Chapter 8

Financing a Practice

Introduction

Many new dentists worry about obtaining essential first-time financing through a commercial loan. Although most have acquired a student loan, many new doctors are not prepared to approach a commercial lender. They are understandably concerned that they will not meet the basic requirements for approval. This chapter seeks to demystify the lending process in dental acquisition.

Financing Dental Transitions—The State of the Industry

In today’s commercial lending environment, dental transition financing can cover up to 100% of the purchase price and can also include additional working capital. The most likely lender will meet underwriting criteria specific for dentistry and will have a portfolio or group of past loans from which inferences have been drawn and risk mitigated.

Other sources of lending for new dentists include seller financing, local or community bank financing, and loans secured by the U.S. Small Business Administration (SBA), in association with another lender. In general, all lenders are looking for borrowers with demonstrated ability to manage debt, as evidenced by a satisfactory review of personal credit.

Few other start-up small businesses have access to this type of 100% financing. Dentists have an attractive record of paying their commercial loans in full and on time. Their default rate is low. Whether this is due to favorable demographics or ethical character and professionalism, or both, lenders do favor doctors with good personal credit and allow them to finance a qualified practice at 100% with favorable terms. The specifics of achieving such financing will be explored throughout this chapter.

Historical Perspective

Only as recently as the 1980s did the dental industry accept that practices had a value (outside of their equipment) that could be transferred. Most doctors in the 1970s had only the options of working for another doctor (which few did) or “hanging out a shingle” and starting from scratch.

When appraisal and evaluation of “goodwill” became accepted, few lenders could get comfortable with these “blue-sky” transactions. If a practice was sold, the seller would have been the only option for financing available to the new doctor.

Many of these internally financed loans had their pitfalls. Sometimes the loan might hinge on the seller’s staying on as an employee. If the relationship did not work out, it was hard to fire the practice “banker.” Some of these transactions lacked the due diligence necessary to determine whether the buyer could afford or had sufficient cash flow to take on the practice loan. Without the lender’s objective input, such analysis never occurred. Without the analysis, the buyer did not know if the practice’s cash flow would support his or her lifestyle. The results could be painful.

Sellers also disliked the risks associated with being the bank for their buyers. At a time in their lives when they were trying to leave dental practice responsibilities behind, sellers found themselves still bound to the practice for income. As a result of these problems and the availability of external financing through specialty lenders, fewer and fewer transactions are being financed by the seller. Today we estimate that less than 15% of dental transitions across the country are exclusively financed by the selling doctor.

Preparing for a Practice Acquisition Loan

Commercial Loan vs. Consumer Loan

Banks make a distinction between commercial and retail (that is, consumer) products. Frequently, commercial and retail loans are handled by different banking departments. Some banks focus on retail lending and have few resources devoted to commercial lending. Student loans, home mortgages, car loans, and credit cards are considered retail lending. New doctors who seek commercial financing are venturing, usually for the first time, into the commercial departments of the bank.

In general, commercial loans are granted based on the strength of the borrower and on the business opportunity they represent. They are typically secured by the assets of the business. The typical business loan is structured over a 5- to 10-year period. The loan’s interest rates may be fixed or floating, and there may be conditions that relate to the business (for example, a lease on the property where the business will reside) and to the borrower (for example, insurance requirements, personal guarantee). Of primary importance is the doctor’s personal credit profile.

Assessing the Borrower’s Personal Credit

The first step in preparing for practice ownership is monitoring and maintaining good personal credit. It is easy to do; it can be done quickly and carries considerable weight in determining eligibility and the terms of a practice financing loan.

Lenders and other vendors access personal credit information by requesting a credit report from at least one of the three nationwide credit agencies: TransUnion, Equifax, and/or Experian. These bureaus gather data on each consumer and provide a report that includes a list of accounts, timeliness of payment, and public information such as tax liens or judgments. The bureaus also employ statistical modeling of this data so that through the borrower’s past performance they create a credit score on each consumer. This score helps lenders evaluate how reliably the borrower is likely to repay the loan promptly. Credit scores range from 300 to 850; the higher the score the better.

A credit score over 730 is considered excellent and will garner the borrower the best rates and terms available. Scores below 625 will significantly narrow the number of commercial lenders interested in a financing project. If such projects can be approved at all, a low score will result in a higher rate and more rigid terms.

Credit scores are influenced by the following factors (by priority):

- Timeliness of monthly payments

- Amount of debt

- Type of debt

- Inquiries from outside vendors

Experian, one of the major consumer bureaus, advises consumers to maintain good credit by paying bills on time, seeking out credit only as needed, and monitoring credit annually to guard against errors and identity theft.

The Federal Trade Commission (FTC) has excellent information on managing personal credit. Its website is www.ftc.gov. The FTC advises consumers to check credit through a website that was set up through the Fair Credit Reporting Act (FCRA), which mandates that all three bureaus give consumers access to a free credit report annually. That website is www.annualcreditreport.com.

Experience in evaluating the credit reports of new doctors has revealed several common but easily avoided problems. Sometimes student loans that are in deferment show up on the credit report as late payments. These “late pays” can and should be disputed and eventually removed from the report. Similarly, small medical bills, unknown to the doctor, are reported as collections accounts. Since students move frequently, a delayed medical bill may be sent to a past address. The young doctor may have no knowledge of the lateness, but it ends up as a collection account—arguing against the doctor’s claim of prompt payment history. Although these accounts cannot be disputed, they can be neutralized by time. Annual credit reviews or credit reporting services that report changes as they happen can alert borrowers to these oversights, allowing quick payment and resolution. After such bills have been paid, the credit score may have time to recover, minimizing the negative effect of late payments.

Assessing Your Income Requirements

Before buying a practice and applying for a business loan, it is essential to know the amount of money necessary to run the borrower’s household. Income requirements are basic information every doctor should know before considering a particular practice purchase.

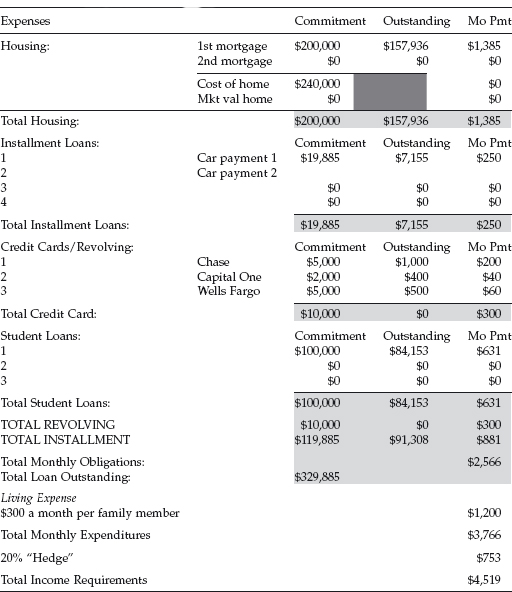

Although there are many ways of estimating personal income requirements, one method is examined in Table 8.1. In this example, the doctor determines his or her monthly expenses based on a review of monthly obligations coupled with a monthly expense allotment per family member.

Table 8.1. Example of estimating personal income.

The doctor lists his or her mortgage total and debt (or rent payment) as well as installment debt (usually automobile debt, but it could be any installment debt that is unrelated to school debts). Next, credit cards and lines of credit are accounted for. Minimum payments on credit cards are used as the monthly expense in this exercise. Finally, student debt payments are listed. Expenses other than monthly debt obligations can be estimated by multiplying the number of family members by $300. This accounts for most day-to-day expenses. In this example the doctor needs a bare minimum of $1,200 a month to cover basic living expenses for a family of four. Unusual or other specific obligations (that is, alimony, child support, special investments) should be accounted for and added to monthly obligations.

In looking at income requirements, many doctors ask if it is appropriate to include an accounting of spousal income. If the spouse’s income is needed to make the deal work, many lenders will in fact ask for the spouse’s personal guaranty. If the practice cash flow is sufficient without the spouse’s income, then the lender may not ask for the guaranty.

Once a doctor has a good understanding of his or her family expenses, projecting income requirements becomes easy. It is recommended that a doctor take these basic expenses, add a small hedge of about 20% on top, and use this final number as a monthly income requirement. In Table 8.1 the doctor in question needs $4,519 per month to comfortably continue his or her lifestyle after the practice purchase.

Preparing a File for a Commercial Lender

An easy task to be done ahead of time is to prepare a file of financial information for the lender. It’s recommended that a potential borrower have the items below handy when applying for a loan. All lenders will require the first three items. The other items are useful in telling your story. Start immediately to gather this information, as it eliminates much of the stress associated with applying for a commercial loan.

These items should be ready for the lender:

- 2 years of personal tax returns

- CV or résumé

- Dental license

- Production reports from current associateship (if available)

- Life insurance and disability policies (if available)

- Personal financial statement (list of assets and debts)—see Table 8.1 for an example

- Income requirements (personal budget)

- Copy of self-obtained credit report

- Any appropriate references (especially if you have a short work history)

Understanding the Commercial Lender

Many doctors are confused at the array of commercial lenders who seem interested in doing business with them. In this section we explore the two overarching credit philosophies that are used in making these decisions. We also examine the type of lenders available and the benefits and challenges of each.

Two Credit Philosophies

In general, lenders can be divided into two categories: asset-based and cash-flow-driven. As the term implies, an asset-based lender looks first at the collateral or hard assets of the business to secure the loan. Equipment, furnishings, inventory, and work in progress are examples of hard assets. Most community banks and large, nonspecialized banks would look to cover most of the loan proceeds with this kind of asset base. Dental practices as a rule do not have this collateral base.

Cash-flow-driven lenders tend to be specialty oriented. These lenders make their decisions based on the historical performance of the business, that is, its ability to generate enough profit to fund the debt while allowing the owner to maintain his or her lifestyle. These lenders may not expect that collateral (assets) will protect the loan. Rather, they base loan approval on sufficient practice cash flow and their knowledge of the dental industry.

Therefore, doctors who approach only community banks or large banks with no dental specialization for a practice acquisition loan may be frustrated by these lenders. There may be exceptions, however. Occasionally, a local bank will choose not to follow its asset-based lending approach and provide a loan program that resembles that of a specialty lender. It is more common, however, for the local bank to proceed within its traditional philosophy and use other methods to shore up its collateral coverage (which will be discussed below).

Types of Lenders

Understanding how each type of lender is prone to react to acquisitions empowers loan seekers to find the right loan for their project. It will also help identify exceptionally good “deals.”

The likely types of lenders encountered are the seller, the local bank, the SBA, the specialty lender, and the loan broker. The benefits and challenges of each will be discussed.

Seller Financing

As discussed earlier, seller financing can benefit the buyer in several basic ways. The seller may off/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses