Dental Insurance

LEARNING OUTCOMES

OVERVIEW OF DENTAL INSURANCE

Evolution

In the early twentieth century, dental insurance and dental benefits programs did not exist. Their emergence and growth provided access to care for people who had never considered routine dental treatment. Patient education changed the general perception of dentistry, transforming the dental office from a place best avoided to a familiar and necessary partner in personal health care.

As more companies and organizations added dental benefits to their group health coverage, the percentage of people seeking regular preventive services and restorative treatment increased. As oral health improved, patients and healthcare professionals began to notice a trend toward better overall health. By the end of the century, the connection between oral health and overall general health was clearly established. With the identification of linkages between certain oral health conditions and serious physical illnesses, dentists can use those oral indicators to help in the detection and early diagnosis of diseases such as diabetes, high blood pressure, oral cancer, anemia, and deficient immune system (HIV positive).

Group dental benefits have high value for the workforce, and more than half of the nation’s population has some type of dental plan. Dental benefits continue to be a factor in treatment; statistics show that 60% of the insured people go to the dentist, whereas only approximately 27% of the uninsured seek any dental treatment. Although the percentage of insured patients may vary (by region, specialty, policy, etc.), nearly every dental office offers insurance billing as a service to their patients.

Prompt and efficient insurance billing of dental services can have a direct effect on the profitability of the practice. The majority of dental offices accept assignment of benefits, allowing the benefit payment to be paid to the dentist or dental office business. Correct billing procedures ensure that the payment reaches the dental office as quickly as possible and keeps the accounts receivable in a positive cash flow position. This job requires organization, perseverance, and strict attention to detail.

Parties Involved

The system of dental insurance involves four parties: the patient, the dentist, the dental benefits carrier, and the group or program sponsor (e.g., employer, union, or business association). The dental office administrative assistant works closely with the patient, dentist, and benefits carrier to produce the successful adjudication of dental benefit claims.

Patient

The patient is the primary resource for the following information needed to submit a claim:

Most patients aren’t aware of the details of their benefit coverage, and they don’t understand most of the dental terminology associated with their treatment and coverage. The administrative assistant is in the position to interpret and explain dental terms, codes, and benefit details in lay terms. This interaction gives the patient the opportunity to be an active partner in his or her dental care and promotes a good relationship between the patient and the practice. Note: It is important to inform patients that even though they are covered by a dental benefits program, they ultimately are liable for all treatment fees.

Dentist

The administrative assistant consults the dentist to verify the services rendered, determine the correct procedure codes, and confirm the fees. Most dental offices work closely with carriers to help their patients make the best use of their benefits; however, the dentist and his or her patient make the final decision as to the best course of treatment for that individual. The dentist’s primary commitment is to discuss and render necessary treatment, establish and maintain the patient’s oral health, and adhere to the standards of care that prevail in the professional community.

Dental Benefits Carrier

This may be an insurer, a third-party administrator (TPA), or a dental service corporation. The administrative assistant can contact the carrier to verify the patient’s eligibility and benefits, claims address, and any other details pertinent to filing claims. The benefit carrier administers the plan according to the group contract, which includes maintaining member eligibility, processing claims, and remitting benefit payments to the appropriate party.

Group or Program Sponsor

The group—for example, an employer, union, or business association—(or a broker who represents the group) contracts with the benefit carrier and selects the benefits levels, program type, maximums, limitations, and exclusions for their dental plan. Communication with the group is generally the responsibility of the patient (also called the group member or subscriber); however, occasionally the administrative assistant may contact the group on behalf of the patient.

DENTAL BENEFITS PROGRAMS

The dental carrier’s method of reimbursement depends on the dental plan design. The two basic models of benefits programs are indemnity and capitation, although many variations of each model exist.

Many dental benefits carriers recruit dentists to participate in their programs. Generally when a dentist signs a participation contract with a benefits carrier, he or she agrees to certain terms and conditions of payment for services rendered to enrollees. Each carrier has a unique set of terms of participation, which may include: accepting the carrier’s fee table (no balance billing or unbundling of procedures or fees), receiving assignment of benefits, and filing claims for enrollees. Although the dentist may be required to discount fees to enrollees, participation is a proven method of practice building, accelerating cash flow, and increasing patient acceptance of treatment.

Indemnity

According to Webster’s New College Dictionary, the term indemnity means “compensation for damage, loss, or injury,” and dental indemnity plans make reimbursement to insured persons (or the dentist through assignment of benefits) for costs incurred through covered dental treatment (approved services). Indemnity programs are most often referred to as fee-for-service plans because the reimbursement is based on each dental service rendered or received. The following list presents types of fee-for-service programs:

Capitation

Capitation is a benefits delivery system in which a contracting provider receives a fixed monthly payment for providing covered dental services to enrollees who select or are assigned to his or her location. The provider receives the payment regardless of whether services were actually performed. This program type is also called a dental health maintenance organization (DHMO), and it is typically a closed panel system. To be covered, enrollees must go to their primary care provider for all their dental treatment. Most plans allow the primary care dentist to refer enrollees to a participating specialist for qualified services, and exceptions may be allowed for emergency and out-of-area dental care. Enrollees may not have out-of-pocket costs for routine services, although they may have a copayment for more extensive, expensive services, such as fixed bridges.

Alternative Benefit Plans

Employers or associations that do not include dental coverage in their benefit package may elect to offer an alternative benefit plan. A variety of options are available, and following are some examples:

PREPARING DENTAL CLAIM FORMS

Dental claims can be submitted on paper forms or in electronic format. Both modes require specific and detailed information about the patient/subscriber, treating dentist, and services rendered. One small error or omission can cause a claim to reject. Rejected claims create more work for the administrative staff and unnecessary delays in payment. Because the requirements of benefit carriers may vary, administrative assistant can further increase efficiency by becoming familiar with or keeping records on the techniques that work best with individual carriers.

Paper Claim Form

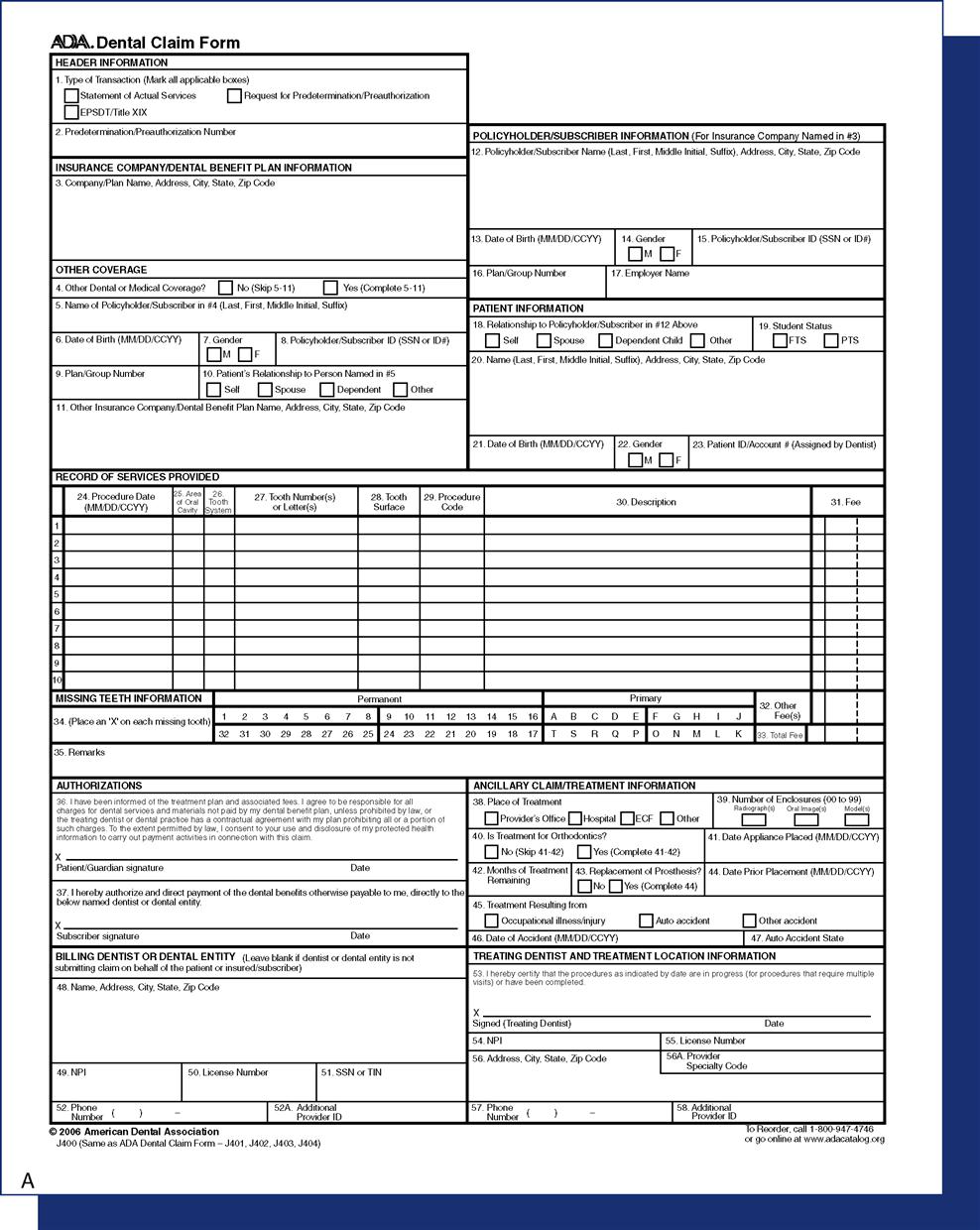

The American Dental Association (ADA) claim form (also known as the attending dentist’s statement) is universal, and it is designed to meet or exceed the informational needs of nearly all dental benefit carriers. The form includes comprehensive completion instructions (Figure 14-1), and it may be purchased from the ADA or through most dental supply vendors. Some dental benefits carriers have a proprietary paper claim form, which may be brought in by the patient or available to download from their web sites.

The administrative assistant can legibly print or type the required information on the claim form or, if the office is computerized, forms can be generated and printed using the practice management software. The assistant then reviews the claims, attaches x-rays, and adds documentation where needed. Claims are batched according to carrier and mailed out.

Note: Some carriers require radiographs or documentation for a limited number of services, such as fixed bridges or miscellaneous procedures. However, sending unnecessary films or documentation may slow down processing and payment. The assistant can contact the benefit carrier for a list of procedure codes that require special handling or support documents.

Electronic Claim Form

According to a survey of dentists and dental staff members conducted in 2006 by Delta Dental of Michigan, Ohio, and Indiana, more than half of dental offices submit all or part of their dental claims electronically—through a clearinghouse, via practice management services, or on web sites.

Offices that file e-claims must comply with federal laws governing electronic transactions that include personal health information (PHI). Under the Health Insurance Portability and Accountability Act of 1996 (HIPAA) all healthcare providers, health plans, and healthcare clearinghouses that transmit PHI electronically must use a universal language, a standard format, and a government-assigned, unique identification number. HIPAA also mandates security and privacy standards for electronic transactions as discussed in Chapter 7.

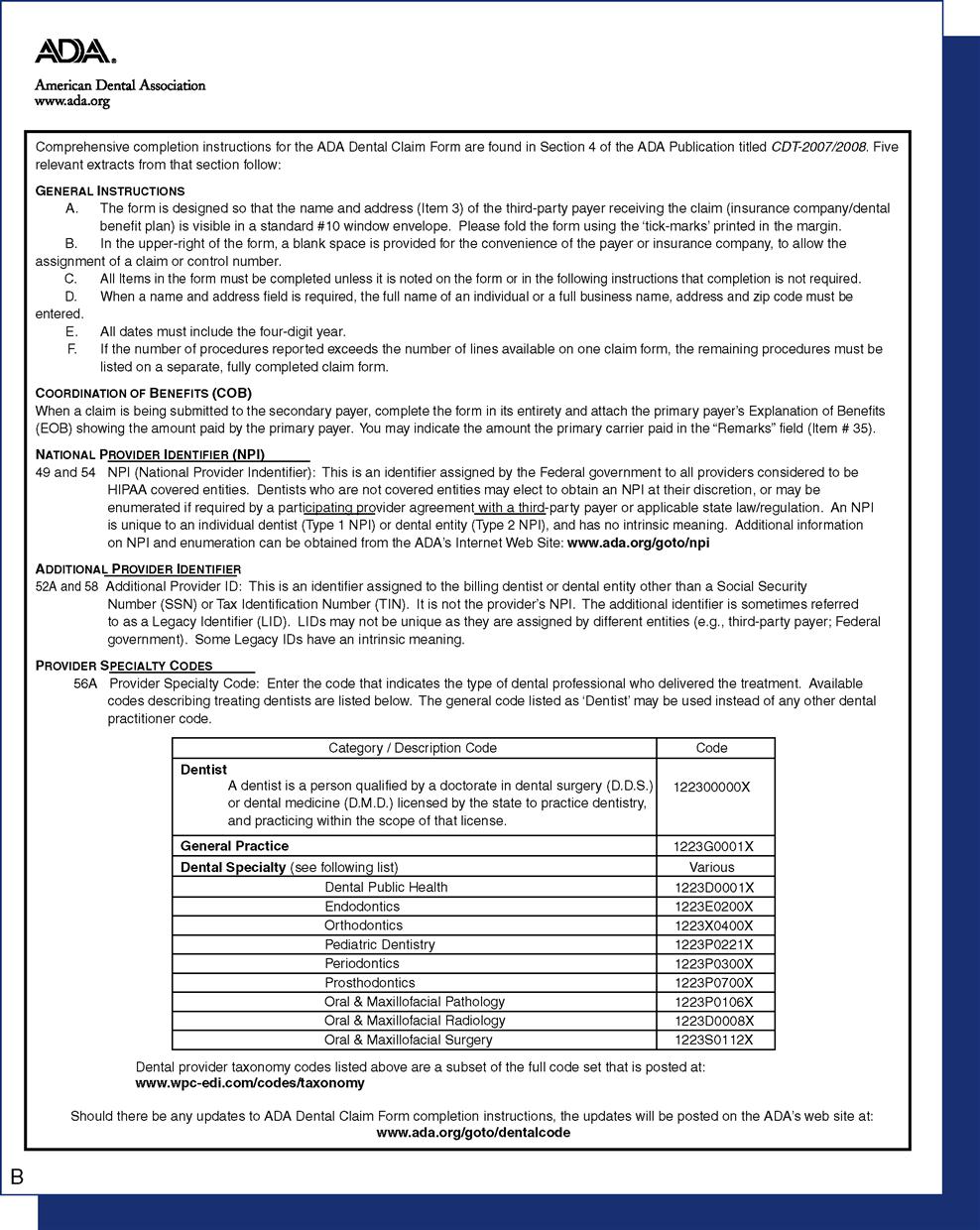

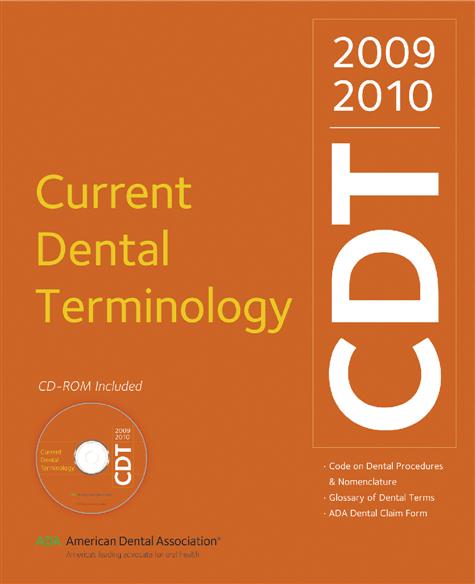

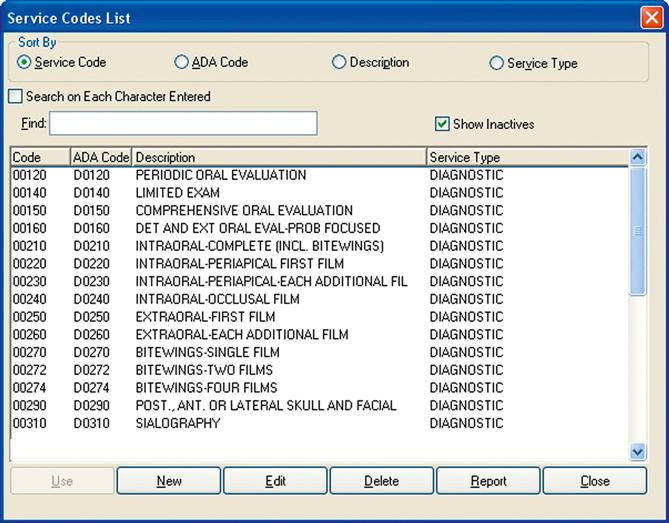

• The Code: The universal language used for electronic transmission of dental data is the ADA Code on Dental Procedures and Nomenclature (the Code), which is updated every 2 years (Figure 14-2). Current Dental Terminology (CDT) manuals, the only official source for these codes, can be purchased from the ADA, and they list the procedure codes with nomenclature and descriptors, changes from the previous code, and other helpful information (Figure 14-3).*

Most dental offices have replaced the pegboard and appointment book with computers and sophisticated practice management software, and the percentage of dental offices submitting all or part of their claims electronically has grown steadily over the past 20 years. Compared with the time and expense of preparing and mailing paper claims, electronic claims submission can be faster, less expensive, and more accurate. E-claims are usually submitted through a clearinghouse or directly to the carrier, and most carriers offer payment via electronic funds transmission (EFT).

Via Clearinghouse

A clearinghouse is a company that accepts the transmission of raw data, scans for errors or missing information, and transforms it into the appropriate data format for submission to the benefit carrier. The clearinghouse charges for this service, usually either a set amount per claim or a monthly fee.

Using practice management software, the dental office administrative assistant collects the patient and treatment information that’s ready to be billed to a benefit carrier. The batch of claims information is transmitted to the clearinghouse. After reformatting the data, any claims with missing or incomplete information are transmitted back to the dental office. The finished claims are sorted by benefit carrier or insurance company, and mass transmitted to the carrier for processing. The clearinghouse can also print and mail a paper claim forms to the few carriers unable to accept electronic/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses