Chapter 24

Employment Opportunities

A man’s got to know his limitations.

Harry Callahan, Magnum Force

dental management service organization (DMSO)

draw against future earnings

employee

employment contract

independent contractor

percent of collections

percent of production

salary

wage

Many new dental graduates take employment positions initially out of dental school. This may be to hone clinical skills, pay down debt or build assets, improve practice management knowledge, or because they do not want the involvement of practice ownership. Regardless of the reason, the important point about employment is that the dentist is there to make money for the employer, whether a private practitioner, network practice, or governmental organization. If the dentist does not make money for the employer, he or she will not be there long. So the dentist should understand that employee positions are not about him or her, they are about the organization. The dentist is valuable so long as he or she contributes to what the organization does.

Methods of Compensation

There are as many compensation formulas as there are employment opportunities. Most involve some variation of a salary or per diem (daily) rate or a percentage of collections or production. Each has advantages and disadvantages, but any system should provide profit and incentives for both sides (Box 24.1). Here only direct monetary compensation is discussed. Employee benefit plans may increase the total compensation significantly. A dentist may take an initially lower compensation with the hope or expectation of higher earnings or ownership later in the relationship.

Salary

A salary is a negotiated amount that the employer pays, regardless how much work that the employee does. The salary may be based on a weekly or daily (per diem) amount. Salaries are easy from a bookkeeping sense. Salaries provide a known budgeting amount for both the owner and associate. This provides substantial financial security for the associate. There is no problem of allocating or dividing accounts receivable in case of break up because all of the accounts are the owner’s. The owner does not pay the associate based on the accounts. However, salaries provide no incentive for the employee to produce or collect. Employees soon realize that if they see 2 or 20 patients a day, their remuneration will be the same. The owner takes a risk that the employee–dentist may cost more than they produce, leading to a financial loss for the employer. This loss may be from employee abilities, inadequate patient base, excessive insurance plan adjustments, or unrealistic expectations of the parties involved.

Wage

A wage is similar to a salary, but it is based on the number of hours that the employee works. This limits, to a degree, the loss that an employer might suffer in that if there are inadequate patients; then the employer can limit the employee’s hours (and, therefore, compensation). This obviously transfers some financial risk from the employer to the employee.

Percentage of Production

Many employers base compensation on a percentage of production. This may be gross production (the total dollar value of the dentistry done) or net production (the value of the dentistry less any required insurance plan adjustments). Most practices use the net production as the basis for compensation.

This method has the advantages of quick cash flow (and therefore more security) for the employee and provides an inducement for the employee to produce because this directly ties compensation to the amount of dentistry that he or she does. Because the employee has no control over the credit and collection policies of the office, this method adds fairness in that he or she is not held accountable for collection failures. Some owners who base compensation on this method simply lower the percentage paid to take into account the uncollectibles or charge back uncollectible amounts to the associate when they write off the bad account. There is no problem of accounts receivable if there is a break up because the employee–dentist has already been compensated for production.

Percentage of Collections

Another common method of compensation involves paying the employee a percentage of the amounts collected from what the employee produced. Many established private dentists like this method because it is similar to the problems of collection and cash flow faced by the established practitioner. This method also provides obvious incentive for the associate to produce and collect. The owner, in this situation, is less likely to lose. However, this method involves more complex bookkeeping methods. The office must specifically allocate the work done by each provider to him or her. (The problem is not difficult, especially if the office has a computerized office accounting system.) The employee has a problem of delayed compensation. This means that it may be several months after the production that the money comes into the office. This makes it difficult, especially for a new practitioner, to develop a family budget. A significant, related problem is the disposition of accounts receivable in case of break up. If the employee is paid based on collections, then he or she must have access to the patient financial records to verify that the owner has made appropriate compensation payments. The owner may not be as diligent as the associate would like in making collection arrangements. A common solution for this is for the owner to pay the associate 80 percent of all of their (associate’s) accounts receivable. The owner then collects the accounts.

A common point of negotiation is whether to credit the employee with production attributed to the dental hygienist that he or she “covers.” Employers claim that they are paying the salary and other costs of the hygienist, and the employee is seeing these patients to generate additional work that leads to compensation. Employees claim that they are using their clinic skills, knowledge, and abilities in doing the exam and reviewing the hygienist’s work. A common resolution is to credit only the exam portion of the visit to the employee’s production.

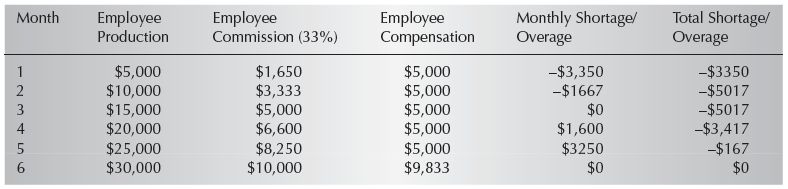

Table 24.1 Example – Draw Against Future Earnings

Assume that the employee will be paid 33% of production as a commission. He or she will be paid a monthly salary of $5,000 as a draw against future earnings. The financial result is:

Combination Methods

There are many combinations or variations on these methods. Some have a base salary with a bonus for production. Many charge back laboratory charges to the employee. Many offices use a variable commission, which provides incentives for the associate to produce at higher levels. Because the employer has already paid fixed costs, these higher production levels are more profitable for them as well.

Some employers offer new dentists an initial salary to develop personal cash flow and then switch to a commission basis when the employee has developed sufficient patient base and clinical skills. Other employers help new practitioners to weather initial cash flow problems by offering a draw against future earnings. In this arrangement, the owner pays the employee a percentage of production or collections. The employer pays an initial fixed monthly amount, similar to a salary, regardless the employee’s earned compensation. Once the employee’s commission is above the “salary” amount, the employee pays back the difference by continuing to take the same draw until they make up the difference. (Table 24.1 gives an example of this arrangement.)

Employee Benefits

Benefits are things of additional value besides money that the employer offers to the employee as a condition of employment. These may be as various insurances (medical, disability, life, malpractice), paid time off (holidays, vacation, personal, or sick days), additional compensation (bonus plans), or financial inducements (retirement plan contributions or dependent care allowances). Benefits are valuable for the dentist from a financial perspective because the whole value of the benefit comes to him or her free of income or social security taxes. Benefits cost the owner the cost of the benefit, although the owner offsets part of the cost through the tax-deductibility of the benefit. (The chapter on employee compensation discusses benefits in more detail.)

There are two ways to fund benefit plans: either the owner can pay the entire amount of the benefit or they can share the cost with the employee. The more the employer pays, the richer the benefit becomes for the employee. Whenever a dentist evaluates an employment situation, he or she should remember to include the value of the benefits offered/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses