Chapter 21

Protecting Yourself with Personal and Business Insurance

Why Insurance Is Important

While working with young professionals during the past 18 years, it has been my experience that many of you have been trained and educated in your field of dentistry; however, when it comes to the exposures you will be faced with and the protection you need to cover these exposures there is a lack of education on the following topics: liability coverage, disability insurance, life insurance, and business insurance. These topics of protection can drastically affect your family and your business. Throughout this chapter it is my intent to educate you on how you can protect yourself and your family from exposures you may not know exist and to help assist you with the type of protection your practice may need.

Personal Liability

You want to make sure you protect yourself for any liabilities that may occur. First, the most important protection you should have is protection from lawsuits. You protect yourself by purchasing good malpractice insurance. Your coverage may be provided by your employer if you are an employee. If you own your own practice, you will need to purchase malpractice for yourself. Claims-made insurance policies will cover you for malpractice claims that take place and are reported to the insurance company during the policy period. The rates for this type of coverage will be lower in the first year and gradually increase every year for the first 5 years of coverage. Claims-made malpractice is the most widely used type of malpractice insurance across the United States. When terminating a claims-made policy it is recommended that you purchase what is called a “tail,” or reporting endorsement, from your prior carrier. This may be required from your prior employer. Another alternative to purchasing a tail or reporting endorsement is to negotiate with your new employer to pick up your retro date or purchase your tail coverage. If you are the employer it is highly recommended to purchase a tail or reporting endorsement and start over as a first year dentist again with first-year rates. By doing one of these actions, you are protected for any future claims that may arise related to the time period when you had the coverage.

Occurrence insurance insures for any claim that occurs while the policy is in effect, regardless of when the claim is filed. Occurrence policies are usually higher than claims-made in the first 5 years. However, with occurrence policies it is not necessary to purchase a tail or reporting endorsement.

This coverage can be somewhat confusing. Here is a situation that you may run into. Bill is a practicing dentist and is employed by XYZ Dental Associates and the year is 2008. He remains with the practice for the next 2 years. Bill then decides to move back to the state he grew up in and join a practice that already has three dentists. Bill will be an employee for the first 2 years at his new practice. His previous employer, XYZ Dental Associates, is requesting that Bill provide verification that he purchased tail coverage.

Because of the huge expense of this coverage, Bill decides to consider some other options. Instead of paying for the tail coverage out of his pocket, he could talk to the new practice he joined and ask them to pay his tail coverage. Or he could back up his retro date with his new malpractice coverage. By picking up this retro date, his malpractice coverage with his new employer would state that it is in effect from 2008, not 2010, when he joined the new practice. This is an example of picking up the retro date.

The second area of coverage regarding liability insurance is carrying a substantial amount of liability insurance on your auto and home insurance. A big mistake most professionals make is they carry a state minimum for liability insurance on their autos. These limits are usually too low. You must remember that you may get sued on future earnings. Ultimately you do not want to work to pay off a claim that could have been handled by having higher limits at a minimal cost. Passing this exposure over to the insurance company is the best way to protect yourself.

Initially homeowner’s or renter’s insurance is taken out to cover one’s possessions. However, the exposure you would have should someone decide to sue you from getting hurt on your property is much greater. That is why I will recommend carrying a higher limit of liability insurance to protect yourself from this exposure.

Most homeowners recognize the need for homeowner’s insurance because their lender will not lend money to purchase the home without it. However, when it comes to renter’s insurance, those who feel they have no valuable assets usually will not purchase renter’s insurance even though they should for the liability alone.

For example, George and Lori, as most young students do, rented a modest home while going to school. They had used furniture and personal belongings that did not amount to much. Therefore, they did not see the need to purchase renter’s insurance. Within this home they had a wood-burning fireplace they used frequently. One morning, after having a fire late the night before, Lori cleaned ashes out the fireplace and put them in a metal bucket by the back door. She did not put a lid on the bucket and did not notice that the wind had picked up. The ashes blew out and caught the backyard on fire. The damage amounted to $20,000 to the structure. George and Lori then received a call from their landlord’s insurance company, which wanted to know if they had renter’s insurance. Little did they know that if the landlord’s insurance company could prove negligence on George or Lori, they would be responsible for the damage. This is why you want to carry renter’s insurance. In this situation Lori was negligent, and her renter’s insurance company would have been responsible for damages.

The fact that a friend or someone you know could come on your property, get injured, and sue you if the injuries are extensive is a very high risk. So having renter’s insurance will again protect you from this exposure.

To go one step further, for extra protection it is highly recommended to carry a personal liability umbrella. This coverage will extend the liability limit of your auto and homeowner’s insurance under one policy. The minimum recommended amount is $1,000,000 and may go higher depending upon your underlying assets. For example, if you have $100,000 liability limit on your homeowner’s or renter’s insurance and $100,000/$300,000 of liability limit on your auto, you can purchase an umbrella policy to extend the limits of your home and auto an additional $1,000,000 with one policy.

If you carry all your policies with one insurance carrier, you may receive a discount for having only one carrier. In fact, it may be hard to find a separate carrier to write an umbrella policy if they do not insure the home or the auto. If they will do it, this coverage is called an unsupported umbrella policy by the insurance company. It is best to use one of the carriers you have for your homeowner’s, renter’s, or auto insurance. You will typically find the most discounted rates if your homeowner’s or renter’s, auto insurance, and umbrella policies are with the same carrier.

We have discussed protecting you against lawsuits in many areas of liability exposure, and the next area of protection that you need to protect yourself for is a disability claim.

Disability Insurance

Buying disability insurance can be a very overwhelming task, and its importance is often overlooked. If I asked you what you consider your most valuable asset, I would probably get varying answers from different people. However, your most valuable asset is your ability to earn an income.

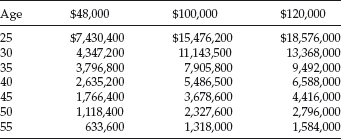

Take a look at Table 21.1 and find your potential income at different ages in life. You will see the amount of income you could lose should you become disabled. These figures do include an annual increase in income of 6%.

Table 21.1. Earning potential to age 55 with an annual 6% increase in earnings (annual income).

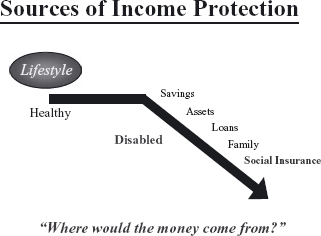

Figure 21.1. Sources of income protection.

With this amount of income at risk of being lost due to a disability, what would happen to your lifestyle? Where would your money come from? Who would provide you with money to pay your expenses? Refer to Figure 21.1 for more details.

Some of you would use your savings, some would sell your assets or try to take out loans. But who is going to loan money to a disabled person? One option might be to go to other family members. However, do you think your family members have your disability calculated into their budget? Some may be counting on Social Security, but at the rate this money is being displaced from our government plan, one should not be counting on this insurance. That is why you want to have a good disability plan.

There are different sources of income protection. First is group disability insurance that may be provided by your employer or by an association you belong to. Second is through individual insurance that you purchase on your own.

Group insurance through an employer or association is usually less expensive than an individual plan and may not require proof of insurability. An individual plan always requires proof of insurability unless offered on a guaranteed basis through your employer, but it usually it is not as comprehensive as an individual plan purchased on your own.

Most group plans offered through employers will have integration with certain benefits such as Social Security, some retirement plans, and workers’ compensation. For instance, integration with Social Security means that you must apply for Social Security benefits and be turned down in order for your benefits from your group plan to continue coverage. This process may be required each year you are disabled and filing a claim for benefits. Social Security offset may just offset benefits you receive or could include all family members. If your spouse and children receive benefits from Social Security while you are disabled, this could offset the monthly benefit you receive from the disability carrier. Offset holds true also for workers’ compensation and some retirement plans.

Group plans may offer a cost of living benefit, but in most cases they do not. Own specialty is another benefit that may or may not be offered within a group plan. Most group plans do offer partial coverage, but again this is an option left up to the employer.

One of the biggest advantages to group plans is the rates. These are usually low; however, they are not guaranteed for life. These rates are negotiated every 1, 2, or 3 years.

This is why one should consider, if healthy, purchasing an individual plan. This task may be a difficult one, especially if you have never had to purchase this type of plan. You may not know what benefits within a policy are right for you. There are several benefits that should be included in an individual plan. First and foremost is deciding on the monthly benefit amount that you are comfortable having, up to the limit the insurance companies will offer based on your income. Most companies are very close on the ratio of income to benefit they offer. Replacing lost income should be the foundation of your coverage. Once you have the benefit amount in place you need to make sure there are good definitions in the contract.

Benefit periods are the length of time the company pays the benefit while you are disabled. The most common are to age 65, 67, or 70; however, 2- and 5-year benefits are also available. Another term you should become familiar with is the elimination period. This is the time period that must pass while being disabled before the benefits from the insurance company start to pay. We refer to this as a deductible in days that must be met (for example, 90 days).

Next, you should determine what specialty definition you wish to have. The most important and the one most requested is the “own specialty” or “own occupation” definition. This definition of occupation could cover you 1 year, 2 years, 5 years, or for as long as the benefit period in your contract. This definition is known in the industry as “double dip own occupation.” This means should you become disabled from your occupation and you choose to work in another occupation, the income you earn will never offset your monthly benefit from the disability company. The other definition is considered a modified own occupation definition, which means should you become disabled and choose to work in another occupation, the income from the new occupation may offset your monthly benefit.

You will also want to make sure within the base level of coverage to include residual benefits. This benefit refers to partial disability. Should you become partially disabled you will receive part of your monthly benefit. Most companies will start partial benefits with a 20% loss of income and total benefits with an 80% loss of income. Some companies will pay total benefits at a 75% loss of income. Residual claims are often made when someone suffers an illness such as cancer. Individuals may gradually stop working throughout their treatment. Typically once they reach a loss of 80% of their income they would then be totally disabled.

The next layer of disability coverage to have on your policy for young professionals is protecting your future insurability. Even though you may feel healthy today, you want to make sure that you are able to purchase more disability coverage in the future. Having a future insurability benefit will enable you to increase your coverage without proving good health in the future. These benefits and when you can execute them will vary depending on the company.

For some it may be difficult to understand why they would need to purchase this coverage while they are in school. Here is a situation that frequently occurs. Sidney is a young dental student who was healthy when she bought her first policy. She had an advisor named Tom who knew the exposures she could be faced with in the future. To protect her, Tom recommended that she purchase a future insurability benefit on her policy. Sidney’s base coverage was $2,500 per month, which she purchased as a student. She also had the ability to increase her coverage an additional $5,000 per month.

Sidney was done with school and going out into practice with Carter Dental. They offered to pay for her disability coverage. She knew that she needed to increase her coverage; however, she was recently diagnosed with rheumatoid arthritis. She discussed this with her advisor, Tom, and he reminded her that they had a future insurability option to fall back on. She could increase her coverage up to $5,000 per month without answering any medical questions. This would give her a/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses