Financial Management in the Dental Office

Learning Outcomes

On completion of this chapter, the student will be able to achieve the following objectives:

• Pronounce, define, and spell the Key Terms.

• Describe the functions of computerized practice management systems and manual bookkeeping systems.

• Demonstrate ways to make financial arrangements with a patient.

• Describe the importance and management of collections in the dental office.

• Explain the purpose of business summaries.

• Identify common payroll withholding taxes and discuss the financial responsibility of the employer.

• Discuss the purpose of dental insurance.

• Identify the parties involved with dental insurance.

• Identify the types of available prepaid dental programs.

• Discuss and define basic dental terminology.

• Identify dental procedures and coding.

• Detail claim forms processing.

• Describe the procedure and purpose of claim forms follow-up.

Electronic Resources

![]() Additional information related to content in Chapter 63 can be found on the companion Evolve Web site.

Additional information related to content in Chapter 63 can be found on the companion Evolve Web site.

Key Terms

Accounting A system designed to maintain the financial records of a business.

Accounts payable Expenses and disbursements paid out from a business.

Audit trail Method of tracking the accuracy and completeness of bookkeeping records.

Bonding Form of insurance that reimburses an employer for loss resulting from theft by an employee.

Bookkeeping The process of managing the financial accounts of a business.

Carrier The insurance company that pays the claims and collects premiums.

Change fund Fixed amount of cash.

Check A draft or an order drawn on a bank account for payment of a specified amount of money.

Check register Record of all checks issued on and deposits made to a specific account.

Coordination of benefits (COB) Coordinating insurance coverage between two insurance carriers.

Current Dental Terminology (CDT) Publication that lists the procedure codes assigned to dental services for the processing of dental insurance.

Customary fee A fee that is within the range of the usual fee charged for the service.

Deposit slip An itemized memorandum of funds to be deposited into the bank.

Disbursements Payments on any outstanding accounts payable.

Expenses The overhead costs of a business that must be paid to keep operating.

Fixed overhead Business expenses that are ongoing.

Gross income The total of all professional income received.

Invoice An itemized list of goods that specifies the prices and terms of sale.

Ledger A financial statement that maintains all account transactions.

Net income Gross income minus expenses.

Packing slip An itemized listing of shipped goods.

Payee The person (or business) named on the check as the recipient of the amount shown.

Pegboard system A manual bookkeeping system.

Petty cash fund A limited amount of cash that is kept on hand for small daily expenses.

Posted Describes the documentation of money transactions within a business.

Provider The dentist who provides treatment to the patient.

Reasonable fee A fee that is considered justified for an extensive or complex treatment.

Responsible party Person who has agreed to pay for services or for an account.

Statement A summary of all charges, payments, credits, and debits for the month.

Transaction Any charge, payment, or adjustment made to a financial account.

Usual fee A fee that the dentist charges for a specific service.

Variable overhead Business expenses that change depending on the types of services needed.

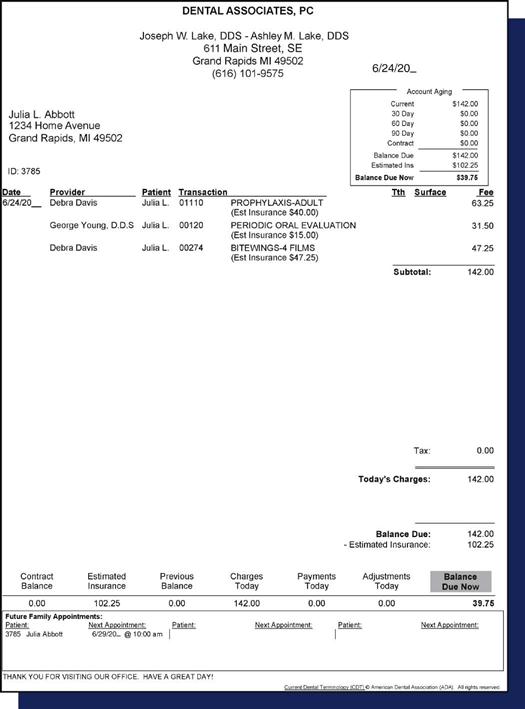

Walkout statement A written indication of any balance due on an account, given to a patient as he or she leaves the practice at the end of an appointment.

The business records of a dental practice are the foundation on which the finances for a dental office are managed. The business assistant has the responsibility of maintaining complete, accurate, and up-to-date financial records in the following areas:

Accounting

Accounting is the means or process of recording, classifying, and summarizing financial transactions. Bookkeeping is the recording of the accounting process. The business assistant conducts bookkeeping procedures on a daily basis to maintain dental practice accounts. The two types of bookkeeping systems used in a dental practice are the accounts receivable and accounts payable systems.

Preventive Account Management

Preventive account management begins with a clearly defined financial policy established by the dentist. Once these guidelines have been determined, it is the responsibility of the business assistant to follow through with them. Basic practice financial policies should include statements on gathering financial information, presenting the fee, making financial arrangements with patients, and collecting overdue accounts.

Gathering Financial Information

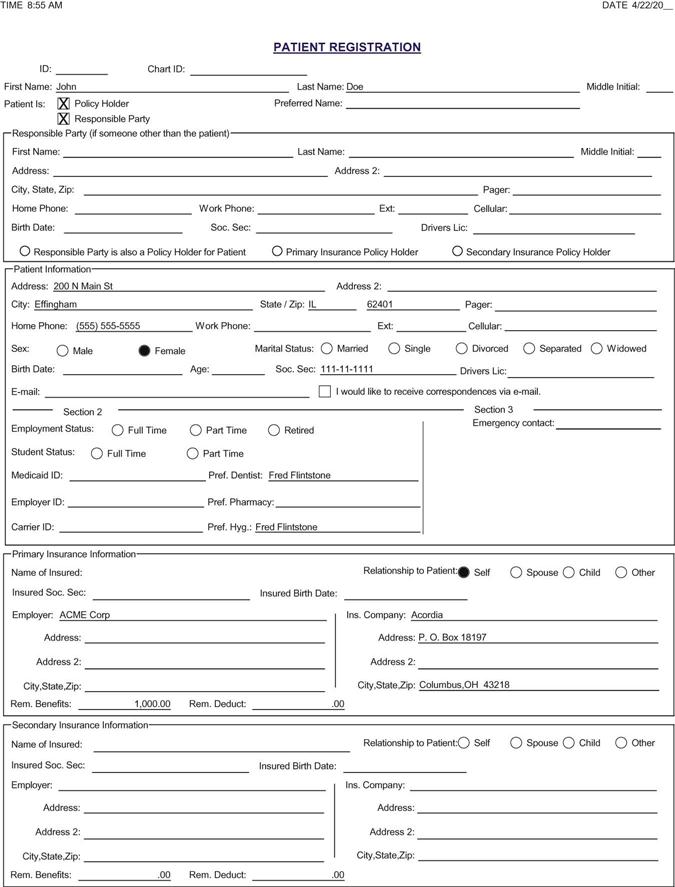

When a new patient calls to schedule an appointment, this is the time to inquire about dental insurance and to inform the patient to bring identification card and benefits booklet to the appointment. This material should be reviewed to determine eligibility and available benefits for coverage. The registration form gathers all the basic financial information needed to manage the account history and complete the patient identification portion of an insurance claim form (Fig. 63-1).

Information on the form includes the following:

• Information specifying the patient’s coverage under a dental insurance plan

• Identification information for all individuals included on the account

Credit Reports

Dentistry today is costly, especially in the area of specialty procedures such as implants, surgical procedures, and orthodontics. A credit report of the responsible party may be requested. If this is the dentist’s policy, the responsible party should be informed before the credit report is applied for. Consumer credit reporting agencies, commonly referred to as credit bureaus or agencies, provide a financial profile of the patient. The report provides information on their paying habits and accounts placed for collection, plus other pertinent information such as lawsuits, judgments, and bankruptcies.

Fee Presentation

Before a case is presented to the patient, an estimate is developed as part of the treatment plan. This estimate is prepared in duplicate: One copy is provided to the patient, and the other is retained with the office records.

The fee for service represents a fair return to the dentist for professional treatment provided. After the dentist has completed the case presentation to the patient, the business assistant may be asked to handle the discussion of fees involved. At this time, the business assistant presents the necessary fee information and makes financial arrangements with the patient to the satisfaction of both the dentist and the patient.

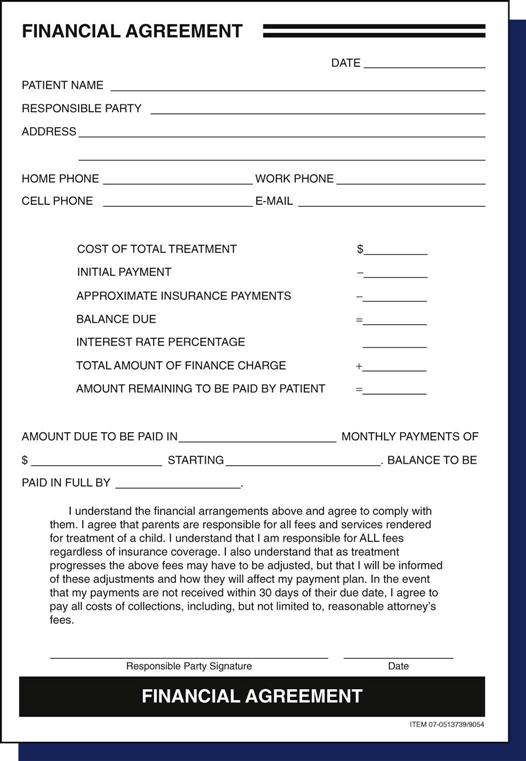

Making Financial Arrangements

Financial arrangements are made with each patient when professional services are performed. These arrangements should be made before treatment is initiated, except in such instances as emergency treatment. Realistic financial arrangements should be made in an unhurried manner with the person responsible for the account. These arrangements are confidential and should take place in a private setting where others cannot overhear the discussion.

When making financial arrangements, it is necessary to take into consideration the dentist’s stated payment plans, along with the sound business principles used in the management of the practice. It is also necessary to consider the patient’s ability to pay. The resulting arrangements should be reasonable to both parties. The patient must realize that once these arrangements have been made, he or she is responsible for following through as agreed. All financial agreements should be recorded on the account ledger. The patient will sign a contract for the agreed amount. A copy is provided to the patient, and the original is retained with the office records.

Accounts Receivable

The accounts receivable system manages all money owed to the practice. Accounts receivable management, which is frequently referred to as bookkeeping, involves maintaining financial records regarding all transactions related to collecting fees for professional services provided to a patient. This information must be arranged systematically so it is accurate at all times and provides the data needed for effective management of these financial matters. Accounts receivable activities are not difficult; however, in carrying out these activities, the business assistant assumes the responsibility of handling other people’s money. In this way, he or she is responsible for making every effort to keep this money safe, to record it accurately, and to respect the confidence in which all of this information must be held.

The dentist may choose to obtain bonding insurance on staff members who handle practice funds by receiving and banking patient payments or writing checks. This insurance will cover a loss, and the employee can be prosecuted under the law for any such theft.

Types of Accounts Receivable Systems

The most frequently used type of accounts receivable bookkeeping system in a dental practice is the computerized system or a manual pegboard system. Increasingly, offices are switching to electronic practice management systems because they are capable of integrating technology with bookkeeping capabilities.

Pegboard Accounts Receivable Management

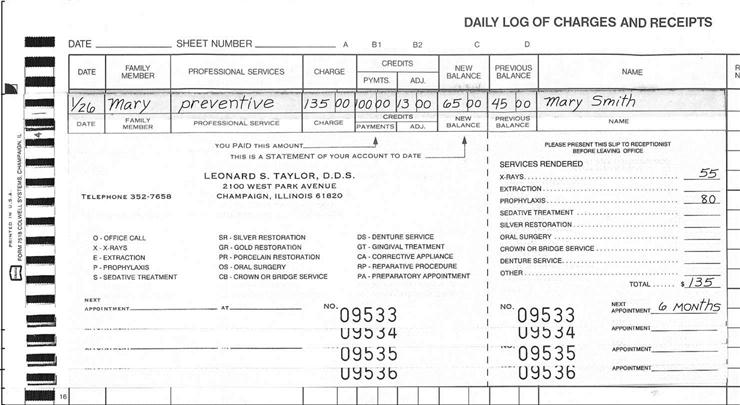

Pegboard accounting, also known as a one-write system, is a manual bookkeeping system in which all records are completed with a single entry. Through positioning of the daily journal page, ledger card, and a carbonized receipt, all financial records for each patient visit are completed by writing the information just one time (Fig. 63-2). Entries for additional records, such as daily totals and monthly summaries, must be completed manually. The totals then must be calculated and verified for accuracy.

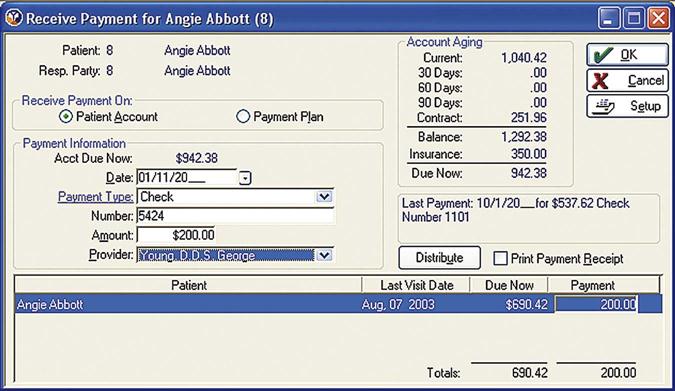

Computerized Accounts Receivable Management

With a computerized accounts receivable system, data entered into the system are used to maintain account histories and practice records (Fig. 63-3). It is essential that the information be entered into the system accurately because it is used to generate account totals and daily and monthly summaries. These and other management reports are automatically calculated and produced by the system. It also is important that the data stored on the hard drive of the computer is protected by being backed up (copied for safekeeping) daily. An additional set of backup files (zip drives or flash drives) should be stored in a safe place outside of the office. These backup records are vital in the event of theft, fire, or other disaster that makes it necessary to reconstruct information that may have been lost from the system.

Accounts Receivable Management Basics

Whether you are using a manual or a computerized system, the same information requirements and organizational format are necessary. Learning to use either system begins with an understanding of the basics of accounts receivable bookkeeping. The accounting process begins when the patient leaves the treatment area.

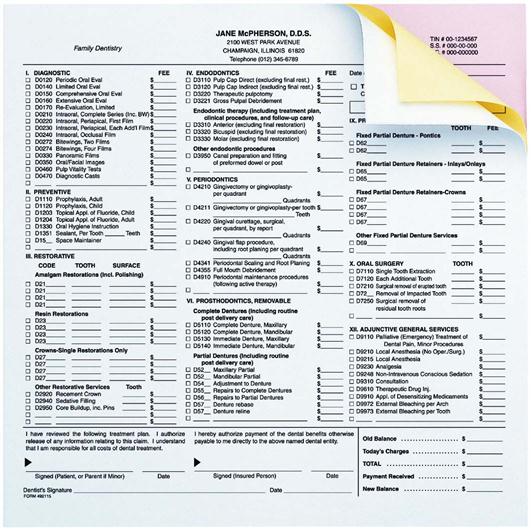

Charge Slips

A charge slip, also referred to as a routing slip or superbill, is used to transmit financial information from the treatment area to the business office. The form contains information about the patient, such as name, account number and previous balance, current charges, and payment. The form can be designed to include all of the procedures completed in the office along with the insurance CDT code. The form provides space for the dentist or assistant to note the treatment provided at the visit. The form consists of three color-coded pages (white for the patient’s permanent record, yellow for the office or patient to submit to the insurance company, and pink for the patient’s copy) (Fig. 63-4).

The completed charge slip is returned to the business office, and the information is posted to the accounts receivable system. Charge slips are a part of the audit trail. A charge slip should be generated for each patient. At the end of the day, a number must account for each charge slip. In this way, the dentist knows that all patient visits have been entered into the system.

Daily Journal Page

The daily journal page is the practice record of all patient transactions each day; this record includes the name of each patient seen and any charges, payments, and adjustments made to that account. Throughout the day, all transactions are posted to the bookkeeping system. In addition to maintaining the patient account record, this posting generates the daily journal page entry. A computerized system automatically totals this form and uses the information to generate other practice reports.

Receipts and Walkout Statements

A walkout statement is similar to a receipt except it shows the current account balance. It is provided to patients who do not provide payment in full (Fig. 63-5). A walkout statement should be provided with a postage-paid reply envelope, allowing the patient to mail the outstanding payment as soon as possible. The use of walkout statements improves cash flow because it speeds payments. It also reduces the number of statements that must be prepared and mailed at the end of the month.

Recording Payments

All payments must be entered promptly into the bookkeeping system so they are recorded in the account history and on the daily journal page. Payments received by mail are entered in the same manner as those made in person. As a safeguard, checks should be stamped immediately with a restrictive endorsement, which prevents anyone from cashing a check if stolen.

Patient Account Records

Patient account records are organized on the basis of information regarding the responsible party. The responsible party, also known as the guarantor, is the person who has agreed to be responsible for payment of the account. This is not always the patient. The patient account record is used to track all account transactions. A current account balance is maintained at all times, and this information is used to generate statements, insurance claims, and other collection efforts. In a manual system, patient account records are maintained on account ledger cards. In a computerized system, these are organized as account histories or ledgers.

Payment

Patients’ accounts can be handled in several ways, such as payment at the time of treatment, payment by monthly statement, and divided payments. Dental insurance may be consider as another method of payment, although it must be emphasized that the patient is responsible for the balance not covered by the insurer. To help alleviate concern for the patient, a pretreatment estimate form can be submitted to the insurance carrier. This would provide information on what the insurance company covers and any additional patient payment or copayments that will be required.

Payment at the Time of Treatment

Under this payment policy, patients are asked to make payment in full for treatment provided at each visit. This system helps control practice costs by improving cash flow and reducing the cost of sending statements or using other collection methods. Patients must be notified of this type of payment plan before the first visit. In many practices, this is completed during the initial telephone conversation. Under this plan, cash, checks, and credit cards are accepted for payment.

Cash

Although few patients pay for dental treatment in cash, it is necessary to be alert to the needs of cash-paying patients. When you are accepting payment in cash for services, it is essential to ensure that the office has correct change available for the patient. The patient who is paying cash must be provided a written (or computer-generated) receipt.

A change fund or petty cash fund is a fixed amount of cash (usually $50 or less) that is maintained in small bills so that money will be available when a patient pays in cash. Each morning, the change fund is placed in the cash drawer, and it is used as needed during the day. At the end of the day, the change fund is removed and placed in safekeeping. Money from the change fund does not become part of the daily deposit, and the amount in the change fund at the end of the day must be the same as it was at the beginning of the day.

Check

Patients will pay for dental services with a personal check to the dentist or to the name of the professional practice. In some practices, it is office policy to record the payer’s driver’s license number and one other form of identification. The patient paying by check is provided a receipt for the payment.

Credit Cards

Another option is to pay for dental services with a credit card. Credit card transactions are listed as payments, but the posting code is different from that used for cash or a check. The credit card system is now electronically able to verify immediately if the card is valid and that the credit limit has not been exceeded. When a dentist agrees to be a bankcard merchant, the participating bank will explain the procedure of verification and submittal.

The credit card charge form is completed, and a copy is handed to the patient. Credit card charges are not part of the regular bank deposit. Instead, they are managed in accordance with the instructions from the institution issuing the credit card. The bank charges a percentage rate as a service fee for handling these transactions. This is referred to as discounting because at the end of the month, the service charge is deducted, or discounted, from these funds. An adjustment entry is made in the checkbook to accommodate this discount as a practice expense. This difference is not subtracted from the patient’s account.

Professional Courtesy and Discounts

Occasionally, the dentist will extend a professional courtesy in the form of a discount to professional colleagues or members of their families. The dentist makes this determination and places a notation on the chart after completing the treatment for the day. For example, if the usual fee for a procedure is $50 and the dentist wishes to give a professional courtesy of $10, the amount owed is $40.

A practice may offer a discount if payment is made in full before the beginning of planned treatment. For example, if a patient is having a complete upper and lower denture fabricated at a cost of $1400, the dentist might extend a 5 percent discount ($70.00) for payment in full. In this case, the patient would pay $1330.00 in advance, for a savings of 5 percent off the total charge.

To enter this discount into the bookkeeping system, the total fee of $1400 is posted. Then an adjustment representing the discount is entered for $70.00. This adjustment acts as a credit and leaves an account balance of $1330.00 to be paid.

Daily Proof of Posting

At the end of each workday, the entries on the daily journal page are compared with the appointment book to ensure that all patient visits have been entered. Computerized systems total all figures automatically and can print various reports as needed. The total for receipts must match the amount in the cash drawer minus the change fund. If these two numbers do not match, or “balance,” it is necessary to go back and find the error.

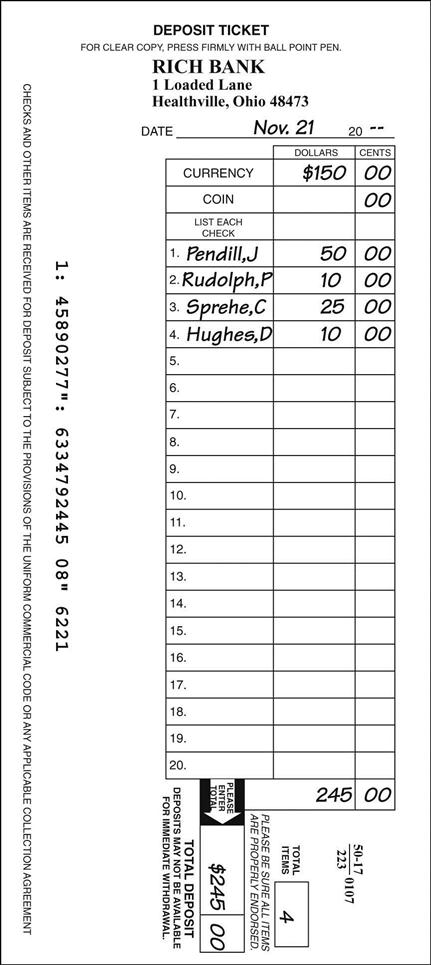

Bank Deposits

All receipts should be deposited daily. When the amount of receipts exactly matches the amount of deposits, the account has met the auditor’s critical test to verify bookkeeping accuracy. A deposit slip is an itemized memorandum of the currency and checks taken to the bank to be credited to the practice’s account (Fig. 63-6). This slip is generated from the computer after all checks have been posted. After the deposit has been made, the date and amount of the deposit should be entered in the practice check register as follows:

• The deposit slip must be imprinted with the practice name, address, and account number.

• The information on the deposit slip must be legible.

• All cash (bills and coins) is listed together under “Currency.”

Monthly Statement

The monthly statement represents a request for payment of the balance due on the accounts receivable. Under this plan, the patient is expected to pay the balance in full on receipt of the statement. With a manual system, this statement frequently is a photocopy of the ledger card that shows the information about charges for treatment provided, payments, and account adjustments. A computer-generated statement shows this data, plus an age analysis of the account balance. Financial arrangements can also be printed on a computer-generated statement. Some practices add a finance charge (usually 1 percent) to accounts that are not paid within 30 days of receipt of the first statement.

When a charge such as this is incorporated on an account, or when more than four payment installments are set up, the patient must be notified of this policy in advance with a Truth in Lending form (Fig. 63-7).

Cycle Billing

Statements should be routinely mailed at the same time each month. If the task is too large to be handled at one time, the practice may use cycle billing. In cycle billing, the alphabet is divided into parts, and statements for patients with last names in each part of the alphabet are mailed at specified times during the month.

Divided Payment Plans

Divided payment plans are arrangements by which the patient pays a fixed amount on a regular basis. For example, orthodontic treatment usually is paid for on a divided payment plan. These arrangements are made at the time of the case presentation. After the patient has accepted the proposed treatment plan, the business assistant will work with the patient to develop a divided payment plan. When a divided payment plan is set up, the primary information to be determined is as follows:

• Total fee for services to be rendered

• Balance after deduction of the down payment; the resulting amount is to be financed

• Annual percentage rate of the finance charge (if there is one)

Once this information has been gathered, the payment plan agreement is completed, and both the patient and the dentist must provide a signature to confirm agreement. A copy is provided to the patient, with the original kept in the patient’s record.

Collections

It is essential for the business assistant to have the skills to manage the money owed to the practice and to collect it in a timely and organized manner.

Accounts Receivable Report

The accounts receivable report is a valuable management report that shows the total balance due on each patient account plus an analysis of the “age of the account.” This shows how much of the balance is current (recent charges not yet billed), 30 days old, 31 to 60 days old, 61 to 90 days old, and older. This information is helpful in tracking and taking action on overdue accounts.

A computer can generate this report automatically with a breakdown of account age. Although creation of the report is not automatic with a pegboard system, it is possible to generate one manually.

Management of Collection Efforts

All collection efforts must be handled tactfully and in keeping with the dentist’s wishes and policies, because the dentist is ultimately responsible for the actions of his or her employees. The dentist does not want to lose a patient’s good will because of poor collection tactics. Under the federal Fair Debt Collection Practice Act, it is illegal for anyone to carry out the following:

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses