Chapter 1

Personal Money Management

Rule No. 1: Never lose money.

Rule No. 2: Never forget Rule No. 1.

Warren Buffet

credit card

credit rating (FICO score)

debit card

discretionary income

emergency fund

financial plan

identity theft

personal record management system

safe deposit box

Many financial planning issues that young professional dentists face are the same as the general public. However, in other ways, the issues for dental professionals are unique. They often start with high debt loads but balance that with high income levels. Dentists are generally not employed by a company or organization that provides any benefits such as medical insurance or a retirement plan. They are often limited in how much income growth they can expect and must balance their income wants and needs with their desire for personal time. Because of these issues, new dentists must quickly become familiar with how to manage money.

Personal Money Management

Become a Good Money Manager

Dentists need to become good money managers, both in business life and private life. The first step is to learn all about money and how to use it. Becoming a good money manager does not just happen; it needs to be worked at, just like becoming a dentist. Dentists should study how to save, how to invest, and how to become a wise consumer. They should subscribe to Kiplinger’s or Money magazine. These are the two leading personal financial magazines, and they give valuable tips for saving and making money.

Personal Records

Dentists accumulate many important personal financial records, therefore, a personal record management system, similar to the one developed for the office, should be created. Dentists should not let the paperwork pile up; they should work on records every month. They should get a safe deposit box at the bank or a fireproof safe at home for important papers. These important papers include wills, insurance policies, names of advisors, certificates of ownership, among others. Dentists should keep all tax records and related items for at least 7 years and keep insurance policies as long as they are in effect.

Getting Professional Help

As a professional, dentists have skills and knowledge that the public does not have. Dentists not only work with patients to take care of a patient’s oral health but also direct and intervene as professional expertise dictates. The same is true for managing financial affairs. A dentist may have a basic level of understanding of financial management, but there are times when the guidance of a person with expert knowledge in a specific area is needed. Most dentists go first to their accountant for advice about both practice and personal finances. An accountant can be used to help with tax planning, setting up basic retirement plans, evaluating the numbers of the practice, and personal budgeting. Depending on the background and expertise of the accountant, additional help for investment planning, establishing estate plans, buying or selling or partnership opportunities, and a host of other advanced financial topics may be needed. In these areas, dentists often use a lawyer, financial planner, or management consultant. This later chapter was not included in the book. The crucial point is that dentists should become actively involved in their own personal financial management and planning but use the expertise of advisors when the situations demand it.

Personal Lifestyle Issues

Increasing Lifestyle and Income

New dentists are often like a kid in a candy store when they first start making money. They have been in school for 8 to 12 years, are often married, and have put off increasing personal spending and lifestyle while in school. Suddenly, with new-found wealth, they buy too much (often on credit) and struggle the next several years to pay increasing bills with the increasing take home pay. The tendency is for lifestyle expenses to increase along with income. Every dollar that a person makes, is spent on a bigger house, newer car, and new toys. Unfortunately, the solution is not a fun, warm process. Personal life expenses must be kept under control. It is easy to increase lifestyle to meet increasing income. Once accustomed to a certain lifestyle, it is difficult to cut back spending, for example, to start a retirement savings plan. A solution is to develop and use a family budget. If income increases, then take half the increase and use it to fund spending or investment plans. Use the other half to increase lifestyle. In this way, lifestyle increases (more slowly than without savings) and a saving or investment plan is painlessly funded. This approach does take discipline however.

Spend or Save

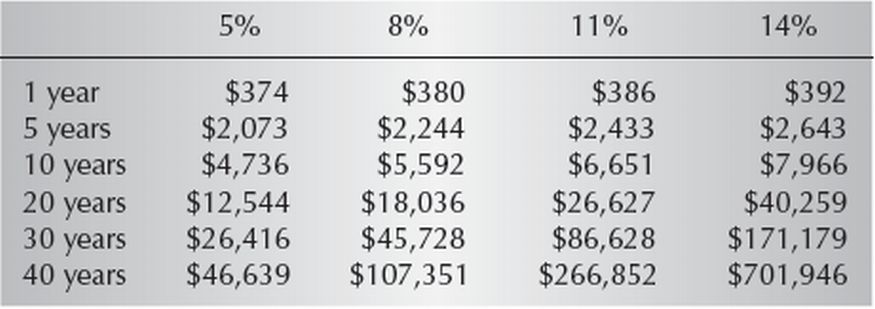

When money is earned, it can be spent or it can be saved. As previously mentioned, after years of training, most new dentists want to spend it immediately and enjoy it. Instead, they should get into the saving habit. Dentists should start each budget period by saving at least 20 percent of take-home pay, learning to live quite adequately on the remaining 80 percent. As income increases, they should save as much of the increase as is spent. As Table 1.1 shows, saving even a dollar a day adds up to a sizeable sum over time.

Table 1.1 Saving (and Investing) a Dollar a Day

Developing Personal Savings

Emergency Fund

One of the most important financial tasks is to establish an emergency fund. The emergency fund should consist of 3 to 6 months’ take-home pay, depending on the amount and type of disability income insurance and other liquid assets that are available in cases of emergency. The money should be put into a low-risk liquid investment such as a money market mutual fund or checking account. (Although this is not exciting, it is safe.) It is a form of savings used for emergency needs and not as a speculative investment. Emergencies that this fund might cover include a car that dies, a short-term disability, or paying for medical treatment. It is not a vacation or Christmas savings plan. Other than emergency purchases, this fund allows one to increase deductibles on all insurance policies, which saves substantial money in premiums. Establishing the emergency fund is one of the most important initial financial planning jobs.

Saving versus Investing

Saving is holding onto money, stashing it away so that it can not be lost. Gain is not expected. Investing is buying an asset (possibly a stock or a share of a mutual fund) that will possibly increase in value over time. When one invests, gain is hoped for, but loss is also a possibility. Both saving and investing are valuable goals in the right situation. If building an emergency fund or holding on to money for a short-term purpose, then the safest bet is to make sure it is not lost. Money should be saved in a low-risk fund, such as a savings account or money market fund. If retirement is planned for in 30 years, then the long-term gains that are hoped for by investing in a mutual fund is the better route. The value of the mutual fund may go down tomorrow, but it will hopefully (with wise fund choice) increase over the longer term.

Pay Off Debt or Build Assets

Should extra money be used to pay off debt, or should it be saved? Paying off debt as quickly as possible has become fashionable. Being debt free should be a long-term financial goal. From a purely financial standpoint, dentists should look at the after-tax return of the investment and the after-tax cost of the loan and then choose the one that gives a better return. If the interest rate is higher for the investment, then they should invest rather than pay off the loan. If the after-tax interest rate of the loan is higher, then they should pay off the loan. (See the chapter on business finance for a discussion of this topic.) From a cash flow perspective, cash may be needed for immediate necessities for the family or at the office. It is better to have an asset (the cash reserve) with a corresponding liability (the loan) than to have no cash and less of a loan. In the former case, a dentist may not need to go to a banker for an additional loan. In the latter case, when an additional loan is asked for, the banker may balk, wondering why previously loaned money was not handled properly. Once an emergency fund is built and an asset base established, then it becomes easier to put additional money into paying off debt. Again, comparing the expected return of investing with the savings from debt pay down is important. A final factor is one’s personal temperament. A dentist must be a disciplined-enough investor to actually invest the money and not “blow it” on a purchase. Then the dentist must get the rate of investment return anticipated. If the loan is paid off, th dentist should have a plan for the monthly payment that had previously gone to loan payment. Finally, the dentist must invest that amount regularly or it will be spent with nothing to show for it at the end of the pay-off period.

Get Adequate Insurance

The chapter on personal insurance details the types of insurance a dentist might need. As a rule, dentists should not buy extended service contracts, which are a type of insurance. When buying a television, refrigerator, automobile, or any other major purchase, the dealer will try to sell an extended service contract. These cover most repairs needed over the term of the contract. It is better to see if the item fails and then pay to repair or replace it. The dentist should never buy additional (credit or mortgage) insurance. These types of policies insure that if one dies or becomes disabled, the policy will pay off a mortgage or car loan. These are expensive life insurance or disability policies. (Dealers sell them because they get a cut of the premium.) The dentist should have adequate life and disability insurance for his or her needs, and then remember to refuse these additional insurances when buying a major item. The dentist should never buy insurance from someone who calls because insurance policies should be investigated before being bought. As a rule, insurance should be shopped around for because it is a commodity item.

Personal Banking

Banks

Many new graduates have never had the problem and luxury of managing significant amounts of personal money. Establishing both a personal checking account and a professional (office) account are paramount. All checking accounts are not the same. Banks require different minimum amounts in accounts, charge different service fees, pay different rates of interest, and may limit numbers of checks that can be written. The dentist should shop around to find a bank that meets all his or her needs. Initially, he or she should find a checking account with low fees and low minimum balances. As assets and savings grow, the dentist should look for accounts that pay more interest and charge lower fees. Many banks allow and encourage patrons to banks electronically via the Internet. Monthly payments can be established, and transferring funds electronically to many different vendors instead of writing a physical check can also be done. If in a private practice and money was borrowed from a bank, the bank may require the dentist to keep all accounts with the bank. In this case, the “private” banking services, which add a tremendous amount of convenience to banking, can also be used.

Banking Services

Banks provide many services besides checking accounts. Most now offer e-banking, which improves convenience, and most banking can be done online. The banks loan money for small business or personal purchases and develop mortgages for large purchases. They offer credit cards for spending and often have accounts for credit card payments from patients. Many banks have special small business divisions that offer payroll and other services to the small business owner. They have safe deposit boxes for critical personal and business records. They often have investment advisors and retirement plan specialists to help a person develop and nurture these accounts. One of the first professional relationships that a dentist should make is with a banker.

Managing Credit

Credit Rating

Establishing a credit rating is another important step in financial planning. The major credit bureaus keep credit ratings on all Americans, using their Social Security numbers. This lets potential lenders quickly assess borrowers. The lender can decide if a person is a good lending risk by looking at how much he or she has borrowed before, and if the loan was paid off in a timely manner. With no credit history (i.e., someone has never borrowed money), the banker will probably deny the application for a loan. The problem is that the creditor simply does not know whether someone is a good credit risk. A credit rating can be established by acquiring a credit card and paying it off according to terms. A credit rating should also be nurtured by paying off all debts and credit cards on time. A bad credit history will haunt a person for many years. It can lead to denial of a practice, home, or other loan, denial of insurance or employment, or even the right to cash a check or open a bank or credit card account.

The lending companies commonly report a credit rating using a Fair, Isaac and Company (FICO) score, which was named for the company that developed the scoring system. (Some agencies use other, similar systems.) Scores range from 300 to 900, with most people in the 600 to 700 range. All credit scores begin at zero and a credit history is built up; it is not started at the top and subtracted down by poor credit choices. So without borrowing money or having any credit (e.g., credit card), a person does not have a credit history and is considered a poor credit risk in the eyes of the rating systems.

The higher the score a person has, the better his or her credit worthiness. A higher credit score means that it will be easier to get loans (and other forms of credit, such as cred/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses