Chapter 10

Business Risk

All businesses put assets at risk to achieve objectives. The roots of business risk management lie in insurance policies, which protect assets from hazards. Business risk management identifies risks detrimental to the viability of a business proposal. It also identifies ways of preventing adversity and mitigating or containing its effects.

Anatomy of Greed is a book about the implosion of the world’s seventh largest company – Enron. Its author, Brian Curver, attributes the collapse of Enron to poor risk management which, he states, “compounded” the company’s other failings.

What is Business Risk?

Business risk can be defined as the threat that an event or circumstance will adversely affect a practice’s ability to achieve its strategic objectives and reduce the expected or anticipated economic profitability. These “adverse affects” may include the failure of a practice to optimise its assets, tangible and intangible, causing it to underperform and lose its competitive edge.

The physical assets of the practice should be protected by insurance, but there are operational risks that cannot be protected in the same way. For example, we make decisions on a risk-reward assessment when we:

-

Start or buy a practice.

-

Expand (or downsize) the business.

-

Employ a new member of staff.

-

Consider partnership options.

-

Commit to capital expenditure for refurbishment.

Effective business risk management facilitates rational business decision-making. It can shape the future of your practice by:

-

Encouraging opportunity-seeking behaviour, allowing you confidently to make informed decisions about the trade-off between risk and reward, and to make business decisions in this context.

-

Helping to control costs if the business is able to respond quickly and effectively to risks and opportunities.

-

Building your practice’s image and reputation with its patients, suppliers, and other agencies.

To manage business risk, we must have:

-

A thorough understanding of the business process.

-

An active imagination and tools to generate ideas about possible effects of risks.

-

A framework to manage risk.

You must ask yourself some fundamental questions:

-

Do you fully understand the risks impacting your business?

-

Are you able to distinguish between risks worth taking from those which you should avoid?

-

Have you undertaken a SWOT (strengths, weaknesses, opportunities and threats) analysis and noted the key threats and opportunities in your business, including the actions in place to mitigate the risks and to exploit the opportunities?

-

When was the analysis last reviewed?

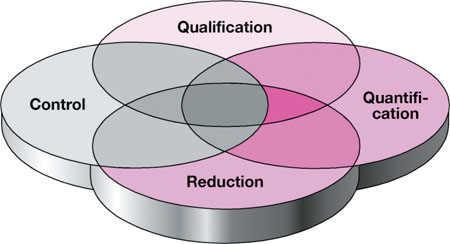

The process is summarised in Fig 10-1.We can categorise the business risks associated with running a dental practice into different segments, see Box 10-1. There is no such thing as a risk-free investment. In order to build assets, we must undertake some type of risk.

Fig 10-1 The elements of business risk management.

Box 10-1

Type of Business Risks Encountered and Possible Outcomes Capital risk The risk that all or part of your capital, your original investment, will not be returned. Credit risk The concern that the practice may not be able to meet its financial commitments in terms of repayments on loans. Inflation risk The concern that your profit may lose some of its purchasing power through inflation. Various investment vehicles (e.g. equities and property) are amongst the various ways of addressing long-term inflation risk Interest-rate risk Fluctuations in interest-rates can affect repayment amounts on borrowings, but can also have a substantial effect on return on investments. Key people risk Your practice may be reliant on key individuals who have contributed to its success. How would you manage without them? Economical risk This is a measure of how people’s expenditure is related to general economic climate. A downturn in the economy may impact on patients’ choice of treatment options. Competitive risk New practices opening in the area may create competitive risk. They may also add to key people risk as they may be proactive in their recruitment efforts. Demographic Changes in demographic profiles will affect needs and wants of your patients. Political risk The likelihood that government decisions will materially affect the way in which dental care is delivered. It may have implications in financial risk areas for any practice dependent on state funding.

Risk and Reward

In contrast to clinical risk management, conventional business thinking tells us that the reward for accepting greater risks is greater return – but there are no guarantees. The old adage: “No risk, no reward” recognises the positive side of business risk.

In dentistry, when we fail to control risk, the effects are often immediately obvious. It is a characteristic of active failure (Chapter 3). Some examples of this are traumatic pulpal exposure, perforations arising from root canal preparation, and soft tissues lacerations during treatment. But sometimes the outcomes will not be apparent for many months or even years – for example, an apical area may develop months or years after endodontic therapy is carried out, or caries may become evident around an ill-fitting crown a long time after its placement.

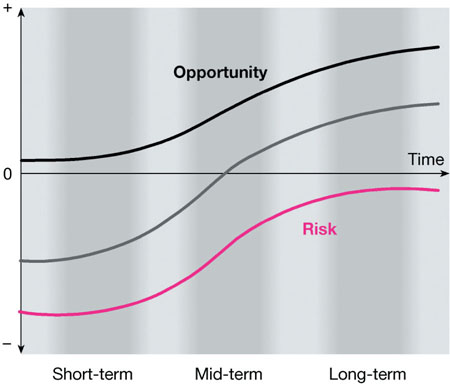

In business risk terms, various time horizons are involved. These are planning horizons used in risk scenarios and strategic planning to represent different time periods – short-term, mid-term and long-term (Fig 10-2).

Fig 10-2 The risk-opportunity curve. Reproduced by kind permission of David McNamee, President of MC2 Consulting.

In McNamee’s model:

-

Risk and opportunity are part of “a continuum of variation”. In business terms, risk is the potential of negative results (less than expected), and opportunity is the potential for positive results (greater than expected). When we make business decisions, the results of negative risk are undesirable. We welcome positive results, but sometimes these can catch us out. For example, the fully booked dentist who is forced to turn away business may never see some of those potential patients again or keep his/her existing patients waiting for long periods and create a dip in the level of service which made him/her busy in the first place!

-

The nature of risk and opportunity changes over time. In the shortterm, risk may prevent us from achieving our goals. It may be that a new surgery has been installed, but there will be a delay before it is fully utilised. We may see this as a threat because opportunity may be some way off on the planning horizon.

To cope, we may make decisions to mitigate this short-term negative potential – we may cut back on staffing levels and reduce the number of working days for that surgery to a minimum. These controls evolve because we are focused on current financial risk to deal with the negative potential in the shortterm.

Once we have moved away from the short-term scenario, we have risks that are felt only in future p/>

Stay updated, free dental videos. Join our Telegram channel

VIDEdental - Online dental courses