Chapter 22

Managing Risk in the Office

Part 1: Office Risk Management

I’m built for comfort; I ain’t built for speed. But I got ev’rything that a good girl need.

Willie Dixon

Business liability insurances

Business premises and personal injury insurance

Professional liability insurance

Loss of use insurances

Property insurance

Building contents insurance

Business overhead expense (BOE) insurance

Employer insurances

Workers’ compensation insurance

Unemployment compensation insurance

carrier

causation

claim

claims made

contingency basis

covered loss

damages

duty

exclusions

experts

failure to diagnose

fee disputes

indemnity

infection claims

informed consent

capacity

loss exposure

malpractice

malpractice litigation

managed care

negligence

occurrence

ownership of dental records

patient abandonment

patient records

peer review board

peer review process

periodontal disease claims

policy

poor outcomes

poor work

equipment failure

failure to diagnose

failure to refer

poor technique

premium

professional liability

reasonable and prudent

risk control (risk avoidance)

risk management

risk (loss) prevention

risk reduction

risk transfer

standards of care

swallowed object claims

wrong tooth claims

The Risk Management Process

Risk management is the process of identification and minimization of the possible sources of negligence to which dentists are exposed. These may develop from a dentist’s role as a practitioner or as the owner of the business. In the risk management area, the best remedy is prevention. So the major task of a practicing dentist is not simply to buy insurance (although that should be part of the whole risk management package). Instead, the major task of the practitioner should be loss prevention. Risk management is an ongoing process. The owner and manager of the practice must see that the practice examines the sources of risk and works to decrease them as much as possible. The risk management process can be divided into the following steps.

Identification of Potential Loss Exposure

The initial task is to evaluate a practice to detect liability exposures. Dentists need to decide why patients might sue them. They should examine the dental procedures that are done. Removing a deep bony third molar impaction that wraps around the mandibular canal exposes a dentist to more risk than if he or she refers that procedure to an oral surgeon. Emergency department patients are notorious for failing to follow-up treatment, resulting in poor outcomes of treatment and possible claims of professional negligence. If a dentist collects accounts aggressively, he or she may encourage retribution (through a lawsuit) by dissatisfied patients. If a dentist has inadequate or outdated patient record systems, he or she may have a difficult time proving that an event or conversation took place. If a dentist does a procedure so seldom that he or she is not proficient at it, or if he or she continually has less-than-optimum outcomes with a particular procedure (e.g., an endodontic technique), the dentist may be opened up to a claim of bad work. If a dentist has an older facility, he or she must be sure to keep it in good repair. The ultimate risk avoidance technique is simply to quit practicing dentistry. Nobody will sue a dentist for dental malpractice or business negligence then. Most practitioners agree that they can accept a certain amount of risk, if they can manage it effectively.

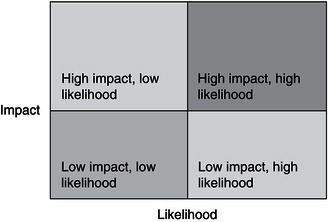

Figure 22.1 Risk Assessment Matrix

Risk is often expressed as a combination of two variables, likelihood and impact. Graphically, this is shown in Fig. 22.1.

Some risks may be likely but carry a low impact. For example, the possibility that a patient may inadvertently walk out with a pen is high, but the financial cost is low. On the other hand, the possibility of a fire destroying the office and a dentist’s livelihood is low, but the impact is extremely high. Dentists would have a different way of managing the two risk exposures. The area of most concern is the area of high impact and high likelihood. Risks in this quadrant need immediate attention and review. Dentists should try to lower the impact, the likelihood, or both. Risks in the high impact, low likelihood often involve purchasing insurance to cover the loss. Dentists often manage risk of low impact and high likelihood by using risk management techniques (such as staff training) to lower the likelihood of occurrence.

Identification of potential loss exposure requires that dentists evaluate themselves and their staff members’ skills and abilities honestly. Occasionally, that evaluation may identify problems or deficiencies that the dentist does not want to confront. (These may be clinical, interpersonal, or management related.) However, it is critical that dentists face them. Dentists should remember that recognizing areas of vulnerability to a liability claim is the first step to reducing the likelihood and severity of a claim against them.

Evaluation of Risk Management Control Techniques

A control is a mechanism that ensures that a dentist’s process is working as designed and intended. Several categories of control techniques exist, including:

- Risk avoidance negates a potential loss because a dentist avoids or does not do the risky procedure. If a dentist refers all bony third molar impactions to an oral surgeon, he or she avoids the risk associated with that procedure. The oral surgeon accepts that risk because of his or her generally higher level of skill, training, and expertise in that specialized area. Dentists often use this technique for risks that have a high impact.

- Risk (loss) prevention reduces the possibility that a loss will occur. This technique occurs before a potential loss, and is, therefore, preventive in nature. If a dentist keeps excellent patient records, including notes of clinically relevant telephone conversations with patients, he or she may find that a malpractice action was prevented. Removing snow from steps in the winter prevents this as a source of negligence. Using this technique moves a risk from a high likelihood to a lower likelihood category.

- Risk reduction is similar to prevention but instead decreases the severity of a loss. If dentists decrease the impact that a loss may have, then the resulting patient damages will also be less. If the dentist has a current emergency kit, he or she should know how to use the drugs and materials in it. If the dentist and staff members are currently trained in CPR and other emergency protocols, then they have reduced the risk of a claim of negligence by a patient in case of a medical emergency. Dentists taking continuing professional education courses sharpen skills and knowledge in difficult clinical cases. In both examples, proper preparation has decreased a potential loss. This technique moves a risk from a high impact to a lower impact category.

- Risk transfer implies assigning the risk to someone else. The most common form of transfer occurs when a dentist buys insurance coverage for a possible professional negligence suit. Here, the dentist has contractually transferred the financial loss to the insurance company in exchange for annual insurance premiums. Risk transfer can also work against the dentist. If he or she participates in managed care contracts that require the dentist to sign a “hold harmless” clause, then he or she has increased the liability exposure to the practice by not allowing a transfer of risk to the managed care company. This technique is often used for risks that have a high impact but low likelihood.

Selection and Implementation of Control Techniques

Once a dentist identifies the risks associated with the practice, he or she should decide which techniques can prevent, reduce, or avoid the liability and resulting loss. This selection and application depend on the dentist’s assessment of the effectiveness and cost of each technique when applied to a potential loss. Examples of controls include:

Reassessment and Reevaluation of Techniques

Dentists should regularly reassess and reevaluate risk exposures and techniques for managing them. As a dentist grows professionally and financially, and as the practice grows, he or she will need to adjust methods and techniques to manage risk exposures and potential losses.

Office Insurances

Dentists should secure several office-related insurances, if they are the owner of a business. If the dentist is an employee, he or she will not need to carry business insurances (e.g., office liability and workers’ compensation), but the dentist still needs a professional liability policy. If he or she is an independent contractor, the dentist is an independent business person and the owner’s policies usually do not cover him or her. Here, the dentist should be sure to have general liability, workers’ compensation (if employees are hired), and business overhead insurances. This book contains a separate section on personal insurance needs, although the two obviously overlap.

Business Liability Insurances

As the owner of a dental practice, a dentist should have two major types of liability insurance. These insurances cover him or her in case that the dentist is negligent, leading to someone’s injury. Some practitioners advocate not carrying general or professional liability insurance, hoping not to get sued or trying to hide assets so that the injured party is not be able to collect significant amounts. This is a dangerous strategy. Lawyers and judges are adept at piercing through these veils of protection. The dentist may find himself or herself facing large legal and damage payments. The cost of insurance is insignificant compared with the cost of the loss of a liability suit.

Many insurers will develop packages of liability insurance for practitioners.

Business Premises and Personal Injury Insurance

A general liability policy (GLP) for the office covers the dentist in the event he or she is negligent and that action leads to a patient or other person being injured in the dental office. This is often called “slip and fall” insurance, from the common occurrence of someone slipping on ice or water, falling, and getting injured. As explained in the chapter on legal issues, a dentist must first be found to have been negligent before he or she can be liable for damages. As a rule, $2 million per occurrence and $4 million aggregate coverage is presently adequate.

Dentists can buy many additional coverage policies or “riders” for liability insurance. A dentist probably wants to be sure that his or her policy covers employees in their cars or in the dentist’s while doing work-related errands. If an employee runs a case to the lab and has an accident, it is the dentist’s accident. Many states allow a liquor legal liability rider. If a dentist entertains where liquor is served (such as a staff Christmas party or drinks after a continuing education course), the dentist may be liable if that person has an accident. The dentist may also purchase a business umbrella liability policy, similar to the personal excess liability coverage. Like all these riders, a dentist has to decide how much risk he or she is willing to take and how much he or she is willing to pay to sell that risk to an insurance company.

Professional Liability Insurance

Because the professionals have a special relationship with their clients (i.e., the dentist–patient relationship), a dentist should carry professional liability (malpractice) insurance to cover this possibility. Professional liability (malpractice) insurance is separate from a general (slip and fall) liability. This is a specialized field of insurance, so few companies will write this type of insurance. A later section in this chapter discusses this insurance in more detail.

Loss of Use Insurances

A couple of insurances cover dentists in case they lose the ability to practice in this location. These are beyond a personal income disability policy, which is described in the personal insurance chapter of this book.

Property Insurance

If the dentist owns the building in which he or she practices, the dentist must insure the physical structure. Commercial property insurance covers the building in much the same way that homeowner’s insurance covers a home. The dentist should be sure to insure the replacement value of the building. The price of constructing a new space can appreciate quickly. If the building is in an area prone to floods or earthquakes, the dentist should be sure to include coverage for these events.

Building Contents Insurance

Dentists should insure the physical contents of the practice whether they own or lease the space. This type of insurance covers dental equipment, supplies, leasehold improvements, patient records, furniture, and fixtures in case they are damaged or destroyed. What could damage them? Fire, water damage from fighting a fire, theft, explosions, broken water pipes, or any of a host of problems that cannot even be named can damage property. Building contents insurance seems like an expensive luxury until a dentist gets to the office and finds that a water pipe has burst, flooding the reception room and business office. Often lenders will require that dentists purchase this insurance to cover them in case of loss.

Dentists have the option of covering the equipment at present (current) value or at replacement value. Present value is the value of the equipment when the loss occurs. Assume a dentist purchases a dental chair for $10,000 and insures it for the present value. If the chair is destroyed the day after it is insured, the present value is what the dentist paid for it. However, assume that the accident causing the loss did not occur for 5 years. That same dental chair may now have a present value of only $3,000, yet to buy a new one (replacement value) would cost $12,000. Although replacement policies are more expensive, they are generally worth the extra premium paid.

Business Overhead Expense (BOE) Insurance

If dentists are unable to practice because of a disability or other reason, office costs continue regardless. Although the landlord is a pleasant fellow, he or she is not going to forgo the rent because a dentist cannot practice. Likewise, the banker needs the loan payment, and the staff still need to be paid, if they are to stay in a dentist’s employ. An office, or business, overhead expense (BOE) policy helps a dentist to pay many office costs if he or she is unable to work. The dentist should carry personal disability income insurance to be sure that he or she provides for the family budget in case of disability. BOE policies do much the same for the office costs. Premiums are deductible, so benefits are taxable. Because the benefits go to pay deductible expenses, the deductible expense offsets the additional taxable income.

Business interruption coverage is the core of the BOE. This coverage pays the dentist either direct costs or a set amount if he or she must shut down the business. If a dentist a major loss (such as a fire), he or she may have many months without practice income while the office is being repaired. The dentist should ensure that the policy covers him or her for interruption causes that are outside the building, such as a citywide power loss. Many do not.

Some practitioners opt not to carry BOE insurance. Instead, they plan to use their accounts receivable to pay office costs if they are unable to work. This is a risky plan. Typical accounts receivable may equal 1 1/2 to 2 months’ billings. If the disability last longer than this (and many do) then the dentist would run out of money to pay the bills. At that point, the dentist would need to tap into personal savings or income to make regular payments. If the dentist does not keep the staff on the payroll, the staff will probably leave, looking for employment elsewhere. Even if the dentist weathers this storm, he or she will then have a cash flow problem when the office is opened again. The dentist will have used up his or her accounts receivable so no cash flows into the office. It will be just like starting up again. The dentist will need to go to the bank and borrow working capital, and then pay off the loan.

Insurances Provided for Employees

Dentists need several insurances to provide for employees. If a dentist does not have any employees, then he or she obviously does not have to provide these insurances. As a proprietor or a partner in a partnership, dentists do not cover themselves (or receive any benefits from) these insurances. If a practice is a corporation, then the dentist is an employee of the corporation. The corporation must provide these insurances for the dentist, the same as all other employees and may also receive the benefits, if qualified.

Workers’ Compensation Insurance

This is an insurance that dentists must, by law, carry on all of employees. (It is optional in some states, but dentists are still responsible for any claims.) It covers a dentist case an employee is injured on the job. This insurance covers medical expenses that are injury related and provides some disability payment (lost wages) if the accident disables the worker. Workers’ compensation is a pure no-fault system. It does not matter whose fault the injury was, workers’ compensation pays for it because the injury occurred while the person was on duty. In return for the no-fault provision, workers’ compensation laws have virtually eliminated the ability of the injured worker to sue the employer for negligence.

Specific workers’ compensation rules vary state by state, but they all have several common elements including:

Workers’ compensation provides four types of benefits:

A dentist’s payment (or premium) for workers’ compensation insurance is based on the number of employees and the annual payroll. Workers’ compensation is a federally mandated system operated by the states. Each state, therefore, has different rules concerning eligibility for benefits, costs, and owner requirements. A dentist can find an insurance company that writes these policies. Many office liability carriers will include workers’ compensation policy in a package of insurances. These packages may be more expensive, but they are easier for the dentist. The question becomes a cost versus convenience trade off.

If a dentist is a proprietor or a partner, he or she is an owner, not an employee. Therefore, in most states the dentist does not fall under the workers’ compensation laws. The dentist does not pay premiums on himself or herself, and he or she is not eligible for benefits. If a dentist practices as a corporation, he or she is an employee of the corporation (though also an officer) and must be part of the workers’ compensation system, unless he or she opts out. The compensation generally includes limited liability company (LLC) members and family member employees, unless they opt out. The compensation does not include independent contractors. Again each state is different and specific application of the rules is confusing. Dentists should check with their workers’ compensation carrier in the state of practice to know how these specifics apply.

Unemployment Compensation Insurance

Unemployment compensation is really a tax, but it operates like an insurance product. This is another joint federal-state program. Dentists pay two unemployment taxes, State Unemployment Taxing Authority (SUTA) and Federal Unemployment Taxing Authority (FUTA). Dentists pay state “contributions” (taxes) monthly. At the end of the year (January 30 the following year), the state checks to see how much the dentist paid into the state unemployment pool the previous year. If the amount were less than the federal requirement, he or she makes an additional payment to the federal government to make up the difference. So dentists only pay FUTA once a year, and the amount depends on the amount he or she has paid to the state (SUTA).

The system is complex. However, the total amounts paid are not large. Payments will vary depending on the history the practice has regarding staff unemployment. The gross FUTA tax rate is 6.2 percent on the first $7,000 of workers’ earnings. Generally, the employer can take a credit against FUTA for contributions to state unemployment funds up to 5.4 percent of the first $7,000. The net FUTA tax rate then is 0.8 percent (0.008). An accountant or payroll manager will provide this information. If a dentist’s staff has many claims, the dentist becomes a higher risk and rates go up. Few or no claims, rates and payments go down.

Other Insurances

Dentists may also provide other forms of insurance for employees as employee benefits. These may include medical, disability, or life insurance. Dentists should check the sections on employee benefits in this book for a detailed look at those insurances.

Professional Risk Management

This book has previously discussed the ideas of risk management as it relates to personal and business risks that dentists face. These are the same risks that all Americans or all US business people face. However, professionals face an additional risk that most other business owners do not. That is the risk that dentists may be negligent in their performance of their professional duties. This risk is special to the practice of dentistry, and so its management is different as well. Most practitioners have adequate malpractice insurance, believing that this satisfies the problem of risk management.

Professional Negligence and Liability

Professional risk management is closely aligned with quality assurance in the office, although risk management takes a more practical view of the problem. Dentists should identify potential sources of professional risk exposure, train themselves and staff to reduce the number and impact of these exposures, and continually work to improve the quality of the dental care delivered in the office.

Negligence is the failure to act as a reasonable and prudent person in a similar situation would act. As described in the chapter on legal issues, this definition is not absolute and opens the door for interpretation and changing definitions as social customs change. If a dentist’s negligence causes an injury to someone, then he or she is liable or must restore that person’s loss. This generally means that a dentist must financially reimburse the injured person for the damages that the dentist’s negligence caused.

Elements to Prove Professional Liability

The same cause-and-effect relationship exists in professional liability issues. If a dentist is negligent in the delivery of health care, he or she can be found liable for the damages that result. These damages may include repair of the problem, lost earnings from missing work or reduced performance or ability, and pain and suffering experienced by the injured patient. (Obviously, significant discretion is available for judges and juries in awarding damages.)

In professional liability, an additional level must be satisfied to prove professional negligence. The idea is similar, but with a different “twist.” Someone must prove each element to established professional liability.

Standards of Care

Malpractice actions do not hinge on the absolute notion that any injury is a malpractice. Instead, these actions are based on what a “reasonable and prudent” professional in a similar situation would have done. This is known as a standard of care. These standards involve knowledge, skill, care, and judgment of the practitioner. They involve the technical level of expertise needed to complete a procedure successfully, the knowledge of how to interpret signs and symptoms, the behavioral accomplishment of treatment, and the ability to diagnose and properly plan for a patient’s treatment. So the standard of care involves both the technical performance of an extraction and the knowledge and judgment of when an extraction is and is not appropriate therapy.

There are no written standards of care published by the American Dental Association (ADA) or other professional organizations. (Some organizations are trying, with mixed success, to compile them.) These standards evolve over time. The technology and knowledge of the profession influence them and well as the wants, needs, desires, and sophistication of the public. Posterior composites, gold foil restorations, silicate restorations, and implant prostheses all enter current standards of care in a dynamic interchange. Standards are not an absolute definition or “prescription” for how dentists should handle every patient procedure. Instead, they are a set of expectations for how a “reasonable and prudent” dentist would behave in a similar professional situation.

Although the standards of care are constantly evolving, they are determined by a consensus of “experts” in the field. Experts are individuals who have background and training that gives them a real or inferred level of professional expertise. In a malpractice case, both sides bring experts to the trial to bolster their point of view. The experts who interpret the prevailing standards are often specialists in their field. To this extent then, the law holds generalists to the level of standards that a specialist would hold. For example, if a case involved extraction of an impacted third molar, the experts would usually be oral surgeons. The courts would then hold the generalist to the same standard of care as the surgeon.

Standards of care vary by state or region of the country, although these differences are becoming smaller with time. Some practitioners in rural, inner-city, or poverty-stricken areas claim that the standard of care is different in those areas. The standard of what is proper care is probably the same in all areas. Patient acceptance of treatment may be different. With the increased speed of communication, ease of travel, and increase in third-party payers, these arguments are becoming less viable as well.

Common Areas of Professional Risk Exposure in Private Dental Practice

Several areas of common professional risk exposure show in the dental office. These may result in resolution through any of the avenues described previously.

Poor work

Poor work is a simple failure to do a procedure at the level of the standard of patient care. It can occur for a variety of reasons, even to competent dentists.

- Poor technique occurs when the technical aspects of a case are not up to the standard of care. If a dentist leaves an overhanging margin on an alloy or crown that can lead to future caries or a periodontal problem, he or she has committed bad work.

- Failure to diagnose a disease or problem is a common source of poor work. A dentist should give the patient a diagnosis of any disease within his or her area of expertise. If he or she fails to diagnose periodontal disease and fails to inform the patient of the problem and likely outcomes, he or she can be found liable for the results. Often a dentist may claim that he or she did a proper exam and found everything to be within normal limits but did not document that fact. An example is an oral cancer screening. If a dentist finds no oral cancers in an intraoral exam, his or her record should note that fact. This will protect the dentist from a future claim of “failure to diagnose” if an intraoral cancer is later found on a patient. The dentist giving a patient a reminder of needed or suggested treatment at each recall visit supports the diagnosis.

- Failure to refer to a specialist is another form of bad work. Although the courts understand that some diagnoses or technical procedures are out of the scope of a typical generalist, they also understand that dentists should recognize these cases and refer them to a specialist for evaluation and possible treatment. Dentists should be most interested in improving the health of patients, not their personal pocketbook.

- Equipment failure may be outside the control of the dentist, yet still be the responsibility of the dentist. If a dentist is doing an endodontic procedure and the file becomes lodged in the canal and breaks, he or she has had an equipment failure, which is considered poor work. As a rule, the dentist is responsible for any equipment or supplies that he or she should have known might be defective.

Poor Outcomes

A poor outcome does not involve poor work, merely a patient who is not satisfied with the result. Dentists have all seen denture cases in which the technical denture is clinically acceptable. The patient is simply not satisfied with the results. (The dentist might have had a suspicion when the patient walked into the office with a bag of seven other dentures that did not “work right.”) The dentist may have also seen the opposite case of a patient who has an anterior crown that looks terrible to his or her eye, yet the patient is completely satisfied with the outcome, although the technical work was poor. This category of risk exposure is difficult for many dentists to accept. Yet the courts have ruled that is real and valid.

Poor outcomes are especially common in cases that involve patient values, such as esthetics. A dentist’s notion of what is acceptable may be entirely different from the patient’s. Patient communication is a critical issue in these cases.

Patient Communication Problems

Communication is a two-way street. Dentists may believe that they have adequately expressed their side of the issue, but the patient either did not truly understand or did not adequately express his or her side of the issue (Box 22.1). These patient communication problems can be grouped into the following categories:

- Lack of treatment plans is the basis of most patient communication problems. Without a treatment plan, patients do not know what to expect and may be surprised by the treatment or the cost of the treatment. Detailed and written treatment plans are one of the best methods of avoiding dental malpractice litigation.

- Unrealistic patient expectations often lead to liability problems. These expectations may be the result of the patient not adequately expressing goals and desires concerning his or her dental treatment or may be the result of the dentist making implied or actual promises of treatment that he or she do not fulfill. Either way, it is in the dentist’s interest to ensure that the patient has realistic expectations of the outcomes before beginning treatment.

- Lack of informed consent becomes the basis of many dental malpractice lawsuits. Informed consent is the ethical and legal doctrine that requires that dentists give patients sufficient information so that they can make a free, rational treatment choice. This also implies the right of informed refusal. Informed consent relates to the treatment planning and patient communication issues discussed previously. For a dentist to have true informed consent, he or she must prove each of the following points concerning the treatment:

- Personally discuss benefits and risks

- Personally discuss alternatives and consequences

- Encourage the patient to ask questions

- Use lay or common terms

- Get a commitment from the patient to proceed

- Keep well-documented records

A patient may not legally consent to malpractice. If a dentist advocates or does a procedure that he or she knows is not within the standard of care, then the dentist has committed malpractice. This happens whether or not the patient has consented to the treatment or agreed not to hold the dentist responsible. So if an 18-year-old patient with healthy teeth and periodontium requests full-mouth extractions and dentures and the dentist does the requested service, he or she is committing malpractice and is liable for the results, even if the patient signed in the record their understand this and will not hold the dentist responsible. This extreme case is easy. The problem comes in interpretation of the standards of care in borderline cases.

Dentists must also allow informed refusal. Informed refusal means that the patient fully understands the treatment, the alternatives, and the outcomes. The patient refuses the dentist’s advice for treatment. If the patient truly is making an informed decision, then the dentist must accept that decision. The dentist should explain the possible outcomes of the lack of treatment. If the patient still refuses the dentist’s advice (even after adequate explanation), the dentist should document the advice and refusal in the patient’s record. Even after this initial refusal of treatment, the dentist has an obligation to again recommend treatment at subsequent follow-up or recall visits, for as long as the condition remains and the dentist–patient relationship exists. Some dentists dismiss patients from the practice who do not accept the full advice of the dentist. The dentists believe that this opens them to charges of “supervised neglect,” in which they know of a problem and are guilty of negligence because they contributed to the problem by allowing the patient to continue to decline under the dentist’s care. If a dentist adequately expresses and documents his or her recommendations, he or she will be on sound legal footing. A dentist’s preferred practice pattern may encourage dismissal of nonaccepting patients.

- Poor work or outcomes by another dentist these issues often arise from fee or third-party problems. One dentist is going to redo poor work from another dentist; however, the third-party carrier will not pay to have the recent work redone. The patient then seeks various methods to have the second dentist pay for the poor work. Dentists are understandably reluctant to criticize their fellow practitioners. They really do not know the circumstances, decision process, patient compliance, or a host of other issues that can negatively affect treatment outcomes. So dentists should avoid saying or giving the patient the impression that the previous dentist did faulty or poor work.

If a dentist encounters poor work by a previous dentist (either negligent treatment or undiagnosed disease), three options are available. The first is to contact the other dentist directly. Often the other dentist can inform the present dentist of problems or circumstances affecting treatment that the patient either could or would not discuss. The previous dentist might also offer to respond directly to the patient in an attempt to correct the problem. The second avenue is to discuss with the patient various professional methods, such as peer review or mediation, that are available for resolution of the problem. However, when a dentist sees grossly or continuously faulty work, he or she has an ethical obligation to report the problem to the appropriate body of the local dental society or to regulatory boards or bodies. - Fee disputes fee disputes often arise from patients who are not completely satisfied with the dental work they have received. When the dentist then pursues aggressive collection techniques, the patient responds with a malpractice complaint. The job of the dentist is to balance the right that he or she has to collect the money owed with the possibility of triggering a lawsuit. Before sending anyone to a collection agent or attorney, the dentist should be confident that the work done is clinically acceptable. Most states have a statute of limitations of 1 year from the date of discovery for malpractice actions. (The patient has 1 year from when he or she knew or should have known about a problem to sue.) Many experts recommend waiting until after 1 year to pursue aggressive collection techniques. The dentist should check with an attorney in the practice state. Many nuances about these laws might affect the dentist’s decision.

- Auxiliary treatment problems The dentist is responsible for the actions and work of the auxiliaries employed in his or her office. If the dentist has committed acts of malpractice, he or she is also liable, through the doctrine of agency. So if a hygienist accidentally injures a patient by dropping an instrument in his or her eye, both the dentist and the hygienist will be liable.

- Patient abandonment Once a dentist–patient relationship is established, the dentist must continue that relationship for the care of the patient. The patient may end the relationship at anytime. The dentist may end the relationship but only under certain conditions. He or she may not end the relationship in the middle of treatment. (What constitutes the “middle of treatment” is obviously open to interpretation.) The dentist may end the relationship if the patient is in stable condition and will not be harmed by a delay in treatment while he or she seeks care elsewhere. If, for example, the dentist is in the middle of root canal therapy, he or she must complete the endodontic treatment and probably place an adequate provisional restoration. If the dentist has done a surgical procedure that normally involves follow-up appointments for dressings, suture removal, or other follow-up care, he or she must complete that course of treatment. If a patient owes the dentist money, the dentist still must complete the procedure and ensure that the patient is dentally stable before ending the relationship. The notion here is that dentists should not harm (or even potentially harm) the patient by ending the relationship. If a dentist simply refuses to continue to treat a patient, he or she has violated the duty to treat that was established in the initial relationship, opening the dentist up to charges of abandonment.

When a dentist ends a relationship with a patient, he or she should inform the patient verbally and in writing (Box 22.2). (The dentist should keep a copy of the written correspondence.) The dentist’s letter should state why the relationship was ended and ensure patient health through referral, emergency care, and an offer to send records to the new dentist. - Insurance problems Insurance problems have led to a new set of malpractice issues. Although managed care itself does not cause poor ethical decisions and malpractice by the practitioner, it causes new problems in the dentist–patient relationship that can lead to accusations of malpractice. The single biggest influence is the temptation to perform less-than-optimal care. The pressure for minimal treatment may come from the dentist, the plan administrator, the patient, or the employer. Despite the pressure, the dentist is still responsible for the treatment rendered.

The dentist should remember that the best treatment for a patient is the best treatment, no matter how much money he or she makes (or does not make) when doing the procedure. The dentist is obligated to recommend and do treatment that is at least at the standard of care, regardless the method or amount of payment. If a dentist can not abide by the rules as established in the managed care contract, then he or she should not participate in the managed care program.

Patient Treatment Records

The patient treatment record is the official document of all treatment procedures, referrals, professional communications, recommendations, and advice that the dentist renders to patients in the dental office. The written treatment record (or its computer equivalent) is the basis of knowledgeable patient treatment and serves as the recorded history of treatment and recommendations in case of professional liability issues.

Components

Patient records may be paper or electronic in form. They should have the following components:

The Value of Good Records

The individualized dental record needs to contain all of the information concerning a patient’s treatment. If many practitioners (e.g., partners, associates, hygienists) all make entries in records, the office depends on accurate entries by every member of the team. Even as a individual practitioner, the records become an indispensable source of information. Memories are notoriously faulty after months (or years) have passed. Most dentists can not accurately remember having an encounter with a patient, much less any specific diagnostic finding, treatment recommendations, or outcome of treatment that occurred during that encounter.

Patient records also are the cornerstones of any malpractice case defense. The old adage that “if it isn’t in the record, it didn’t happen” is, unfortunately accurate. Because patient records are critical to prevention and resolution of patient problems and disputes, a few words concerning their use are in order.

All Entries Should Be Accurate and Thorough

Dentists should make entries at the time that the event occurs, rather than later. The patient’s record is a legal document. When the dentist or staff writes in a record, it should only be in blue or black ink. (Colored chart notations are OK.) The dentists should not use slang or common language or use only objective, factual, and medically accurate information. The dentist should avoid disparaging or personal comments. (“Patient was a real pain in the butt today” is a highly inflammatory statement. “Patient appeared agitated, was demanding and uncooperative in treatment” says the same thing in a more fac/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses