risk associated with ownership that workers have not, then he or she has the benefits that result, whereas workers do not. Dentists can make a profit (or incur a loss) from business activities, whether they personally do dentistry or not. This is the basis of network practice entities. Dentists may choose (through a profit-sharing plan) to share those profits with workers, but it is not necessary. If the business shows a loss, workers will not accept paying for a loss; they will go elsewhere to work or not work at all. Because a dentist owns the business, he or she can decide how the business will operate and who will be hired to do the various business functions. The dentist has the responsibility for ensuring that the business is operated effectively. He or she also has liability in the case that the business (or someone working in the business) injures someone, or if the dentist directly injures someone through his or her negligence. Because the dentist owns the assets of the business, he or she can pledge them as collateral for a loan or other purposes. If the business gains or loses value because of a dentist’s management abilities, then the dentist (as the owner) will enjoy the gain or suffer the loss in value. Workers do not share in this gain or loss. Associate dentists may not understand this difference clearly. They often feel that they have contributed to the growth in the value of a practice and should not, therefore, have to pay for that growth when they purchase (or buy-in) the practice.

- Ability to make a profit from the business

- Decision-making authority (may be delegated)

- Increased responsibility and liability

- Pledge assets (for a loan)

- Gain in the value of the business

Making Money in Dentistry

There are two ways to make money in dentistry. The first is to do the dentistry itself. The second is to have an ownership interest. If a dentist owns the practice and sees patients, then he or she makes money both ways.

Compensation for Doing Dentistry

Whether a dentist is the owner of a practice or an employee, he or she will earn money for doing dentistry. If a dentist is a proprietor or a partner, then he or she is an owner. The dentist takes a draw on the assets of the practice (one of which is the office checking account), estimates his or her income tax liability, and prepays it quarterly to the IRS. If the dentist is an employee of an organization (such as a health center) or a practice corporation (even if he or she is the sole stockholder and provider), then the corporation will pay him or her as an employee. The corporation will estimate the dentist’s personal tax liability (based on IRS tables), withhold that amount, and send it to the government in his or her name as prepaid taxes. The dentist receives the amount left after the corporation has paid estimated income taxes for him or her.

If a dentist practices in a corporate structure, then he or she will earn pay for doing dentistry as any other employee. That is, the corporation may pay the dentist a commission (based on production or collections), salary, wage, or a combination method. If a dentist is a proprietor or a partner in a partnership, he or she pays himself or herself through taking a draw on the assets of the practice. Some dentists simply take any money left over in the checkbook at the end of the month as a draw. Others take a fixed amount (similar to a salary) for budgeting purposes and to ensure enough cash in the practice to pay normal bills. A dentist does not pay tax on how much money is taken out of the practice (as draw) but on how much profit the practice generated. Whether the dentist took any of it for personal expense is irrelevant.

Compensation for Ownership Interest

If a dentist is an owner, he or she may have a profit left in the business (practice) after he or she has paid all expenses (including paying dentists to do dentistry on patients). This is often called entrepreneurial profit. If the dentist is an excellent manager, his or her entrepreneurial profit will be larger than if he or she is a mediocre or poor manager. The dentist may distribute that profit to employees (as a bonus) or to the owners of the practice as a reward for their investment in the practice. The dentist may also combine the methods.

Bonus

The dentist may distribute any profit to any employee as a bonus. The IRS considers this taxable income. He or she can distribute it by shares, based on production, or any other means that the owners(s) choose. For example, a dentist may distribute profits only to certain dentists (owner or nonowner). It is entirely up to the owners what they do with the profits from the business.

Ownership Interest

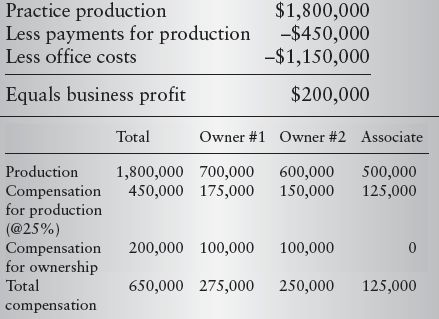

A dentist may distribute any profits to the owners of the business to compensate them for their ownership. If a practice is a corporation, then the distribution is based on the number of shares owned. Dividends are from the corporation’s profits. If the practice is a C corporation, then the corporation must pay taxes on the profits first and then distribute them as dividends (where they are taxed again as personal income). To avoid this double taxation, C corporate practices usually pay out profit as bonuses, so they are only taxed once. Often these bonuses go only to the owner(s). S corporations (or “pass-through” corporations) do not have this problem. They pass dividends through to the owners without paying tax at the corporate level. Because these dividends are unearned income, the individual does not pay Social Security, Medicare, or self-employment taxes on them. Box 25.2 gives the results of how a hypothetical practice might divide income and profit.

Individual Practice

An individual practice involves the greatest investment of a dentist’s time and emotional energy. It also provides the greatest personal rewards when successful.

Ownership

One person owns an individual practice. From a management perspective, the business entity is not important. It may be a proprietorship, a limited liability company (LLC), or a corporation in which the only stockholder is the owner. This means that the owner has complete control and responsibility for the business.

Compensation

The owner takes all profit from the business as compensation. This can be separated into compensation for doing dentistry and business profit if the owner wants. In the proprietorship practice, the difference is not meaningful because the owner is the business. In an individual corporate practice, the owner can characterize profits from the business as dividends, which the IRS taxes differently than earned income.

Advantages

In the individual practice, the owner exercises complete control over the operational and strategic direction of the practice. It is the dentist’s practice. He or she can make the practice what he or she wants, without having to compromise with other owners. If the practice increases in value, the dentist enjoys the gain.

Disadvantages

As an individual practitioner, the dentist has additional time commitments to manage the business. Often the dentist may want an additional trusted practitioner to discuss clinical or management problems. (Study clubs and mentors help to solve this problem.) The dentist is responsible for the financial health of the practice. If he or she wants to borrow money for a practice purchase or expansion, the dentist has his or her credit rating and borrowing power to use.

The individual practitioner may find it more difficult to take time from the office for vacations or personal reasons. If the dentist is not there seeing patients, his or her income decreases. If a dentist finds a substitute, he or she pays the substitute most of what the owner would have taken as compensation for doing the dentistry, leaving only the entrepreneurial profit for the owner. When the dentist is gone, patients still want to be seen and staff still wants to be paid. Without a large cash cushion, cash flow problems can occur with time away from the office.

Solo Group Practices

This arrangement consists of independent practices physically located under one roof. Each dentist practices as a single practit/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses