Chapter 10

Dental Practice Fees: What Do You Charge and Why?

Introduction: Dental Fees—What Do You Charge?

Fees for dental services are based on many factors, including practice location, local economy, insurance participation agreements, and personal practice philosophy. In medicine the patient pays, based on procedure, a lab fee and facility fee in addition to the professional fee. For the most part, the fees patients pay for dental services include all of these costs. There are wide variances in fees among North American dental practices, many of which are identified in fee surveys that are stratified by the practitioner’s location. These fee surveys provide a perspective on the usual and customary fee at various percentiles for a broad range of procedure codes (example: the National Dental Advisory Service Pricing Program). The cost of dental care for any particular patient is based on the American Dental Association (ADA) procedure codes and the practice’s usual and customary fee for the procedures performed. The “usual and customary fee” is in a sense the “list price” for that particular procedure.

Within a particular location, the prevalent factor affecting this is most evident when comparing practices that accept a variety of dental insurance plans versus practices that limit the number of insurance plans. Office amenities and staff compensation rates contribute to increased overhead and higher costs. While in many instances there is a close relationship between practice fees and the practitioners’ wage on a per hour basis, practice overhead can often erode any potential profit from high fees.

The fees charged for procedures are an important consideration for many practitioners. While there are numerous annual surveys that report on average fees for various procedures, many practitioners are unable to articulate the basis for setting fees. In addition, the relationship between the fee, time allocated for a particular procedure, and expenses associated that procedure are often not in direct proportion to each other. Essentially, for the practice of dentistry, the practitioner’s wage is determined by the net sum of all fees collected minus the expenses. Many practice managers and practice management consultants work with practice owners to help improve their ability to increase reimbursement per procedure and increase the number of billable procedures delivered within a given time. These are two unique strategies. In order to increase fees, the practitioner must be able to convince the patient (purchaser of the service) that the service is worth the higher fee. This is often done by patient education, marketing, or changing the practice philosophy and physical amenities within the office. Many times this occurs when a retiring dentist sells his or her practice to a new dentist. The new owner-dentist redefines the practice image and purchases new “state-of-the-art” equipment to improve the level of services performed. Ultimately, he or she hopes to increase fees and annual collections.

The ultimate fee charged for any given procedure, and therefore the practitioner’s income, is determined by simple economic principles. These economic principles are the basis for patient behaviors as consumers and for practitioners’ behaviors as producers of dental services. This is because dental services are considered to be an economic good that patients purchase. Any patient’s decision to purchase a particular good or service is determined by whether that good or service gives the patient satisfaction equal or greater to the satisfaction of the dollars paid for that service—dollars that the patient could spend on other goods or services. In addition, the “total cost” of the procedure from the patient’s perspective also includes the value of lost wages, the cost of commuting to the practice, and any cost for other miscellaneous items such as child care.

Basic Healthcare Economic Principles

The law of supply and demand economics says that within a given marketplace, the price of any good or service will equal the equilibrium point price where supply equals demand. This point is defined by what economists call the intersection point between supply and demand curves. The supply curve of a particular good or service is determined by surveying the willingness of suppliers to provide a certain good or service at various prices. These points, when graphed, will produce a line. The slope of the supply curve shows how the supply of a good or service increases with increased price. Similarly, the demand curve for a particular good or service illustrates the willingness of consumers to purchase that good or service at various prices. The slope of the demand curve illustrates how fast demand will decrease as price increases.

When measured across large groups, dentists and patients have supply and demand curves for various dental procedures that intersect at a point that is deemed to be the economic equilibrium price. There are a number of factors that affect this; however, for the most part, the fee for a particular service is determined by the dentist’s willingness to provide the service at that fee and the patient’s willingness to purchase the service at that fee. A sample supply and demand curve is in Figure 10.1.

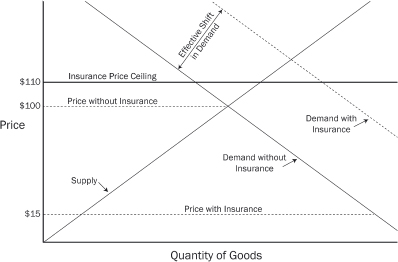

There are a number of things that affect the supply and demand curves. Patients who are given the chance to have dental insurance will consume dental procedures at a different rate when compared with similar patient populations without dental insurance. The actual cost of the procedure to patients decreases, and they demand more of the service than they would otherwise demand. So, the demand for the procedure increases in the presence of third-party reimbursement. Similarly, advertising campaigns and events in the media that portray the desirability of dentistry will also increase the demand for services. However, if the equilibrium point is not prepared to meet the increased demand, the dentist as a supplier of services will respond to the increased demand by increasing fees. The insurance carriers, on the other hand, will control reimbursement by placing ceilings on reimbursement and capping reimbursement, usually below the new equilibrium point. Figure 10.2 illustrates the effect of insurance on supply and demand.

Figure 10.1. Basic economics of supply and demand.

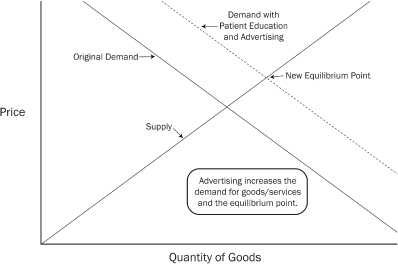

Based on what we have seen so far, it seems that the secret to being able to charge higher fees is to get the patients’ demand curve to shift so that the demand for services increases at the higher fee. Advertising, marketing, and patient education all cause the demand curve to shift. This is because if the patient perceives an increased value to the dental services provided, he or she will be willing to pursue treatment that would otherwise not be purchased. Figure 10.3 illustrates the shift in the demand curve caused by advertising and patient education.

This effect of advertising is particularly true for patients who view dental services as elective procedures. Of course, nonelective dental procedures, such as emergency exams and extractions, would have a different slope to the demand curve. The demand for these services would be more resistant to changes as the fee increased. That is, the demand for emergency procedures to relieve pain would not demonstrate the same decrease as price increases relative to dental prophylaxis procedures or routine dental exams. For many the “annual dental check-up” is an elective procedure. These type of procedures are responsive to marketing, and therefore many dental societies have advertisements to encourage the public to see their dentist regularly.

Figure 10.2. Effective shift in demand with insurance.

Figure 10.3. Effective shift in demand with patient education and advertising.

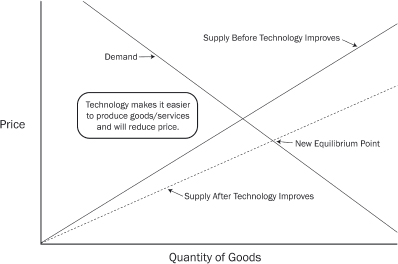

Improvements in technology that make it easier to perform a particular procedure and the ability to delegate procedures to dental auxiliaries will cause the equilibrium price point to fall by shifting the supply curve. Similarly, economists will predict that changes in the dental practice acts permitting the use of expanded duty auxiliaries will result in lower fees. Dentists will be more willing to perform these procedures at lower fees than they would otherwise be willing to do without the technology or ability to use auxiliaries. Figure 10.4 illustrates the effect on improvements in technology.

Figure 10.4. Effect of new technology and improved efficiencies on price of goods/services.

There are some procedures whose consumption decreases when the local economy improves. In economic terms these products are termed to be “inferior products.” That is, if the income of the patients in the practice increases, the consumption of economically “inferior” services decreases. An example of this in the dental setting is extractions. An example of this in the consumer marketplace is macaroni and cheese. As the average income of any practice increases, patients elect to have endodontic treatment and crowns instead of extractions. Another example would be posterior amalgams or composites versus inlays or crowns. So the fee any dentist can charge for these services is in many ways related to the economic well-being of the patients of record.

In economic terms, two procedures can be substitutes when the price of one increases relative to the other, the demand for the other increases. In dentistry, a three-unit bridge and an implant are economic substitutes. One way to increase implant case acceptance and demand is to increase the price of the three-unit bridge. Merely increasing the fee for the three-unit bridge will cause an increase in the demand for single tooth implants. Another example of this economic principle is posterior amalgams versus posterior composites. Patients are willing to pay a premium for composites, however, and as the price differential increases when composite fees increase, the demand for amalgams will eventually increase and patients will substitute amalgams for composite.

In summary, dentists and patients behave in the marketplace in accordance with basic economic principles. It is important to understand these basic principles in order to understand the consumer-oriented behavior of patients as they make their decision to purchase (or not to purchase) dental services.

Cost-Based Fee Structures

From an accounting perspective it is important for every practitioner to understand the costs associated with running a practice. For most solo-practitioner general dental practices, the overhead costs run 50–65% of gross collections. Factors affecting this percentage include number of hours worked, staff salaries, numbers of staff, rent/mortgage payments, supplies, lab fees, and other miscellaneous office expenses. As a rule, the fee for procedures that incur lab fees is often three to four times the lab fee.

One method of setting fees is to analyze the practice and the mix of procedures performed. The costs associated with each procedure can be calculated by determining the average time spent on each procedure and actuarially assessing a portion of the fixed costs of the practice to that procedure. In addition, variable costs associated to that procedur/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses