Chapter 19

Controlling Costs in the Practice

A penny saved is a penny earned.

Ben Franklin

break-even analysis

break-even point

cost allocation

fixed costs

practice cost analysis

practice revenue analysis

step-fixed costs

total costs

variable costs

“What if . . . ?” analysis

Increasing income and controlling costs are the two methods to improve profitability in the dental office. Cost control is the easier to understand because a dollar saved saves through reducing costs adds directly to the bottom line.

Types of Costs

Dental practice costs fall into three basic categories: fixed, variable, or step-fixed. These differing costs can be displayed graphically, where it becomes more apparent how each type of cost behaves as production changes (Fig. 19.1).

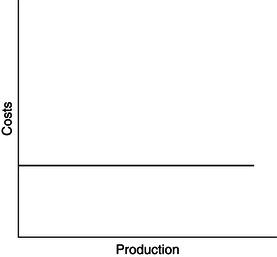

Fixed costs do not change with production (Fig. 19.1). Whether a dentist produces $30 or $30,000 per month, fixed costs are constant. For example, rent, dental association dues, malpractice insurance, and many other costs remain constant, regardless the production. These may not be exactly the same from month to month but are generally consistent. Fixed costs consist of the following:

- Office space and equipment is the largest category of fixed costs. It consists of all costs associated with operating the physical space and equipment of the practice. These include rent, utility, tax, and repair charges associated with the occupancy of the building. Dentists should also include an estimate of the depreciation expense for office and equipment because this represents wear and tear on those assets, and any equipment replacement programs.

- Other fixed costs include bank charges, office insurances, advertising, and legal and professional expenses.

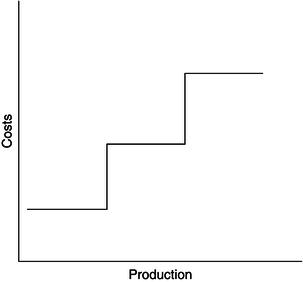

Step-fixed costs vary with production but only in discrete steps (Fig. 19.2). The existing staff will work harder as production increases. However, finally the load becomes too great, and dentists must hire an additional staff member to help the office run efficiently. Therefore, the cost jumps in a discrete step when the new person is hired. Dentists hire staff members as entire people (or increments of people). These costs are considered “fixed” over their range so that when the dentist hires a new person, a new set of fixed costs is established. Unless a dentist hires an additional staff member or loses one of the present staff members, these costs will be relatively constant or fixed in the range of the analysis. For that reason, dentists often include staff costs with fixed costs.

Staff costs include direct wages, benefits, payroll taxes, retirement plan contributions, hiring and training expenses, and any other costs that are direct results of employing staff members for the office. Dentists can divide labor costs into clerical (front office), hygiene, and chair side assisting personnel and should categorize them individually for detailed analysis:

Clerical (front office) compensation

Chairside assisting compensation

Hygiene compensation

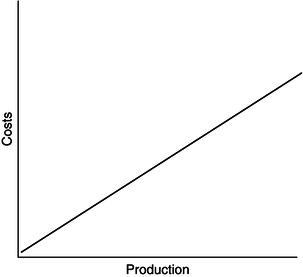

Variable costs change directly with the production level (Fig. 19.3). If a dentist produces $30,000 of dentistry 1 month, then his or her costs for dental supplies will be approximately 10 times more than a month in which he or she produces $3,000. If the dentist has no production, then theoretically he or she will have no variable costs. Variable costs change with production levels, not just collections. Dentists still must purchase supplies for procedures that he or she discounted or did not collect. In the dental office, variable costs consist of dental lab, dental supplies, and general office supplies. These costs often appear the month after they are purchased as a result of typical billing and inventory cycles. Nevertheless, conceptually, the costs are used in direct relation to the production. Each category should be tracked separately:

- Dental lab costs are associated with contract laboratory work. The costs of laboratory supplies in the office (stone, waxes, etc.) are considered dental supplies. If a dentist employs a laboratory technician in the office, he or she should include all costs associated with the laboratory operation (e.g., salary, benefits, supplies, and lab space rent) in this category.

- Dental supplies are the materials dentists use when doing dentistry. They include expendable supplies (e.g., cotton rolls, anesthetic, alloy, and composite material) and small-instrument replacement.

- Office supplies are the costs associated with materials for the front desk operation. This includes paper products, computer program fees, postage, magazine subscriptions, pencils, and other items used in processing patient visits.

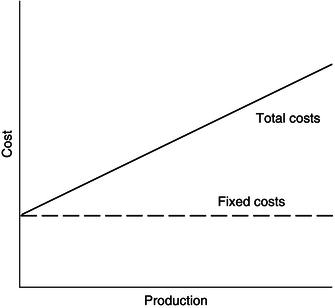

Total cost is the sum of fixed, step-fixed, and variable costs (Fig. 19.4). (Step-fixed costs are considered fixed over their range.) Likewise, the diagram for total costs is the combination of these various types of expenses.

Figure 19.1 Fixed costs

Figure 19.2 Step-fixed costs

Figure 19.3 Variable costs

Figure 19.4 Total cost

Owner’s expenses are items that the dentist benefits from directly. The dentist could have taken them as profit from the practice but instead he or she elected (or were required) to pay for them, appearing to reduce the practice profit. Common examples include self-employment taxes, automobile expenses, continuing education programs, travel, meals, entertainment, and retirement plan contributions for the dentist.

Typical Dental Office Cost Allocation

Dentists can develop a list of common dental practice costs for use in financial analysis. One obvious place to begin is to examine the previous year’s tax return. A Schedule C is a report of most dental office expenses. A complete checkbook register will a/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses