This article examines the financing of dental care in the United States. The major issues addressed include the amount and sources of funds, the reasons for increased dental care expenditures, the comparison of dental care with other medical care expenditures, the policy implications of current trends, and some cautious predictions about the financing of dental care in the next 10 to 20 years. The supply of dental services is expected to increase substantially in the next 10 to 20 years with more dental school graduates, a new midlevel practitioner, and greater use of allied dental health personnel. Whether the supply of services will grow faster than the demand for care is unknown.

The financing of dental care is concerned with the amount and sources of funds that pay for personal dental services. These monies are paid to dental practices and clinics for the services provided to patients. They do not include the monies allocated for community level dental public health programs such as water fluoridation and public education. Although the exact percentages are not known, probably 90% or more of national dental expenditures go to pay for personal dental services .

The amount and sources of funds that are spent on dental care are important for several reasons. First, the amount of money spent on dental care is an indication of the population’s access to dental services and their oral health status. The United States spends much more money on a per capita basis for personal dental services than most other developed countries, which is one reason why the oral health status of Americans is better than in most developed countries . There are significant differences in dental expenditures among population subgroups within the United States. As is well known, low income families spend much less money on dental care than high income families, and this difference explains, in large part, the substantial disparities in access to care and oral health seen in this country .

Second, the source of funds is important, because payers have a major say on the amount of money allocated for dental services and how the money is spent. Employers, government, and individual patients are the primary payers for dental services. For privately insured patients, employers are the main payers for care, and they usually contract with insurers to administer these funds. As the primary payer, employers have a major role in deciding how much money is spent on dental benefits and how these costs will be shared with employees. In general, large employers spend much more money on dental benefits than do small employers. The richness of the dental benefit plan is a major determinant of how often patients seek dental care and the services that they receive when they go to dentists .

Working through insurers, payers also decide what services are covered benefits, the amount and types of patient cost-sharing for the covered services, and how dentists are paid for their services. Practicing dentists have to be concerned with these financing issues because they influence dentists’ incomes and the services patients receive.

To address these important issues, this article first considers trends in total expenditures for dental care and compares the growth of dental expenditures with that of other common health care services. The sources of these funds are then described, followed by an examination of the factors that explain the growth of dental expenditures. Within each topic area, the health policy implications are considered, especially as they impact private dental practitioners. The article ends with a general discussion of these trends and their influence on access to dental care and dentist’s incomes.

Total expenditures

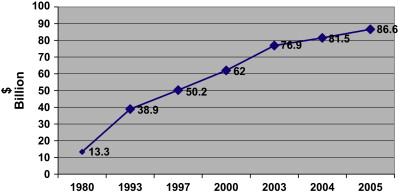

As shown in Fig. 1 , $86.6 billion was spent on personal dental services in 2005, 5.5 times more dollars than in 1980 . Relative to total national spending for all health care, dental treatment accounts for 4.4%. Although this percentage may seem like a small amount of money, it is not. For example, $83.6 billion dollars is spent annually (2007) to treat coronary heart disease and $74 billion to treat cancer (2005) . In terms of these comparisons, expenditures for dental care are substantial. The difference is that relatively few people receive care for heart disease or cancer, but over half the population receives dental care each year.

Over this 25-year time period, the average annual increase in dental expenditures was 7.2%, more than twice the annual rate of general inflation (3.2%) . The Center for Medicare and Medicaid Services, a federal agency, projects that the growth of dental expenditures will slow down somewhat for the next 6 years, reaching $126.3 billion in 2013 . This growth is an increase of almost $40 billion, with an average annual growth of 6.6%.

Table 1 compares the growth in expenditures for dental services versus the costs for physicians, hospitals, prescription drugs, nursing homes, and total expenditures . Overall, expenditures for the other medical services grew faster than that for dental services. Costs for prescription drugs led the group, with an average annual increase of about 11.9%. Although expenditures for dental care are increasing faster than the general economy, the rate of increase is less than for other medical services. This difference explains why the percentage of total health dollars spent on dental care is declining each year.

| Average annual percent growth from prior year | |||||||

|---|---|---|---|---|---|---|---|

| Spending category | 1980 | 1993 | 1997 | 2000 | 2003 | 2005 | Average, 1980–2005 (%) |

| Dentists | 11.1 | 8.6 | 6.6 | 7.3 | 7.4 | 6.3 | 7.2 |

| Physicians | 12.9 | 11.8 | 4.6 | 6.2 | 8.3 | 7.0 | 9.2 |

| Hospitals | 13.9 | 9.2 | 3.6 | 4.6 | 8.0 | 7.9 | 7.5 |

| Prescription drugs | 8.2 | 11.7 | 11.1 | 15.9 | 13.1 | 5.8 | 11.9 |

| Nursing homes | 16.8 | 10.0 | 6.6 | 4.1 | 5.1 | 6.0 | 7.7 |

| Total | 13.1 | 10.3 | 5.5 | 5.9 | 8.3 | 7.1 | 8.6 |

Policy implications

Of considerable interest is the slow down in spending for physicians and hospitals but not dentists in 1997 and 2000 . This reduction was due to the impact of managed care on physician and hospital expenditures. Managed care had little impact on dental care expenditures for several reasons. First, managed care is a type of insurance plan, and fewer Americans have private dental insurance when compared with those who have private medical insurance. Without dental insurance, there is no managed care. Second, dental insurance plans require substantial patient cost-sharing (eg, deductibles and co-insurance) when compared with medical plans; therefore, patient cost-sharing is already a significant barrier to increased expenditures, and there is relatively little to gain by the traditional cost-control techniques used in managed care. Third, insurance companies have much less negotiating leverage with dentists when compared with physicians, because the number of dentists relative to the size of the population is declining, which is not true for physicians. Also, dental insurers have, on average, much less market share in a given geographic location than medical insurers. The latter two facts mean that dentists do not have to join managed care plans to have an adequate supply of patients. In fact, less than 50% of dentists participate in a managed care plan. In contrast, almost 90% of physicians are enrolled in managed care plans .

In 2003 and 2006, the monies spent on physicians and hospitals substantially increased, suggesting that the impact of managed care was limited to a brief time period and, currently, is not effective in controlling the rate of increase in health care expenditures. The bottom line is that aggregate expenditures for personal health services continue to grow almost three times faster than general inflation.

This rate of growth in health care costs is not sustainable in the long run because payers (businesses, government, and individuals) have to take funds from other priority areas and reallocate them to health care. For government, this means spending less for programs such as public education, research, and roads. For individuals, this means spending less for housing, vacations, and other things. The alternative to spending more money is to reduce the amount and types of services available to patients. In fact, both things are happening. Indeed, almost 20% of our national wealth is directed toward paying for health care services . At the same time, the rapid growth of health care costs is the primary reason why almost 47 million Americans under the age of 65 years (15% of this population) are not covered by health insurance at any one point in time . Clearly, these issues are explosive political topics, and the control of health care costs is certain to dominate domestic politics for the next 10 or more years. Whatever steps are taken to control increases in health care costs, they are certain to have a significant impact on the practice of medicine and possibly dentistry.

Assuming that the solution to the problem of rapidly rising costs and uninsured patients is some form of government regulation of medical care finances, the key question is whether dentistry will be included in the government plan. In some countries, dental care is included in the national health plan, whereas in others it is not . In the United States, there is a good possibility that dental care for children will be an integral part of the plan but not adult care.

Payment sources

Table 2 gives expenditures for selected personal health services by fund source in 2005 . The two main fund sources are private and public. Almost all dental services are paid for from private funding sources ($81.4 billion), namely, private insurance and patients (out-of-pocket). Only 6% ($5.2 billion) comes from a public fund, the Medicaid program that pays for the care of some 30 million low income Americans. The Medicare program for elderly Americans provides little dental coverage (only when dental care is an integral part of treating a medical problem).

| Expenditures in billions of US dollars | |||||||

|---|---|---|---|---|---|---|---|

| Category | Total | Out-of-pocket | Private health insurance | Total | Medicare | Medicaid | Other |

| Dental | 81.4 | 38.3 | 43.1 | 5.2 | 0.1 | 4.5 | 0.6 |

| Physicians | 272.7 | 42.5 | 203.3 | 148.5 | 89.3 | 30.3 | 28.9 |

| Hospitals | 264.5 | 20.1 | 217.0 | 347.1 | 180.3 | 106.3 | 60.5 |

| Prescription drugs | 146.1 | 50.9 | 95.2 | 54.6 | 4.0 | 37.6 | 13.0 |

| Nursing homes | 57.9 | 37.4 | 9.1 | 75.9 | 19.2 | 53.5 | 3.3 |

| Total | 914.5 | 249.4 | 596.7 | 746.9 | 331.4 | 302.2 | 113.3 |

This limited commitment of public funds for dental care is in contrast to that for most other medical services. For example, federal and state governments pay for 57% of hospital care, 35% of physician services, and 62% of nursing home care. These allocations of public funds indicate that access to dental care has a relatively low priority in government health plans.

The two primary sources of private dental funds are employer-based insurance and individuals paying for care out-of-pocket. Of these sources, employer insurance pays for 52.9%. This percentage is very high considering that only one third of the population is covered by an employer-based dental insurance plan. People with private dental insurance receive a lot more care when compared with those without this benefit .

The remaining private expenditures come from insured patients who have to pay deductibles and co-insurance for covered services (and the total amount for uncovered services) and from patients without insurance who have to pay for all services out-of-pocket. In contrast, private payments to physicians and hospitals come overwhelmingly from private insurance. Private insurance covers 85% of private funds paid to physicians and 93% of private funds paid to hospitals.

Another way to look at this issue is to compare total out-of-pocket expenditures versus private and public insurance. From this perspective, people pay out-of-pocket for 44.2% of dental care, 10.1% of physician services, and 3.0% of hospital care. This stark contrast indicates why the general population perceives dental care to be so expensive . The fact is that they are paying much more out-of-pocket for dental care when compared with care from physicians and hospitals even though total expenditures for dental care are only a small percentage of these other services.

Policy implications

Actually, the out-of-pocket dental expenses of privately insured patients are considerably higher than these numbers suggest because most employers require employees to contribute to dental insurance premiums. In fact, for the average family plan, employees pay about 70% of the premiums with before tax dollars . Employers pay the other 30%. Although private insurance pays for 30% of privately funded dental care, employees contribute a large percentage of these funds. If employee contributions to premiums are added to patient payments for deductibles and co-insurance, many employees are financially better off without dental insurance. That is, they are paying more for dental care with insurance than without it. This issue becomes significant when employers make dental insurance an optional benefit. Many employees who are in good oral health or who have small families opt not to enroll in dental plans. Those selecting dental insurance often have families that expect to use a lot of care. From an insurance perspective, this causes dental premiums to increase rapidly because more plan participants are heavy users of dental services. In the long run, fewer employees will select dental benefits because high premiums will further exacerbate the problem. Employees’ contributions to premiums are paid with before tax dollars, which is an indirect type of government subsidy. Without this subsidy, few employees would enroll in employer-based dental insurance plans.

Because private dental insurance is a major driver of patient use of services and, in turn, dentists’ incomes, trends in the number of people with dental insurance are an important issue. The data that are available ( Fig. 2 ) indicate that, surprisingly, the percentage of full- and part-time employees with private dental insurance has increased modestly from 32% in 1999 to 36% in 2006 . For just full-time workers, the percentage is even higher, 44% (2006). This increase is surprising because the percentage of employees with private medical insurance is declining, and the number of people without medical insurance is growing . The stability of private dental insurance enrollment probably results from this benefit mainly being offered by large employers and the fact that, thus far, most large employers have not eliminated dental benefits. In contrast, many small companies are dropping medical insurance benefits or making the employee contribution to premiums so large that many employees decline enrollment. Instead of dropping dental insurance, many large employers appear to be passing on most of the cost of premiums to employees.